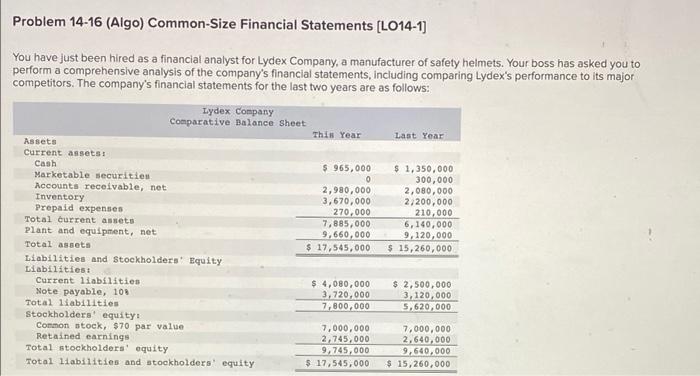

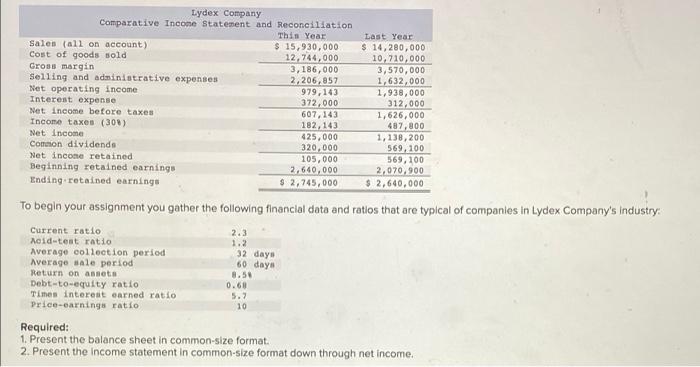

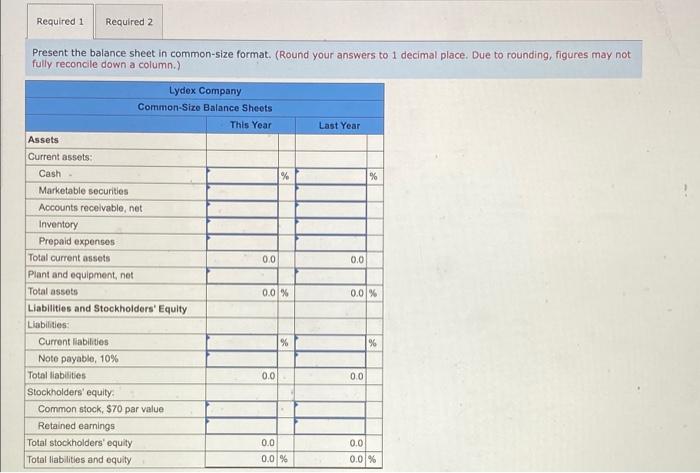

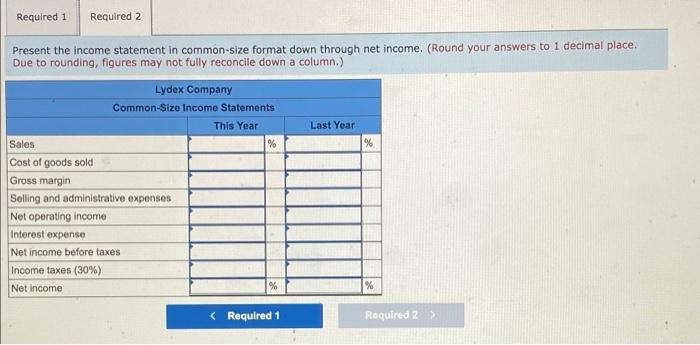

Problem 14-16 (Algo) Common Size Financial Statements (L014-1] You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your boss has asked you to perform a comprehensive analysis of the company's financial statements, including comparing Lydex's performance to its major competitors. The company's financial statements for the last two years are as follows: Lydex Company Comparative Balance Sheet This Year Last Year Assets Current assets! Cash $ 965,000 0 2,980,000 3,670,000 270,000 7,885,000 9,660,000 $ 17,545,000 $ 1,350,000 300,000 2,080,000 2,200,000 210,000 6,140,000 9,120,000 $ 15,260,000 Marketable securities Accounts receivable, net Inventory Prepaid expenses Total current asseto Plant and equipment, net Total assets Liabilities and Stockholders' Equity Liabilities: Current liabilities Note payable, 108 Total liabilities Stockholders' equity Common stock, $70 par value Retained carnings Total stockholders' equity Total liabilities and stockholders' equity $ 4,000,000 3,720,000 7,800,000 $ 2,500,000 3,120,000 5.620,000 7,000,000 2,745,000 9,745,000 $ 17,545,000 7,000,000 2.640,000 9,640,000 $ 15,260,000 Lydex Company Comparative Income Statement and Reconciliation This Year Sales (all on account) $ 15,930,000 Cost of goods sold 12,744,000 Gross margin 3,186,000 Selling and administrative expenses 2,206,057 Net operating income 979, 143 Interest expense 372,000 Net income before taxes 607,143 Income taxes (308) 182, 143 Net Income 425,000 Common dividends 320,000 Net income retained 105,000 Beginning retained earnings 2.640,000 Ending retained earnings $ 2,745,000 Last Year $ 14,280,000 10,710,000 3,570,000 1,632,000 1,938,000 312.000 1,626,000 487,800 1,138,200 569, 100 569,100 2,070,900 $ 2,640,000 To begin your assignment you gather the following financial data and ratios that are typical of companies in Lydex Company's Industry Current ratio 2.3 Acid-test ratio 1.2 Average collection period 32 day Average sale period 60 days Return on annet 8.54 Debt-to-equity ratio 0.68 Times interest earned ratio 5. Price-earnings ratio 10 Required: 1. Present the balance sheet in common-size format. 2. Present the income statement in common-size format down through net income. Required 1 Required 2 Present the balance sheet in common-size format. (Round your answers to 1 decimal place. Due to rounding, figures may not fully reconcile down a column.) Last Year % % 0.0 Lydex Company Common Size Balance Sheets This Year Assets Current assets: Cash- Marketable securities Accounts receivable, net Inventory Prepaid expenses Total current assets 0.0 Plant and equipment, net Total assets 0.0 % Liabilities and Stockholders' Equity Liabilities: Current liabilities Note payable, 10% Total liabilities 0.0 Stockholders' equity. Common stock, S70 par value Retained earnings Total stockholders' equity 0.0 Total liabilities and equity 0.0 % 0.0% % %6 0.0 0.0 0.0 % Required 1 Required 2 Present the income statement in common-size format down through net income. (Round your answers to 1 decimal place. Due to rounding, figures may not fully reconcile down a column.) Last Year % Lydex Company Common-Size Income Statements This Year Sales % Cost of goods sold Gross margin Selling and administrative expenses Net operating income Interest expense Net income before taxes Income taxes (30%) Net Income %