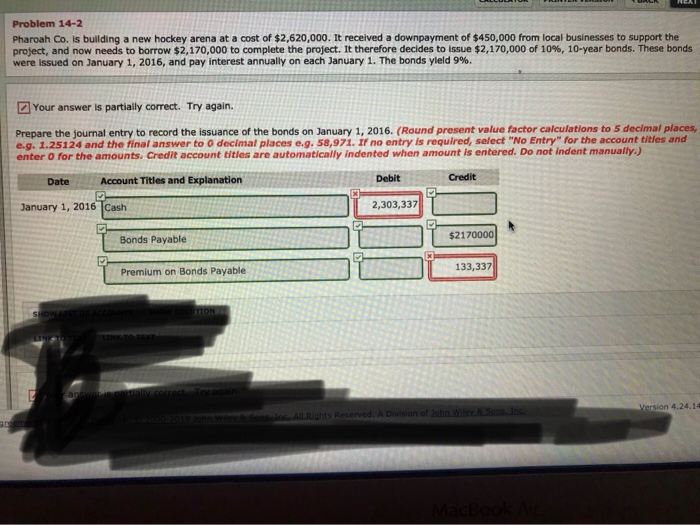

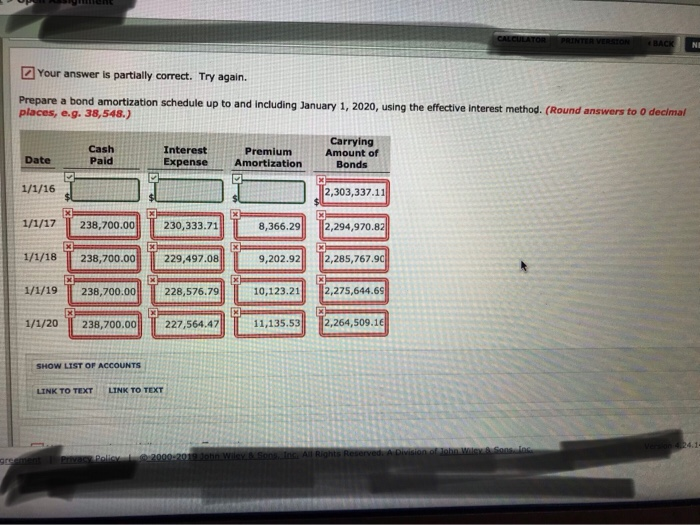

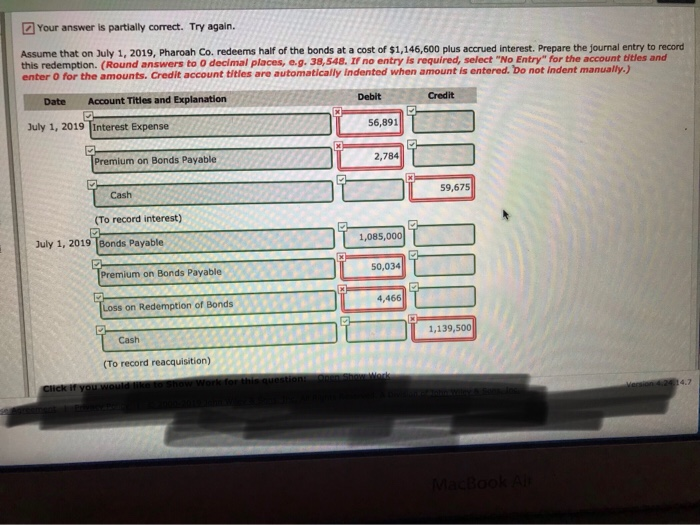

Problem 14-2 Pharoah C. is building a new hockey arena at a cost of $2,620,000. It received a downpayment of $450,000 from local businesses to support the project, and now needs to borrow $2,170,000 to complete the pr ect. It therefore decides to issue $2,170,000 of 10% 10-year bonds. These bonds were issued on January 1, 2016, and pay interest annually on each January 1 . The bonds yield 9%. Your answer is partially correct. Try again. Prepare the journal entry to record the issuance of the bonds on January 1, 2016. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places e.g. 58,971. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Credit DateAccount Titles and Explanation 2,303,337 January 1, 2016 Cash $2170000 Bonds Payable 133,337 Premium on Bonds Payable Version 4.24.14 2 Your answer is partially correct. Try again. Prepare a bond amortization schedule up to and including January 1, 2020, using the effective interest method.( places, e.g. 38,548.) Round answers to o decimal Carrying Amount of Cash Paid Interest Premium ExpenseAmortization Date Bonds 1/1/16REE 2,303,337.11 1/1/17 238,700.00230,333.71 8,366.29 2,294,970.82 1/1/18 T 238,700.00 229,497.08 9,202.922,285,767.9C 1/1/19 238,700.00 228,576.79 10,123.21 2,275,644.69 1,135.53 2,264,509.16 1/1/20 238,700.0011 227,564.47 SHOW LIST OF ACCOUNTS LTNK TO TEXT LINK TO TEXT Your answer is partially correct. Try again. Assume that on July 1, 2019, Pharoah Co. redeems half of the bonds at a cost of $1,146,600 plus accrued interest. Prepare the journal entry to record this redemption. (Round answers to 0 decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically Indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit July 1, 2019 Interest Expense 56,891 Premium on Bonds Payable 2,784 Cash 59,675 (To record interest) July 1, 2019 Bonds Payable 1,085,000 50,034 Premium on Bonds Payable 4,466 Loss on Redemption of Bonds 1,139,500 Cash (To record reacquisition) 4.7