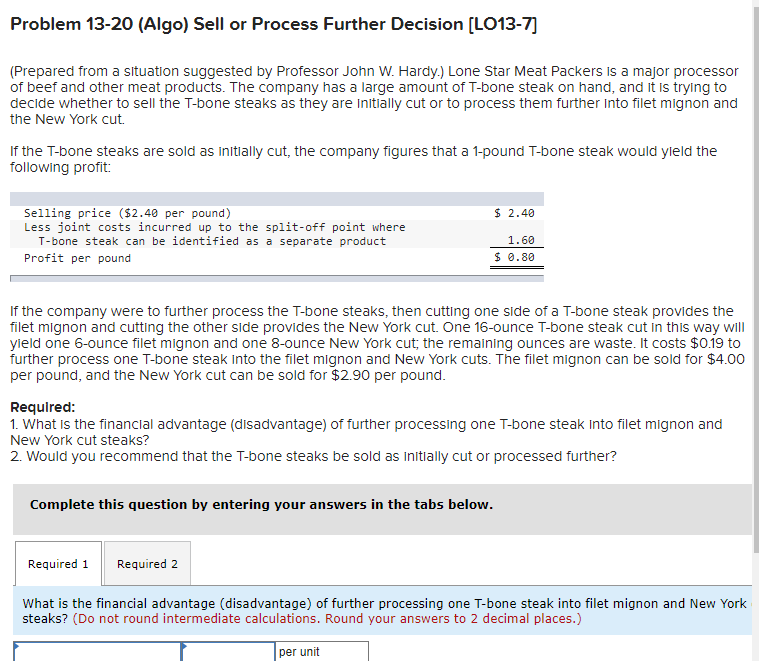

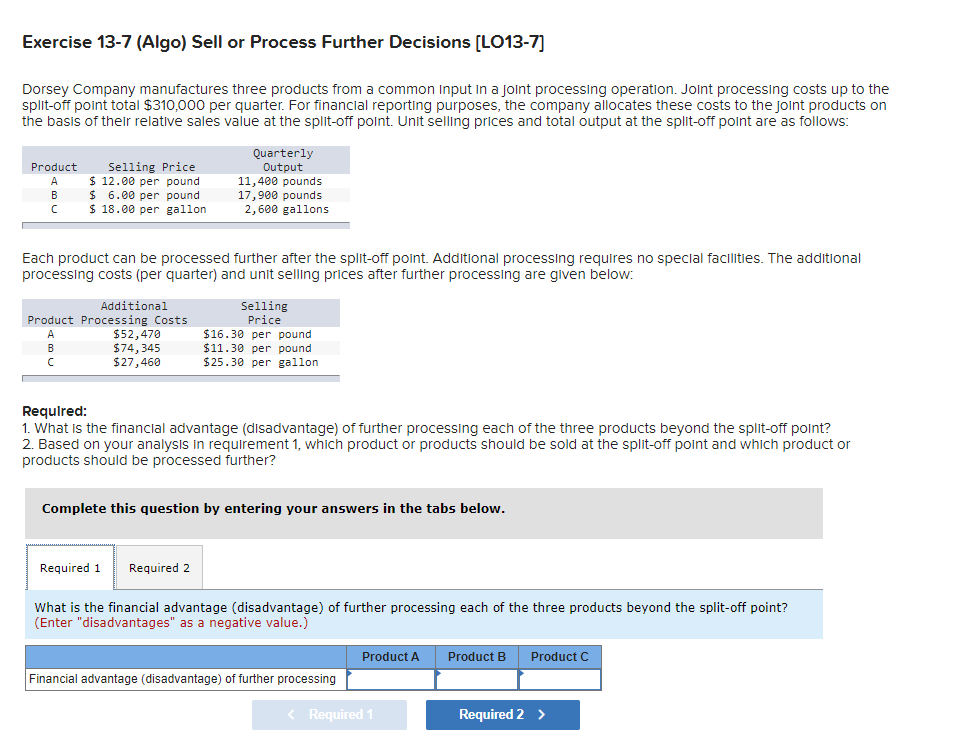

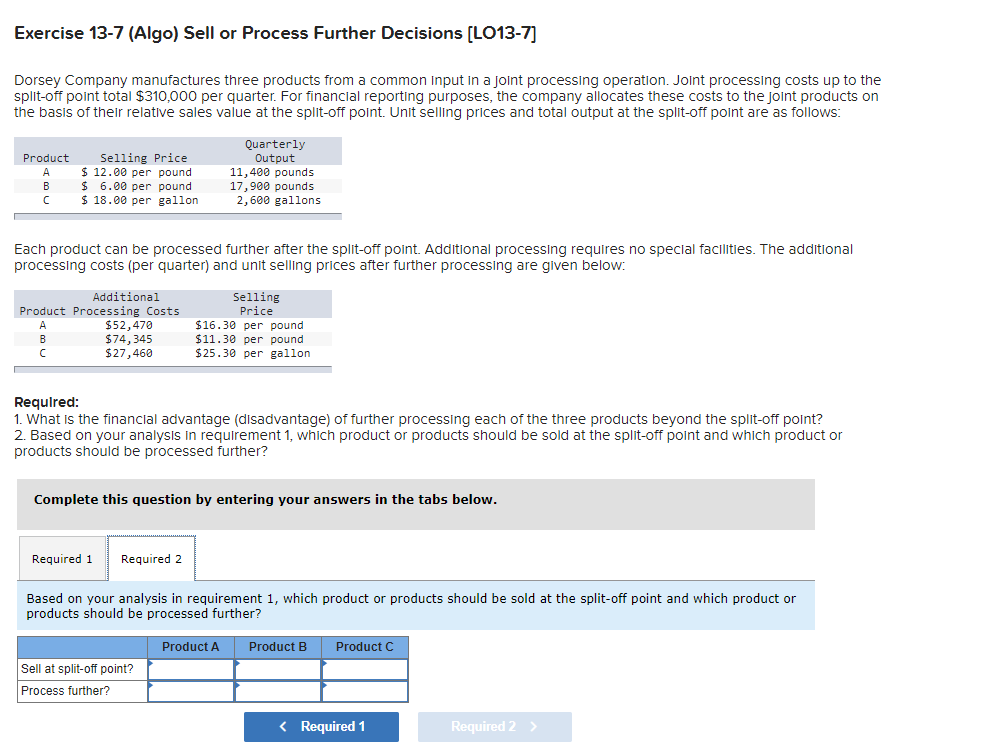

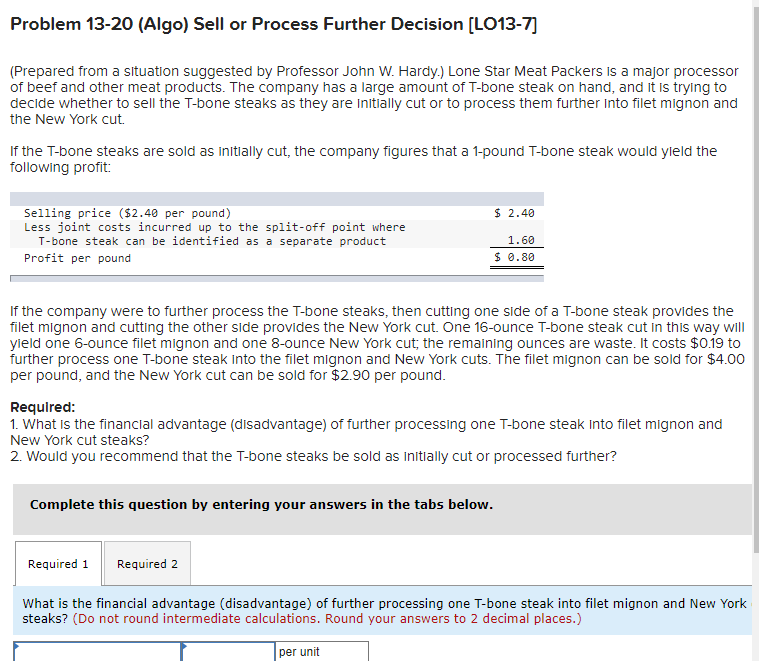

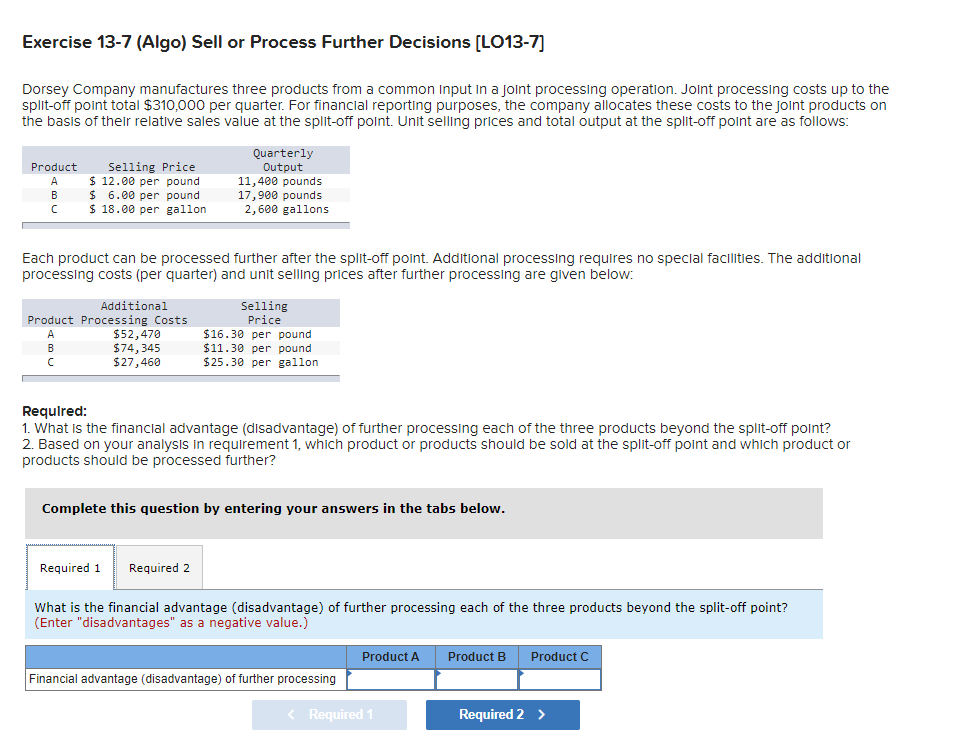

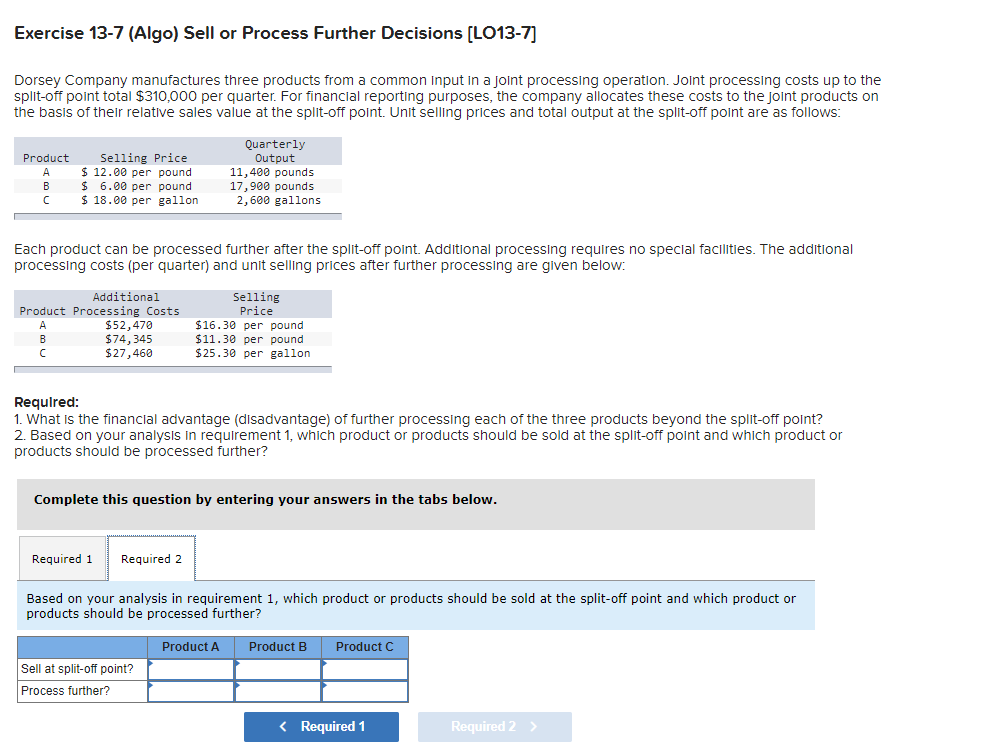

Problem 13-20 (Algo) Sell or Process Further Decision (LO13-7] (Prepared from a situation suggested by Professor John W. Hardy.) Lone Star Meat Packers is a major processor of beef and other meat products. The company has a large amount of T-bone steak on hand, and it is trying to decide whether to sell the T-bone steaks as they are Initially cut or to process them further into filet mignon and the New York cut If the T-bone steaks are sold as initially cut, the company figures that a 1-pound T-bone steak would yield the following profit: $ 2.40 Selling price ($2.40 per pound) Less joint costs incurred up to the split-off point where T-bone steak can be identified as a separate product Profit per pound 1.60 $ 0.80 If the company were to further process the T-bone steaks, then cutting one side of a T-bone steak provides the filet mignon and cutting the other side provides the New York cut. One 16-ounce T-bone steak cut in this way will yield one 6-ounce filet mignon and one 8-ounce New York cut; the remaining ounces are waste. It costs $0.19 