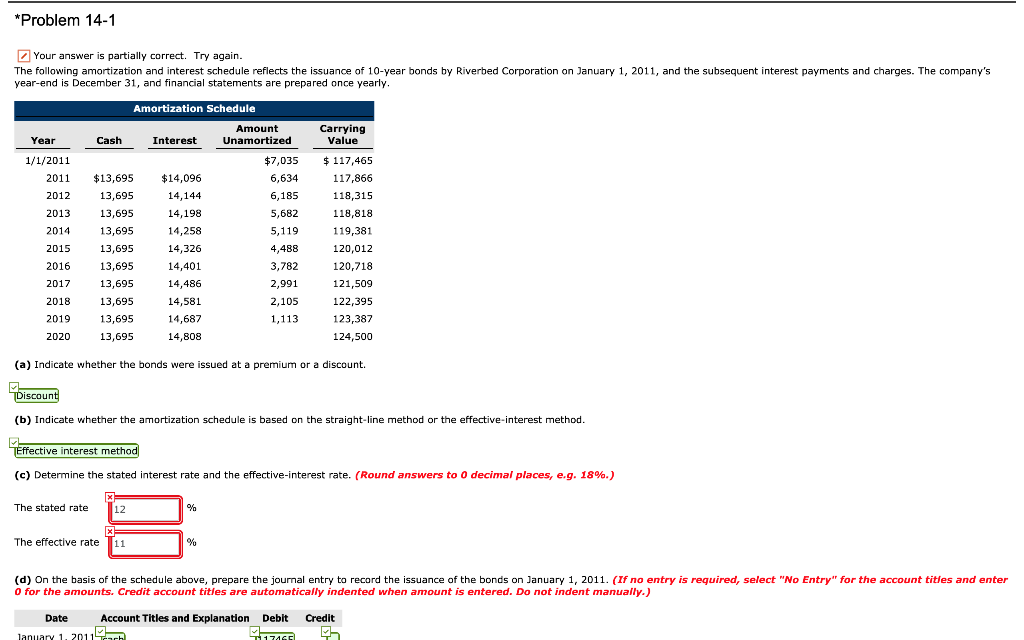

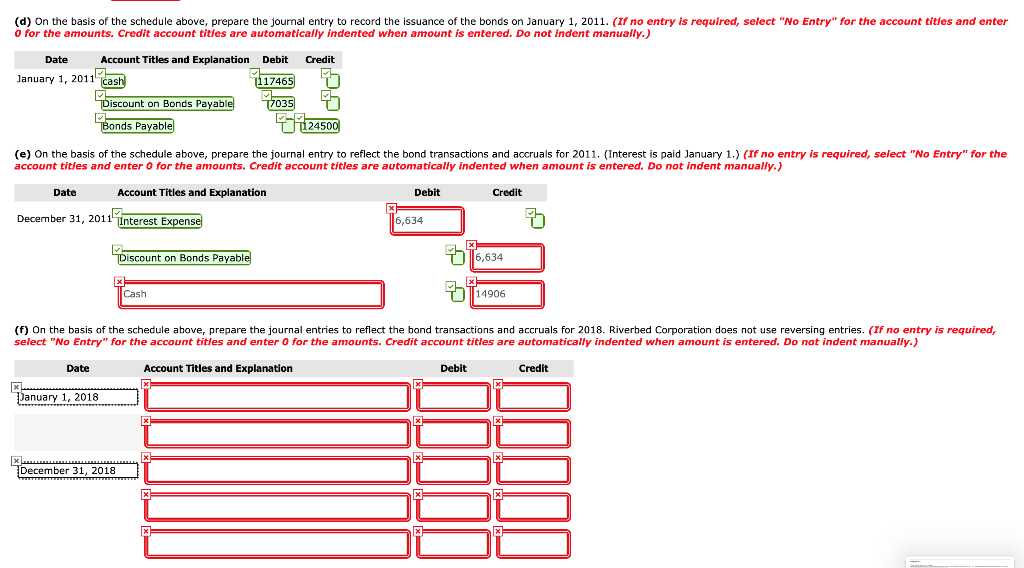

*Problem 14-1 Your answer is partially correct. Try again. The following amortization and interest schedule reflects the issuance of 10-year bonds by Riverbed Corporation on January 1, 2011, and the subsequent interest payments and charges. The company's year-end is December 31, and financial statements are prepared once yearly. Amortization Schedule Amount Unamortized Year Cash Interest 1/1/2011 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 $13,695 13,695 13,695 13,695 13,695 13,695 13,695 13,695 13,695 13,695 $14,096 14,144 14,198 14,258 14,326 14,401 14,486 14,581 14,687 14,808 $7,035 6,634 6,185 5,682 5,119 4,488 3,782 2,991 2,105 1,113 Carrying Value $ 117,465 117,866 118,315 118,818 119,381 120,012 120,718 121,509 122,395 123,387 124,500 (a) Indicate whether the bonds were issued at a premium or a discount. biscount (b) Indicate whether the amortization schedule is based on the straight-line method or the effective-interest method. Effective interest method (c) Determine the stated interest rate and the effective-interest rate. (Round answers to 0 decimal places, e.g. 18%.) The stated rate X The effective rate 11 (d) On the basis of the schedule above, prepare the journal entry to record the issuance of the bonds on January 1, 2011. (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Credit Date lanuary 1, 200 Account Titles and Explanation h (d) On the basis of the schedule above, prepare the journal entry to record the issuance of the bonds on January 1, 2011. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Credit Date Account Titles and Explanation Debit January 1, 2011 cash Discount on Bonds Payable Bonds Payable 117465 7035 1124500 (e) On the basis of the schedule above, prepare the journal entry to reflect the bond transactions and accruals for 2011. (Interest is paid January 1.) If no entry is required, select "No Entry" for the account tities and enter o for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit December 31, 2011 Interest Expense 6,634 Discount on Bonds Payable 6,634 Cash D114906 (f) On the basis of the schedule above, prepare the journal entries to reflect the bond transactions and accruals for 2018. Riverbed Corporation does not use reversing entries. (If no entry is required, select "No Entry" for the account tities and enter o for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit XL Danuary 1, 2018 December 31, 2018