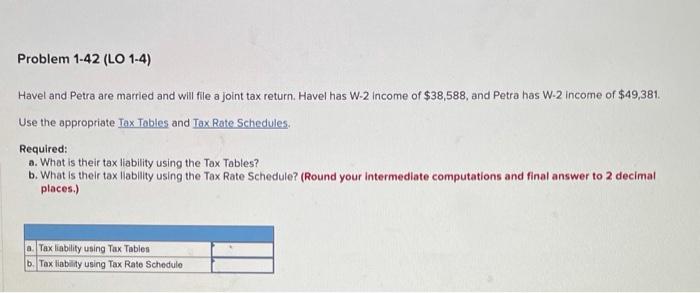

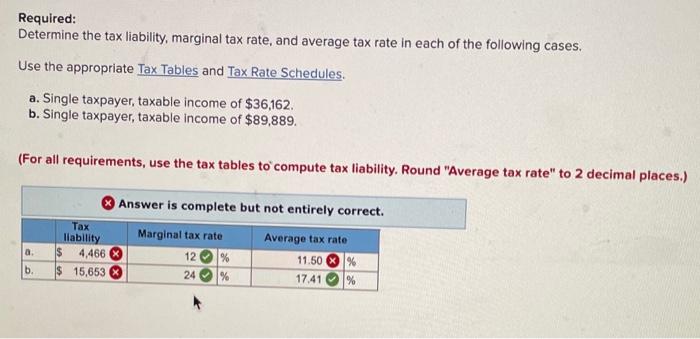

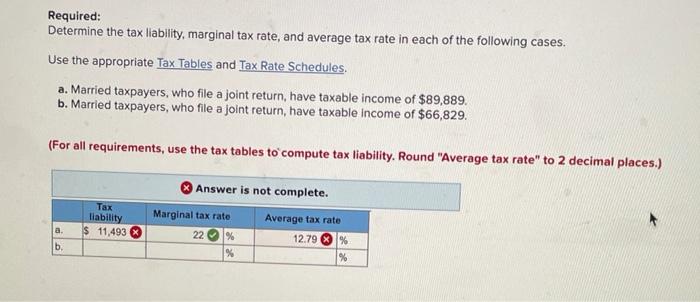

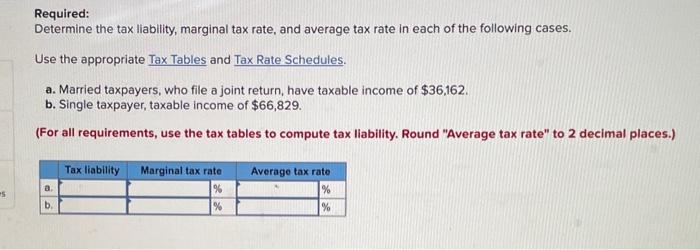

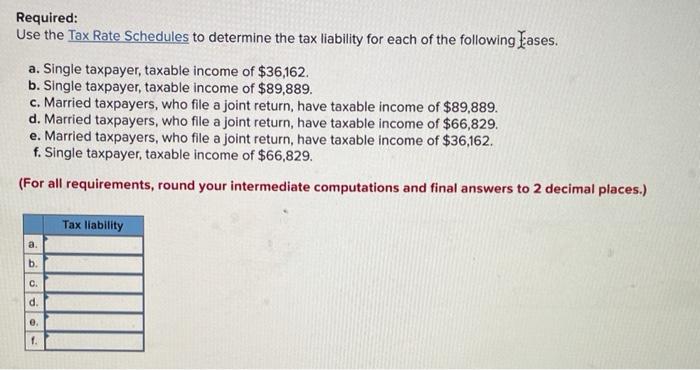

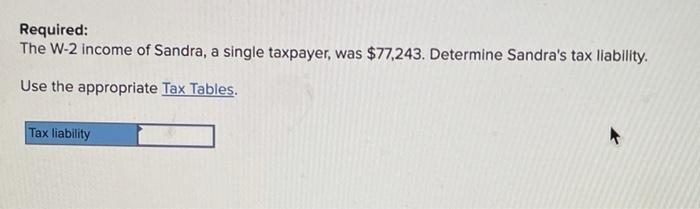

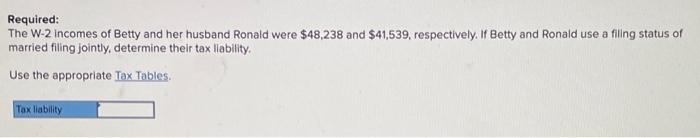

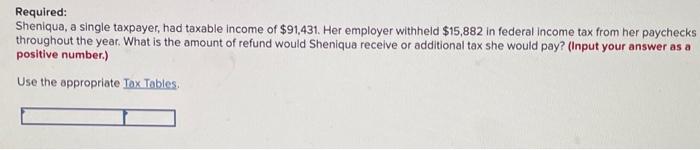

Problem 1-42 (LO 1-4) Havel and Petra are married and will file a joint tax return. Havel has W-2 Income of $38,588, and Petra has W-2 Income of $49,381. Use the appropriate Tax Tables and Tax Rate Schedules, Required: a. What is their tax liability using the Tax Tables? b. What is their tax liability using the Tax Rate Schedule? (Round your intermediate computations and final answer to 2 decimal places.) a. Tax liability using Tax Tables b. Tax liability using Tax Rato Schedule Required: Determine the tax liability, marginal tax rate, and average tax rate in each of the following cases. Use the appropriate Tax Tables and Tax Rate Schedules. a. Single taxpayer, taxable income of $36,162. b. Single taxpayer, taxable income of $89,889. (For all requirements, use the tax tables to compute tax liability. Round "Average tax rate" to 2 decimal places.) Answer is complete but not entirely correct. Tax liability Marginal tax rate Average tax rate $ 4,466 12 % 11.50 % $ 15,653 24 % 17.41 % a b. Required: Determine the tax liability, marginal tax rate, and average tax rate in each of the following cases. Use the appropriate Tax Tables and Tax Rate Schedules. a. Married taxpayers, who file a joint return, have taxable income of $89,889. b. Married taxpayers, who file a joint return, have taxable income of $66,829. (For all requirements, use the tax tables to compute tax liability. Round "Average tax rate" to 2 decimal places.) Tax liability $ 11,493 Answer is not complete. Marginal tax rate Average tax rate 22 % 12.79 % % % a b. Required: Determine the tax liability, marginal tax rate, and average tax rate in each of the following cases. Use the appropriate Tax Tables