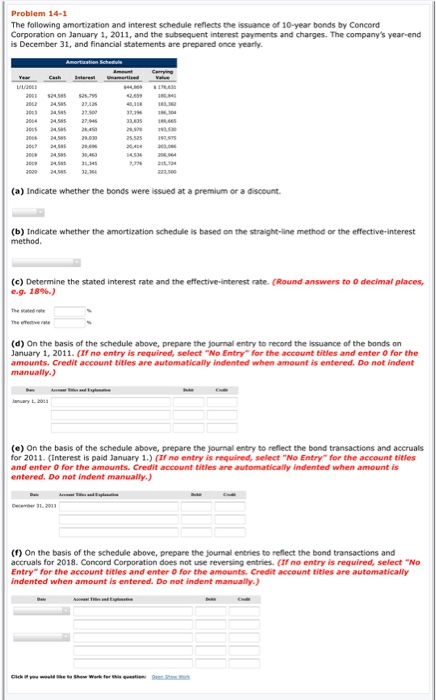

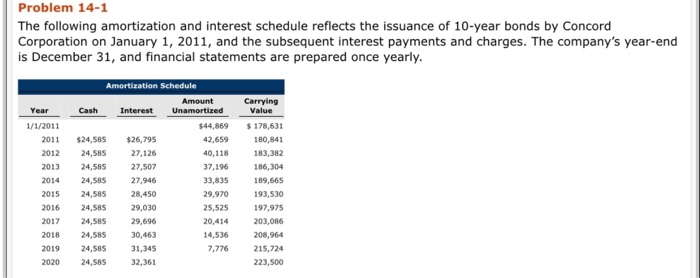

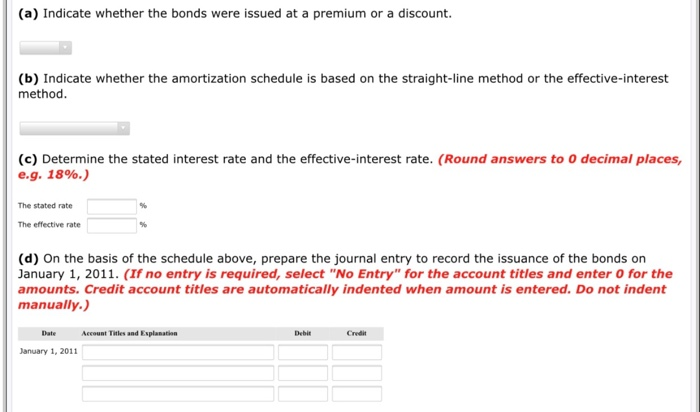

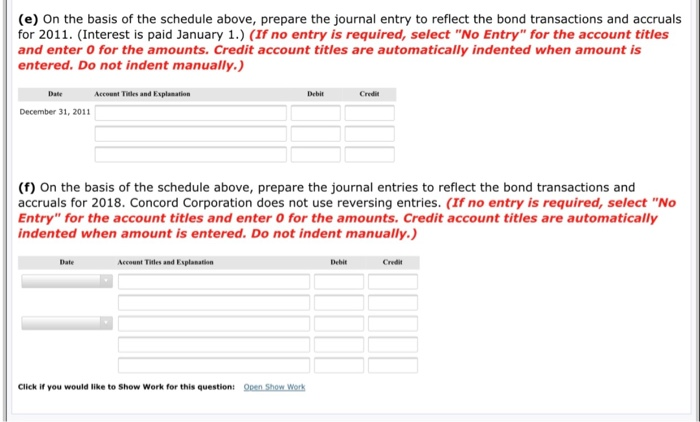

Problem 14-1 The following amortization and interest schedule reflects the issuance of 10-year bonds by Concord Corporation on January 1, 2011, and the subsequent interest payments and charges. The company's year and is December 31, and financial statements are prepared once yearly (a) Indicate whether the bonds were issued at a premium or a discount (b) indicate whether the amortization schedule is based on the straight-line method or the effective interest method. decimal places, (c) Determine the stated interest rate and the effective interest rate. (Round answers to c.g. 1896) (d) On the basis of the schedule above, prepare the journal entry to record the issuance of the bonds on January 1, 2011. (If no entry is required, select "No Entry for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) (e) On the basis of the schedule above, prepare the journal entry to reflect the bond transactions and accruals for 2011. (interest is paid January 1.) CIF no entry is required, select "No Entry for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) (1) On the basis of the schedule above, prepare the journal entries to reflect the band transactions and accruals for 2018. Concord Corporation does not use reversing entries. ( no entry is required, select "No Entry for the account titles and enter for the amount Credit account titles are automatically indented when amount is entered. Do not indent manually) Problem 14-1 The following amortization and interest schedule reflects the issuance of 10-year bonds by Concord Corporation on January 1, 2011, and the subsequent interest payments and charges. The company's year-end is December 31, and financial statements are prepared once yearly. Amortization Schedule Year Cash Interest Amount Unamortized Carrying Value 1/1/2011 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 $24,585 24,585 24,585 24,585 24,585 24,585 24,585 24,585 24,585 24,585 $26,795 27,126 27,507 27,946 28,450 29,030 29,696 30,463 31,345 32,361 $44,869 42,659 40,118 37,196 33,835 29,970 25,525 20,414 14,536 7,776 $ 178,631 180,841 183,382 186,304 189,665 193,530 197,975 203,086 208,964 215,724 223,500 (a) Indicate whether the bonds were issued at a premium or a discount. (b) Indicate whether the amortization schedule is based on the straight-line method or the effective-interest method. (c) Determine the stated interest rate and the effective-interest rate. (Round answers to 0 decimal places, e.g. 18%.) The stated rate The effective rate (d) On the basis of the schedule above, prepare the journal entry to record the issuance of the bonds on January 1, 2011. (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Tiles and Explanation Credit January 1, 2011 (e) On the basis of the schedule above, prepare the journal entry to reflect the bond transactions and accruals for 2011. (Interest is paid January 1.) (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation December 31, 2011 (f) On the basis of the schedule above, prepare the journal entries to reflect the bond transactions and accruals for 2018. Concord Corporation does not use reversing entries. (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Credit Click if you would like to Show Work for this question: Open Show Work