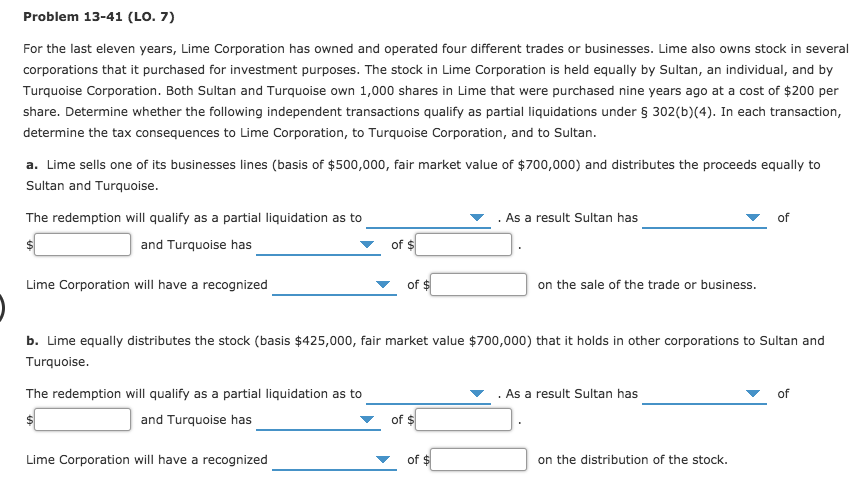

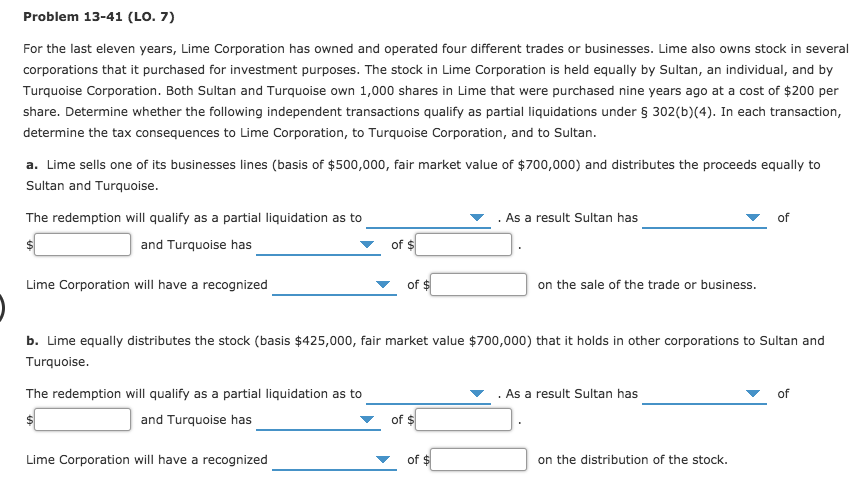

Problem 13-41 (LO. 7) For the last eleven years, Lime Corporation has owned and operated four different trades or businesses. Lime also owns stock in several corporations that it purchased for investment purposes. The stock in Lime Corporation is held equally by Sultan, an individual, and by Turquoise Corporation. Both Sultan and Turquoise own 1,000 shares in Lime that were purchased nine years ago at a cost of $200 per share. Determine whether the following independent transactions qualify as partial liquidations under 302(b)(4). In each transaction, determine the tax consequences to Lime Corporation, to Turquoise Corporation, and to Sultan. a. Lime sells one of its businesses lines (basis of $500,000, fair market value of $700,000) and distributes the proceeds equally to Sultan and Turquoise The redemption will qualify as a partial liquidation as to . As a result Sultan has of of and Turquoise has of on the sale of the trade or business. Lime Corporation will have a recognized b Lime equally distributes the stock (basis $425,000, fair market value $700,000) that it holds in other corporations to Sultan and Turquoise As a result Sultan has The redemption will qualify as a partial liquidation as to of and Turquoise has of of Lime Corporation will have a recognized on the distribution of the stock. Problem 13-41 (LO. 7) For the last eleven years, Lime Corporation has owned and operated four different trades or businesses. Lime also owns stock in several corporations that it purchased for investment purposes. The stock in Lime Corporation is held equally by Sultan, an individual, and by Turquoise Corporation. Both Sultan and Turquoise own 1,000 shares in Lime that were purchased nine years ago at a cost of $200 per share. Determine whether the following independent transactions qualify as partial liquidations under 302(b)(4). In each transaction, determine the tax consequences to Lime Corporation, to Turquoise Corporation, and to Sultan. a. Lime sells one of its businesses lines (basis of $500,000, fair market value of $700,000) and distributes the proceeds equally to Sultan and Turquoise The redemption will qualify as a partial liquidation as to . As a result Sultan has of of and Turquoise has of on the sale of the trade or business. Lime Corporation will have a recognized b Lime equally distributes the stock (basis $425,000, fair market value $700,000) that it holds in other corporations to Sultan and Turquoise As a result Sultan has The redemption will qualify as a partial liquidation as to of and Turquoise has of of Lime Corporation will have a recognized on the distribution of the stock