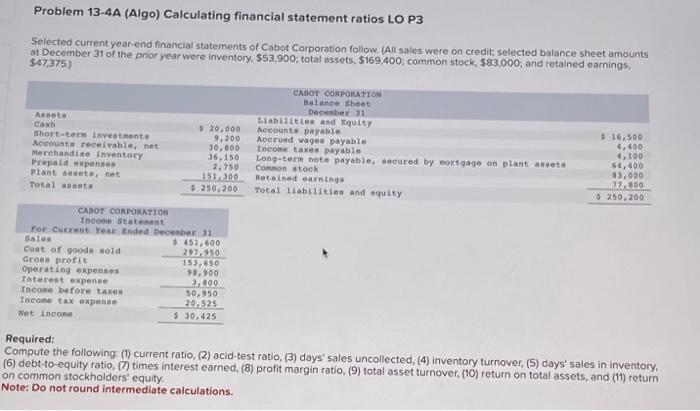

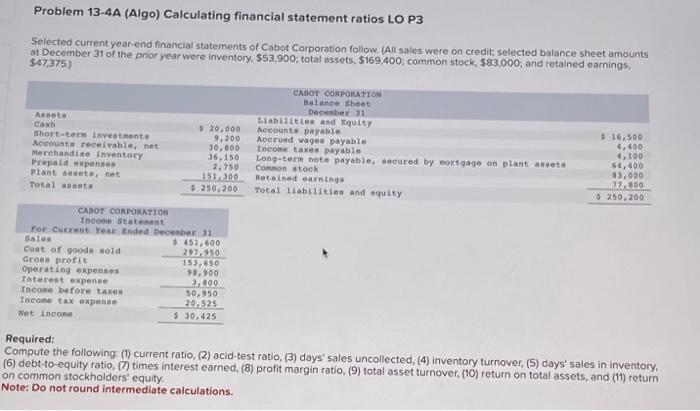

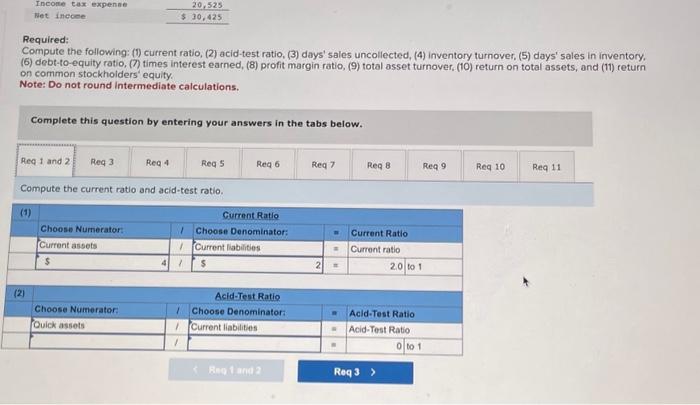

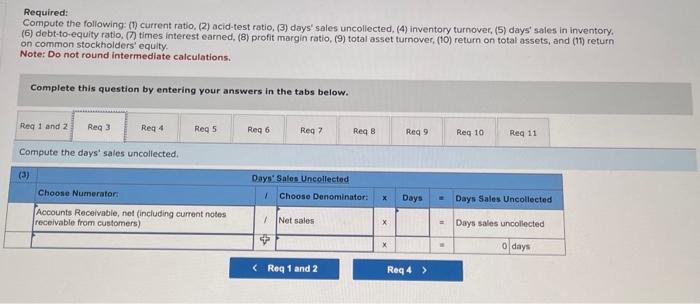

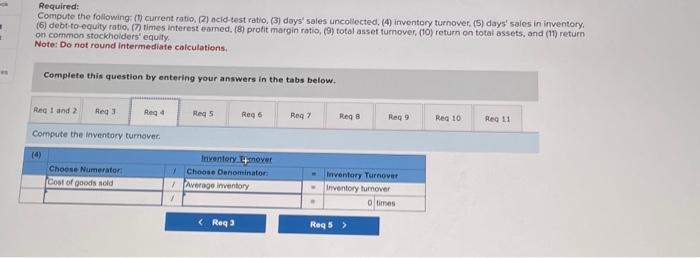

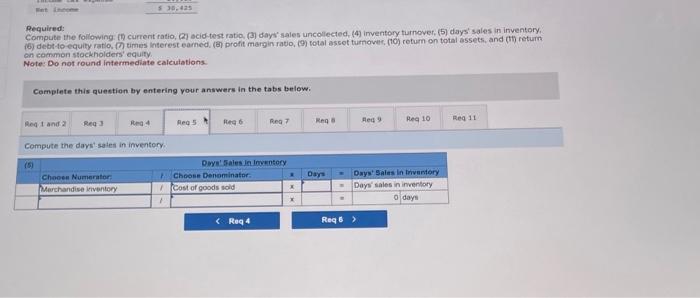

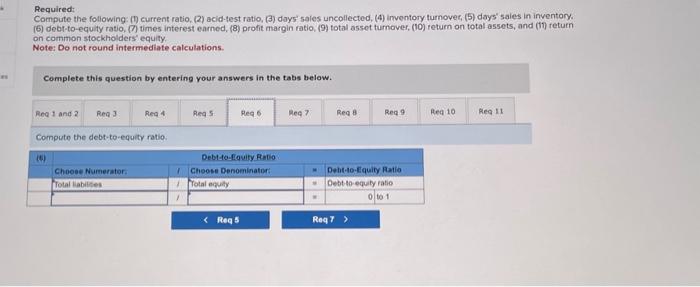

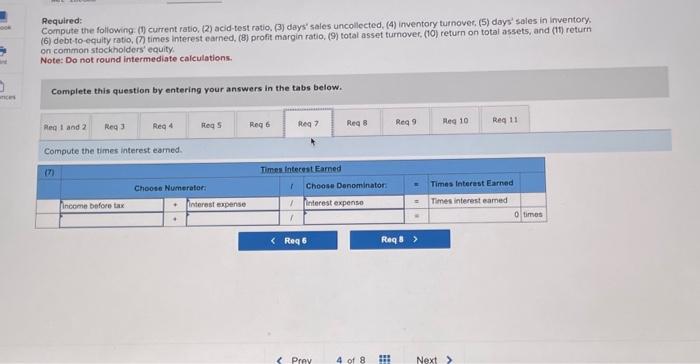

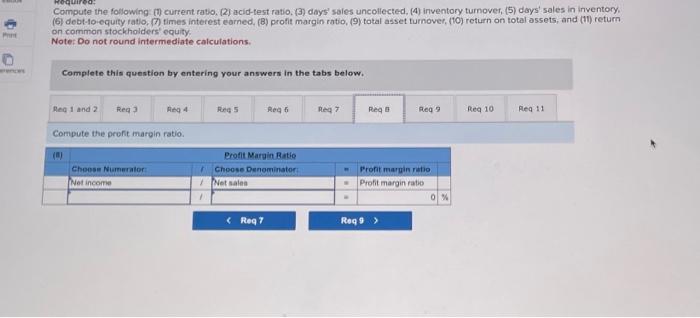

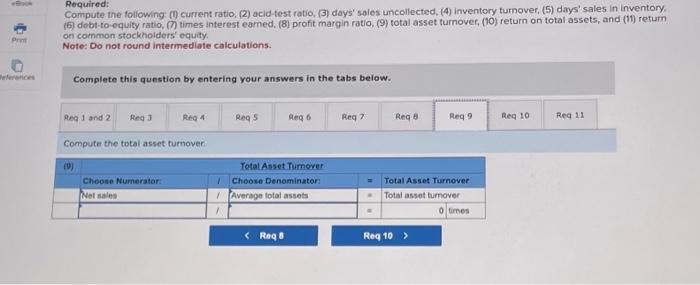

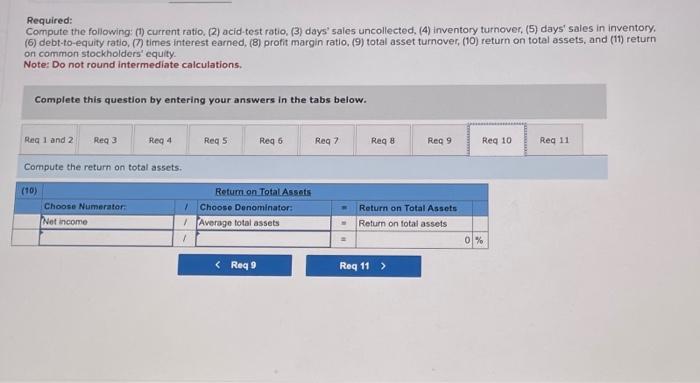

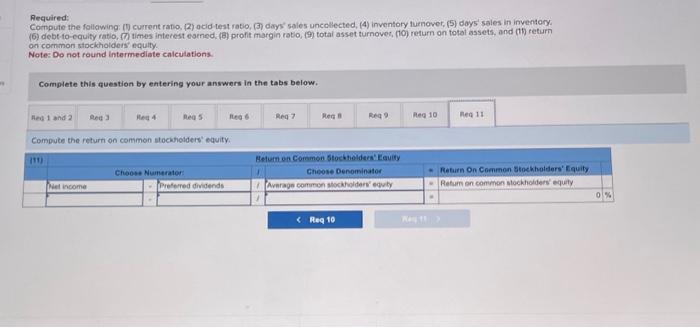

Problem 13-4A (Algo) Calculating financial statement ratios LO P3 Selected current year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $53,900; total assets, $169,400; common stock, $83,000; and retained earnings, $47,375.) Assets Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets CABOT CORPORATION Income Statement For Current Year Ended December 31 Sales $ 451,600 297,950 Cost of goods sold Gross profit $ 20,000 9,200 30,800 36,150 2,750 151,300 $ 250,200 Operating expenses Interest expense Income before taxes Income tax expense Net income 153,650 98,900 3,800 50,950 20,525 $ 30,425 CABOT CORPORATION Balance Sheet December 31 Liabilities and Equity Accounts payable Accrued wages payable Income taxes payable Long-term note payable, secured by mortgage on plant assets Common stock Retained earnings Total liabilities and equity $ 16,500 4,400 4,100 64,400 83,000 77,800 $ 250,200 Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on common stockholders' equity. Note: Do not round intermediate calculations.

