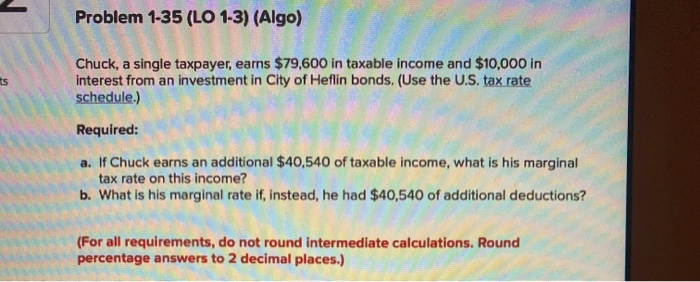

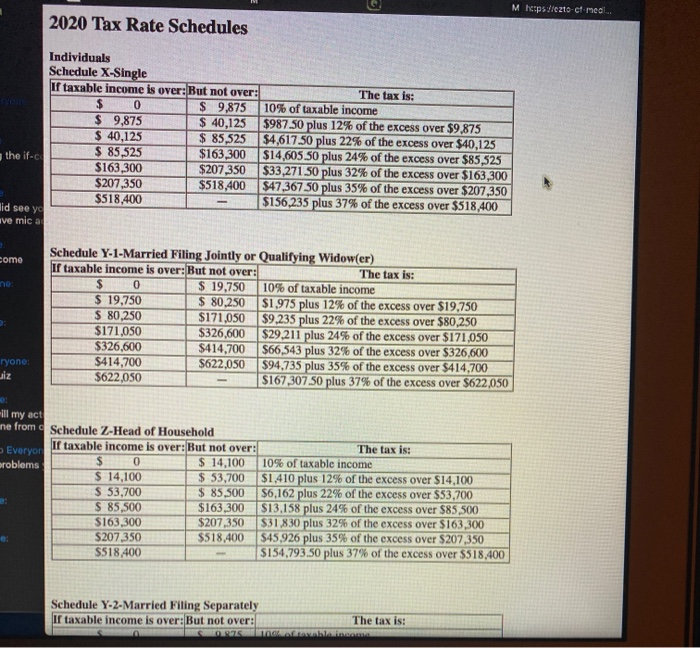

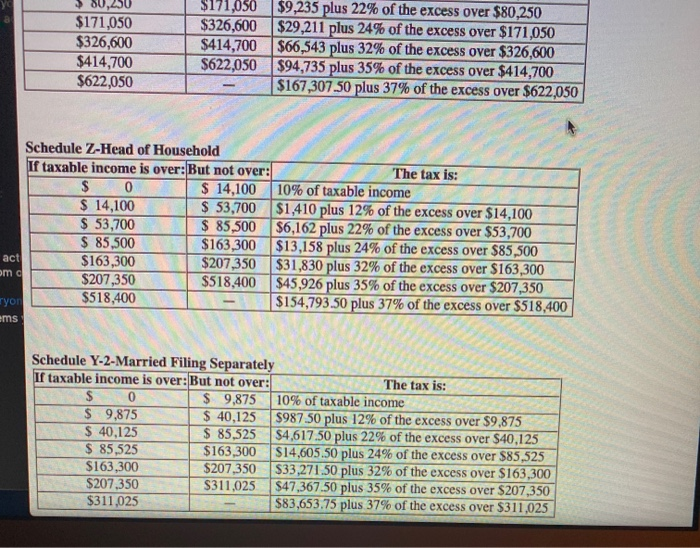

Problem 1-35 (LO 1-3) (Algo) ts Chuck, a single taxpayer, earns $79,600 in taxable income and $10,000 in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule.) Required: a. If Chuck earns an additional $40,540 of taxable income, what is his marginal tax rate on this income? b. What is his marginal rate if, instead, he had $40,540 of additional deductions? (For all requirements, do not round intermediate calculations. Round percentage answers to 2 decimal places.) M https:/ezto-cf meal. 2020 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over: But not over: The tax is: 0 $ 9,875 10% of taxable income $ 9.875 $ 40,125 $987 50 plus 12% of the excess over $9,875 $ 40,125 $ 85,525 54,617 50 plus 22% of the excess over $40,125 the if-ca $ 85,525 $163,300 $14,605 50 plus 24% of the excess over $85,525 $163,300 $207,350 $33,271.50 plus 32% of the excess over $163,300 $207,350 $518,400 $47,367 50 plus 35% of the excess over $207,350 $518,400 $156,235 plus 37% of the excess over $518,400 ve mic al lid see yo come ne: Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: $ 0 $ 19,750 10% of taxable income $ 19,750 $ 80,250 $1,975 plus 12% of the excess over $19,750 $ 80,250 $171,050 $9,235 plus 22% of the excess over $80,250 $171,050 $326,600 $29,211 plus 24% of the excess over $171,050 $326,600 $414,700 $66,543 plus 32% of the excess over $326,600 $414,700 $622,050 $94.735 plus 35% of the excess over $414,700 $622,050 $167,307 50 plus 37% of the excess over $622,050 ryone: iz e: Fill my act une from Schedule Z-Head of Household Everyon If taxable income is over: But not over: The tax is: problems $ 0 $ 14,100 10% of taxable income $ 14,100 $ 53,700 $1,410 plus 12% of the excess over $14,100 $ 53,700 $ 85,500 $6,162 plus 22% of the excess over $53,700 $ 85,500 $163,300 $13,158 plus 24% of the excess over $85,500 $163,300 $207,350 $31,830 plus 32% of the excess over $163,300 $207,350 $518,400 $45,926 plus 35% of the excess over $207,350 $518,400 $154,793.50 plus 37% of the excess over $518,400 Schedule Y-2-Married Filing Separately Ir taxable income is over: But not over: The tax is: 100 mm ORZS $171,050 $326,600 $414,700 $622,050 $171,050 $9,235 plus 22% of the excess over $80,250 $326,600 $29,211 plus 24% of the excess over $171,050 $414,700 $66,543 plus 32% of the excess over $326,600 $622,050 $94,735 plus 35% of the excess over $414,700 $167,307.50 plus 37% of the excess over $622,050 Schedule Z-Head of Household If taxable income is over: But not over: The tax is: $ 0 $ 14,100 10% of taxable income $ 14,100 $ 53,700 $1,410 plus 12% of the excess over $14,100 $ 53,700 $ 85,500 $6,162 plus 22% of the excess over $53,700 $ 85,500 $ 163,300 $13,158 plus 24% of the excess over $85,500 act $163,300 $207,350 $31,830 plus 32% of the excess over $163,300 mc $207,350 $518,400 $45,926 plus 35% of the excess over $207,350 ryon $518,400 $154,793.50 plus 37% of the excess over $518,400 ems Schedule Y-2-Married Filing Separately If taxable income is over: But not over: The tax is: $ 0 $ 9.875 10% of taxable income $ 9,875 $ 40,125 $987 50 plus 12% of the excess over $9.875 $ 40,125 $ 85,525 $4,617.50 plus 22% of the excess over $40,125 $ 85,525 $ 163,300 $14,605.50 plus 24% of the excess over $85,525 $163,300 $207,350 $33,271.50 plus 32% of the excess over $163,300 $207,350 $311,025 $47,367.50 plus 35% of the excess over $207,350 $311,025 $83,653.75 plus 37% of the excess over $311,025