Answered step by step

Verified Expert Solution

Question

1 Approved Answer

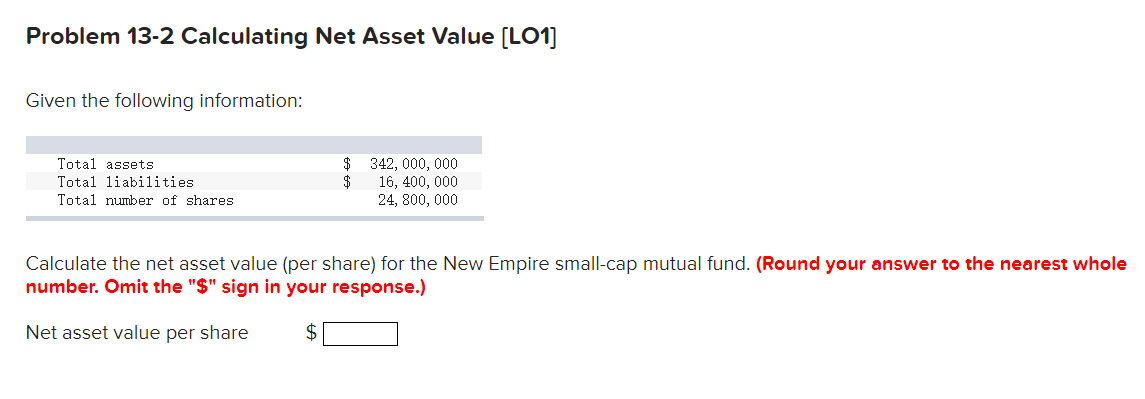

Problem 13-2 Calculating Net Asset Value [LO1] Given the following information: Calculate the net asset value (per share) for the New Empire small-cap mutual fund.

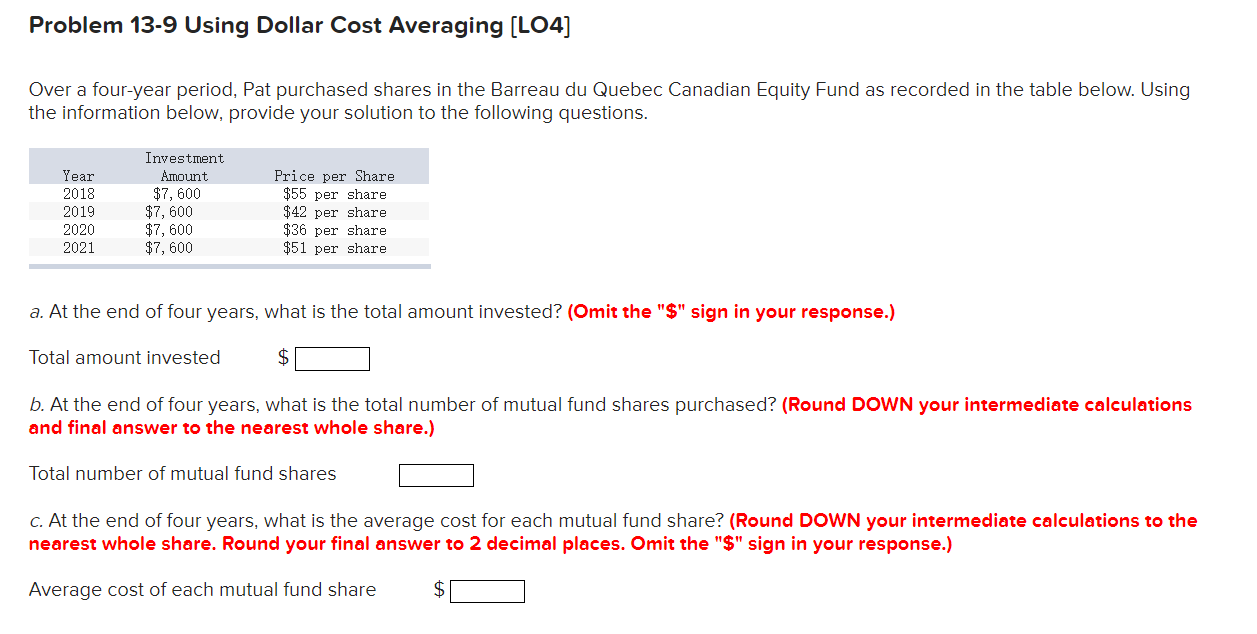

Problem 13-2 Calculating Net Asset Value [LO1] Given the following information: Calculate the net asset value (per share) for the New Empire small-cap mutual fund. (Round your answer to the nearest whole number. Omit the "\$" sign in your response.) Net asset value per share $ Problem 13-9 Using Dollar Cost Averaging [LO4] Over a four-year period, Pat purchased shares in the Barreau du Quebec Canadian Equity Fund as recorded in the table below. Using the information below, provide your solution to the following questions. a. At the end of four years, what is the total amount invested? (Omit the "\$" sign in your response.) Total amount invested $ b. At the end of four years, what is the total number of mutual fund shares purchased? (Round DOWN your intermediate calculations and final answer to the nearest whole share.) Total number of mutual fund shares c. At the end of four years, what is the average cost for each mutual fund share? (Round DOWN your intermediate calculations to the nearest whole share. Round your final answer to 2 decimal places. Omit the "\$" sign in your response.) Average cost of each mutual fund share $

Problem 13-2 Calculating Net Asset Value [LO1] Given the following information: Calculate the net asset value (per share) for the New Empire small-cap mutual fund. (Round your answer to the nearest whole number. Omit the "\$" sign in your response.) Net asset value per share $ Problem 13-9 Using Dollar Cost Averaging [LO4] Over a four-year period, Pat purchased shares in the Barreau du Quebec Canadian Equity Fund as recorded in the table below. Using the information below, provide your solution to the following questions. a. At the end of four years, what is the total amount invested? (Omit the "\$" sign in your response.) Total amount invested $ b. At the end of four years, what is the total number of mutual fund shares purchased? (Round DOWN your intermediate calculations and final answer to the nearest whole share.) Total number of mutual fund shares c. At the end of four years, what is the average cost for each mutual fund share? (Round DOWN your intermediate calculations to the nearest whole share. Round your final answer to 2 decimal places. Omit the "\$" sign in your response.) Average cost of each mutual fund share $ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started