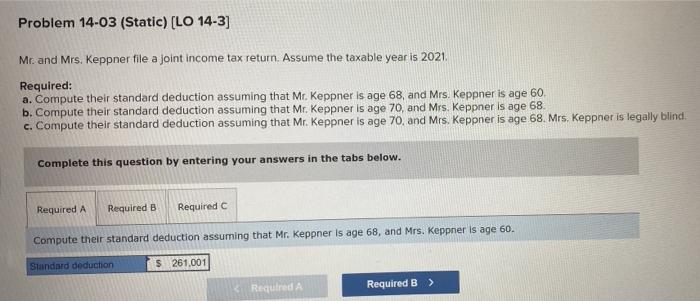

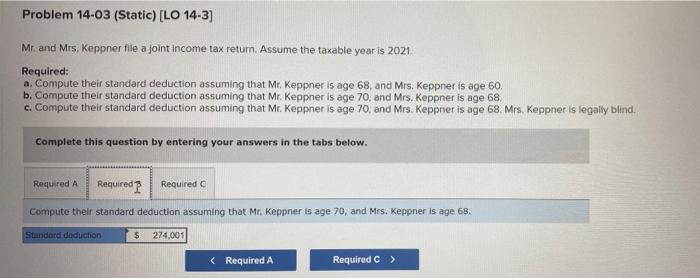

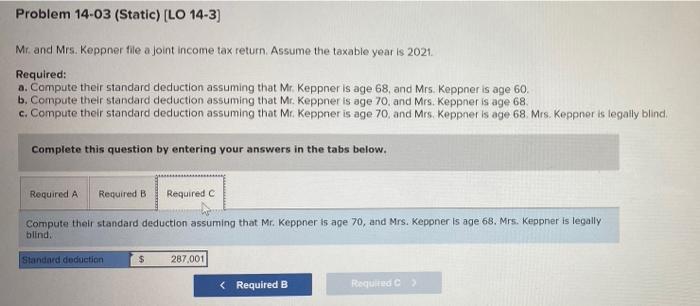

Problem 14-03 (Static) [LO 14-3] Mr. and Mrs. Keppner file a joint income tax return. Assume the taxable year is 2021. Required: a. Compute their standard deduction assuming that Mr. Keppner is age 68, and Mrs. Keppner is age 60 b. Compute their standard deduction assuming that Mr. Keppner is age 70, and Mrs. Keppner is age 68. c. Compute their standard deduction assuming that Mr. Keppner is age 70 and Mrs. Keppner is age 68. Mrs. Keppner is legally blind. Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute their standard deduction assuming that Mr. Keppner is age 68, and Mrs. Keppner is age 60. Standard deduction $ 261.001 Required A Required B Problem 14-03 (Static) (LO 14-3] Mr. and Mrs. Keppner file a joint Income tax return. Assume the taxable year is 2021 Required: a. Compute their standard deduction assuming that Mr. Keppner is age 68, and Mrs. Keppner is age 60 b. Compute their standard deduction assuming that Mr. Keppner is age 70, and Mrs. Keppner is age 68. c. Compute their standard deduction assuming that Mr. Keppner is age 70, and Mrs. Keppner is age 68. Mrs. Keppner is legally blind, Complete this question by entering your answers in the tabs below. Required A Required Required Compute their standard deduction assuming that Mr. Keppner is age 70, and Mrs. Keppner is age 68. Standard deduction $ 274,001 Problem 14-03 (Static) (LO 14-3) Mr. and Mrs. Keppner file a joint income tax return. Assume the taxable year is 2021 Required: a. Compute their standard deduction assuming that Mr. Keppner is age 68, and Mrs. Keppner is age 60 b. Compute their standard deduction assuming that Mr. Keppner is age 70, and Mrs. Keppner is age 68 c. Compute their standard deduction assuming that Mr. Keppner is age 70, and Mrs. Keppner is age 68 Mrs. Keppner is legally blind, Complete this question by entering your answers in the tabs below. Required a Required B Required Compute their standard deduction assuming that Mr. Keppner is age 70, and Mrs. Keppner is age 68. Mrs. Keppner is legally blind. Standard deduction $ 287,001