to further process one T-bone steak into the filet mignon and New York cuts. The filet mignon can be sold for $4.00 per pound, and the New York cut can be sold for $2.90 per pound. Required: 1. What is the financial advantage (disadvantage) of further processing one T-bone steak Into filet mignon and New York cut steaks? 2. Would you recommend that the T-bone steaks be sold as initially cut or processed further? Complete this question by entering your answers in the tabs below. Required 1 Required 2 What is the financial advantage (disadvantage) of further processing one T-bone steak into filet mignon and New York steaks? (Do not round intermediate calculations. Round your answers to 2 decimal places.) per unit Exercise 13-7 (Algo) Sell or Process Further Decisions (LO13-7] Dorsey Company manufactures three products from a common input in a joint processing operation. Joint processing costs up to the split-off point total $310,000 per quarter. For financial reporting purposes, the company allocates these costs to the joint products on the basis of their relative sales value at the split-off point. Unit selling prices and total output at the split-off point are as follows: Product A B C Selling Price $ 12.00 per pound $ 6.00 per pound $ 18.00 per gallon Quarterly Output 11,400 pounds 17,900 pounds 2,600 gallons Each product can be processed further after the split-off point. Additional processing requires no special facilities. The additional processing costs (per quarter) and unit selling prices after further processing are given below: Additional Product Processing Costs A $52,470 B $74,345 C $27,460 Selling Price $16.30 per pound $11.30 per pound $25.30 per gallon Required: 1. What is the financial advantage (disadvantage) of further processing each of the three products beyond the split-off point? 2. Based on your analysis in requirement 1, which product or products should be sold at the split-off point and which product or products should be processed further? Complete this question by entering your answers in the tabs below. Required 1 Required 2 What is the financial advantage (disadvantage) of further processing each of the three products beyond the split-off point? (Enter "disadvantages" as a negative value.) Product A Product B Product C Financial advantage (disadvantage) of further processing Required 1 Required 2 > Exercise 13-7 (Algo) Sell or Process Further Decisions (LO13-7) Dorsey Company manufactures three products from a common input in a joint processing operation. Joint processing costs up to the split-off point total $310,000 per quarter. For financial reporting purposes, the company allocates these costs to the joint products on the basis of their relative sales value at the split-off point. Unit selling prices and total output at the split-off point are as follows: Product A B C Selling Price $ 12.00 per pound $ 6.00 per pound $ 18.00 per gallon Quarterly Output 11,400 pounds 17,900 pounds 2,600 gallons Each product can be processed further after the split-off point. Additional processing requires no special facilities. The additional processing costs (per quarter) and unit selling prices after further processing are given below: Additional Product Processing Costs A $52,470 B $74,345 C $27,460 Selling Price $16.30 per pound $11.30 per pound $25.30 per gallon Required: 1. What is the financial advantage (disadvantage) of further processing each of the three products beyond the split-off point? 2. Based on your analysis in requirement 1, which product or products should be sold at the split-off point and which product or products should be processed further? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Based on your analysis in requirement 1, which product or products should be sold at the split-off point and which product or products should be processed further? Product A Product B Product C Sell at split-off point? Process further?