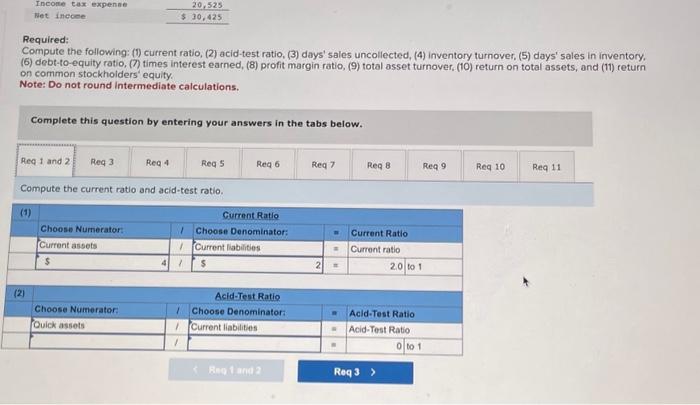

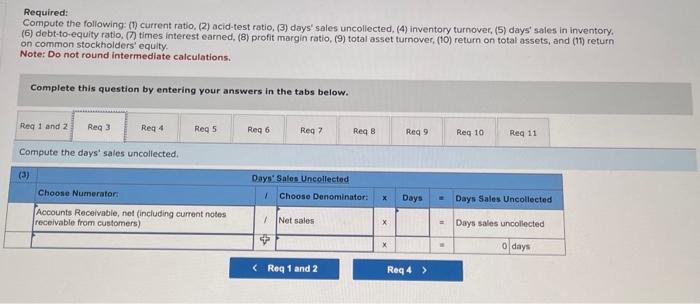

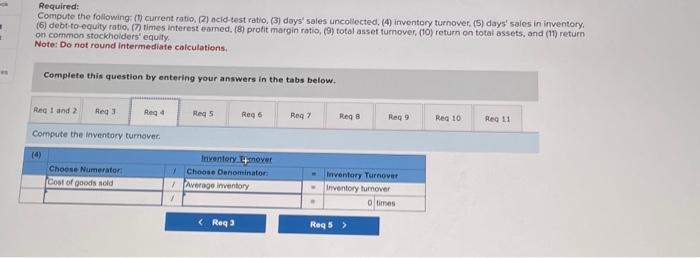

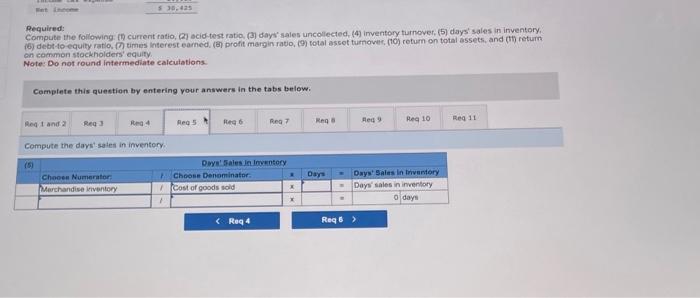

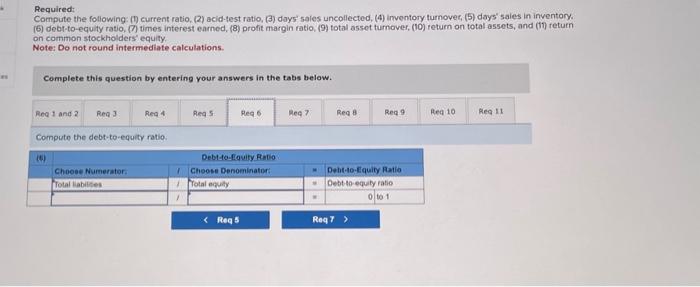

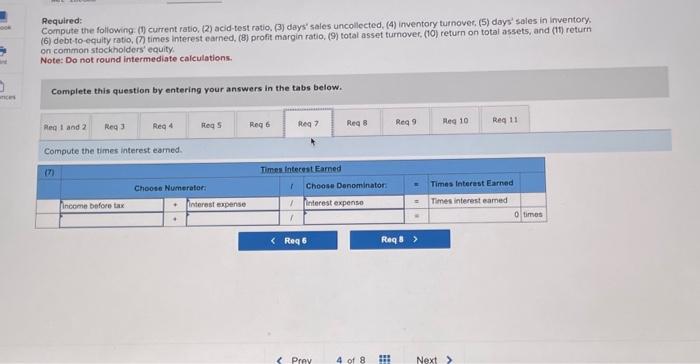

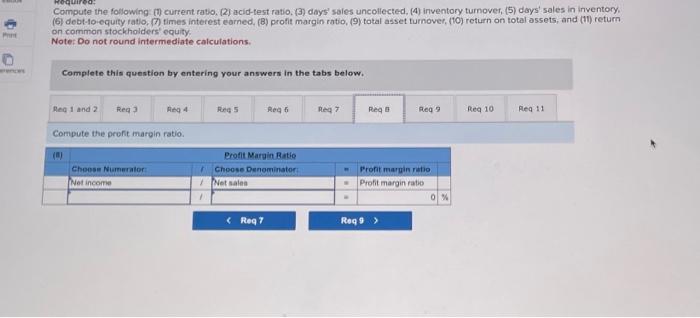

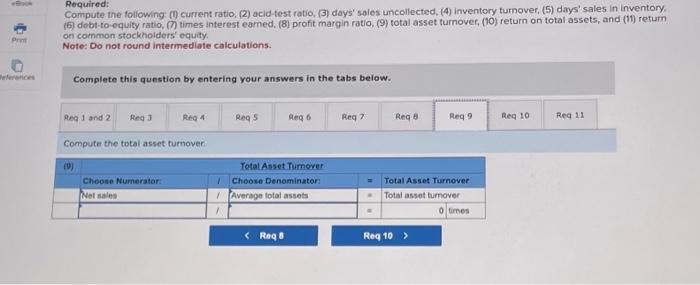

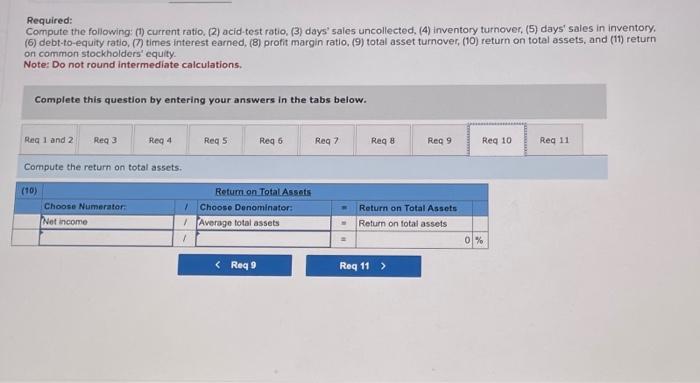

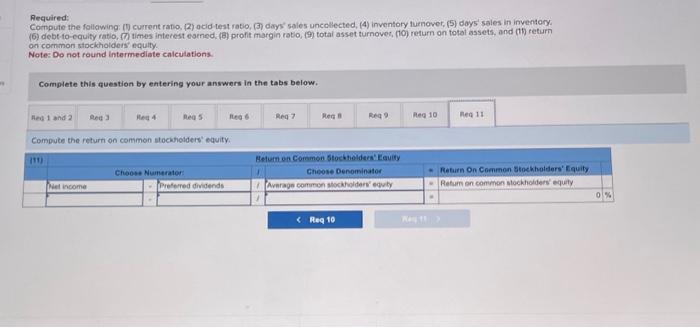

Problem 13-4A (Algo) Calculating financial statement ratios LO P3 Selected current year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $53,900; total assets, $169,400, common stock, $83,000; and retained earnings, 547,375 ) Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return. on common stockholders' equity. Vote: Do not round intermediate calculations. Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover. (5) days' sales in inventory. (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on common stockholders equity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the current ratio and acid-test ratio. Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (1) return on common stockholders' equity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the days' sales uncollected. Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-equity ratio, (7) times interest eamed, (8) protit margin ratio, (9) total asset fumover, (10) return on total assets, and (11) return on common stockholders' equity. Note: Do not round intermediafe calculations. Complete this question by entering your answers in the tabs below. Compute the inventory turnaver. Pequired: Required: Compute the following. (2) current ratio, (2) ocio test ratio, (3) days' sales uncollected, (4) imventory turnover, (5) days' sales in inventory, an common stockiolders' equity. Note: Do not round intermediate calculations. Camplete this question by entering your answers in the tabs below. Compute the dars' sales in ifrentory. Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) imventory turnover, (5) days' saies in inventory. (6) debr-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset tumaver, (10) return on total assets, and (1) return on common stockholders' equity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the debt-to-equity ratio. Required: Required: Compute the following. (1) current ratio, (2) acid-test ratio. (3) days' sales uncollected, (4) inventory turnovet, (5) doys' sales in inventory (6) debt-to-equity ratio, (7) times interest earned, (B) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on common stockholders' equity Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the times interest eamed. Compute the following in current ratio. (2) acid-test ratio, (3) days' saies uncollected, (4) inventory turnover, (5) doys' sales in inventory. (G) debt-10,equity tatio, (7) times interest earned, (B) profit margin ratio, (9) total asset turnover, (10) return on total ossets, and (11) return on common stockholders' equity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the prent maroin ratio. Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' soles uncollected, (4) inventory turnover, (5) days' sales. in inventory. (5) debt-to-equity ratio, (7) times interest eamed. (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on common stockholders' equity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the total asset tumover. Required: Compute the following: (1) current ratio. (2) acid-test ratio, (3) days' sales uncollected. (4) inventory turnover. (5) days' sales in inventory. (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on common stockholders' equity. Note: Do not round intermediate calculations, Complete this question by entering your answers in the tabs below. Compute the return on total assets. Required: Compute the follawing: (1) current ratio, (2) acid test ratio, (3) days' sales uncellected, (4) inventory turnover, (5) days sales in inventory, (6) debe-fo-cquity ratio, (7) times interest esrned; (B) profit margin rato, (9) totai asset turnover, (10) return on total assets, and (1) return on cornmon stocicholders' ecuity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the return on common stockholders' equity. Problem 13-4A (Algo) Calculating financial statement ratios LO P3 Selected current year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $53,900; total assets, $169,400, common stock, $83,000; and retained earnings, 547,375 ) Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return. on common stockholders' equity. Vote: Do not round intermediate calculations. Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover. (5) days' sales in inventory. (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on common stockholders equity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the current ratio and acid-test ratio. Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (1) return on common stockholders' equity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the days' sales uncollected. Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-equity ratio, (7) times interest eamed, (8) protit margin ratio, (9) total asset fumover, (10) return on total assets, and (11) return on common stockholders' equity. Note: Do not round intermediafe calculations. Complete this question by entering your answers in the tabs below. Compute the inventory turnaver. Pequired: Required: Compute the following. (2) current ratio, (2) ocio test ratio, (3) days' sales uncollected, (4) imventory turnover, (5) days' sales in inventory, an common stockiolders' equity. Note: Do not round intermediate calculations. Camplete this question by entering your answers in the tabs below. Compute the dars' sales in ifrentory. Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) imventory turnover, (5) days' saies in inventory. (6) debr-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset tumaver, (10) return on total assets, and (1) return on common stockholders' equity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the debt-to-equity ratio. Required: Required: Compute the following. (1) current ratio, (2) acid-test ratio. (3) days' sales uncollected, (4) inventory turnovet, (5) doys' sales in inventory (6) debt-to-equity ratio, (7) times interest earned, (B) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on common stockholders' equity Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the times interest eamed. Compute the following in current ratio. (2) acid-test ratio, (3) days' saies uncollected, (4) inventory turnover, (5) doys' sales in inventory. (G) debt-10,equity tatio, (7) times interest earned, (B) profit margin ratio, (9) total asset turnover, (10) return on total ossets, and (11) return on common stockholders' equity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the prent maroin ratio. Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' soles uncollected, (4) inventory turnover, (5) days' sales. in inventory. (5) debt-to-equity ratio, (7) times interest eamed. (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on common stockholders' equity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the total asset tumover. Required: Compute the following: (1) current ratio. (2) acid-test ratio, (3) days' sales uncollected. (4) inventory turnover. (5) days' sales in inventory. (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on common stockholders' equity. Note: Do not round intermediate calculations, Complete this question by entering your answers in the tabs below. Compute the return on total assets. Required: Compute the follawing: (1) current ratio, (2) acid test ratio, (3) days' sales uncellected, (4) inventory turnover, (5) days sales in inventory, (6) debe-fo-cquity ratio, (7) times interest esrned; (B) profit margin rato, (9) totai asset turnover, (10) return on total assets, and (1) return on cornmon stocicholders' ecuity. Note: Do not round intermediate calculations. Complete this question by entering your answers in the tabs below. Compute the return on common stockholders' equity