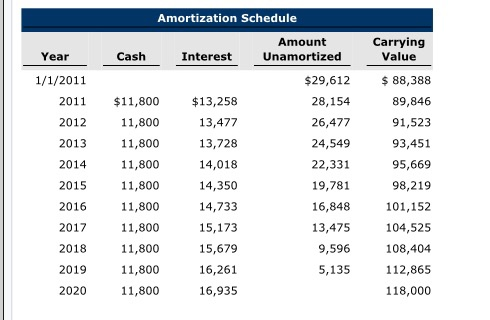

Problem 14-1 The following amortization and interest schedule reflects the issuance of 10-year bonds by Skysong Corporation on January 1, 2011, and the subsequent interest payments and charges. The company's year-end is December 31, and financial statements are prepared once yearly. Amortization Schedul Aunt Caryng alee Year Cash nterest Unamertied ara/21 s 129,12 21 sL00 13258 54 22 4P 00 100 ,22 24,5 2233 1, 24 L00 141 450 219 2 0 4,33 00 ,a73 35 2a 100 5679 L800 6,26 5,135 28 a00 000 220 (a) Indicate whether the bonds were issued at a premium or a discount (b) Indicate whether the amortization schedule is based on the straight-line method or the effective-interest method. (e) Determine the stated interest rate and the effective-interest rate. (Round answers to o decimal places, e.g. 18%.) The stated rate The effective rate (d) On the basis of the schedule above, prepare the journal entry to record the issuance of the bonds on January 1, 2011. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Cd auary 1, 2013 (e) On the basis of the schedule above, prepare the journal entry to reflect the bond transactions and accruals for 2011. (Interest is paid January 1.) (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) ber 31,3011 (f) On the basis of the schedule above, prepare the journal entries to reflect the bond transactions and accruals for 2018. Skysong Corporation does not use reversing entries. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) cick if you would ke to Show Work for this question S k Amortization Schedule Carrying Amount Year Cash Interest Unamortized Value 88,388 1/1/2011 $29,612 2011 89,846 $11,800 $13,258 28,154 2012 11,800 13,477 26,477 91,523 11,800 93,451 2013 13,728 24,549 2014 11,800 14,018 22,331 95,669 2015 11,800 14,350 19,781 98,219 2016 11,800 14,733 16,848 101,152 2017 11,800 15,173 13,475 104,525 2018 11,800 15,679 9,596 108,404 2019 11,800 16,261 5,135 112,865 2020 11,800 16,935 118,000