and Tax Rate Schedules. a. Married taxpayers, who file a joint return, have taxable income of $36,162. b. Single taxpayer, taxable income of $66,829. (For all requirements, use the tax tables to compute tax liability. Round "Average tax rate" to 2 decimal places.) Tax liability Marginal tax rate a Average tax rate % % es b % Required: Use the Tax Rate Schedules to determine the tax liability for each of the following Eases. a. Single taxpayer, taxable income of $36,162. b. Single taxpayer, taxable income of $89,889. c. Married taxpayers, who file a joint return, have taxable income of $89,889. d. Married taxpayers, who file a joint return, have taxable income of $66,829. e. Married taxpayers, who file a joint return, have taxable income of $36,162. f. Single taxpayer, taxable income of $66,829. (For all requirements, round your intermediate computations and final answers to 2 decimal places.) Tax liability a. b. C. d. e 1. Required: The W-2 income of Sandra, a single taxpayer, was $77,243. Determine Sandra's tax liability. Use the appropriate Tax Tables. Tax liability Required: The W-2 incomes of Betty and her husband Ronald were $48,238 and $41,539, respectively. If Betty and Ronald use a filing status of married filing jointly, determine their tax liability Use the appropriate Tox Tables Tax liability Required: Sheniqua, a single taxpayer, had taxable income of $91,431. Her employer withheld $15,882 in federal Income tax from her paychecks throughout the year . What is the amount of refund would Sheniqua receive or additional tax she would pay? (Input your answer as a positive number.) Use the appropriate Tox Tables Required: Xavier and his wife Maria have total W-2 income of $95,102. They will file their tax return as married filing jointly. They had a total of $7,910 withheld from their paychecks for federal income tax purposes. Determine the amount of refund or additional tax due upon filing their tax return. (Input your answer as a positive number.) Use the appropriate Tox Tables