Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 14-39 (Algorithmic) (LO. 1, 2, 3) Mahan purchases 1,000 shares of Bluebird Corporation stock on October 3, 2022, for $310,000. On December 12, 2022,

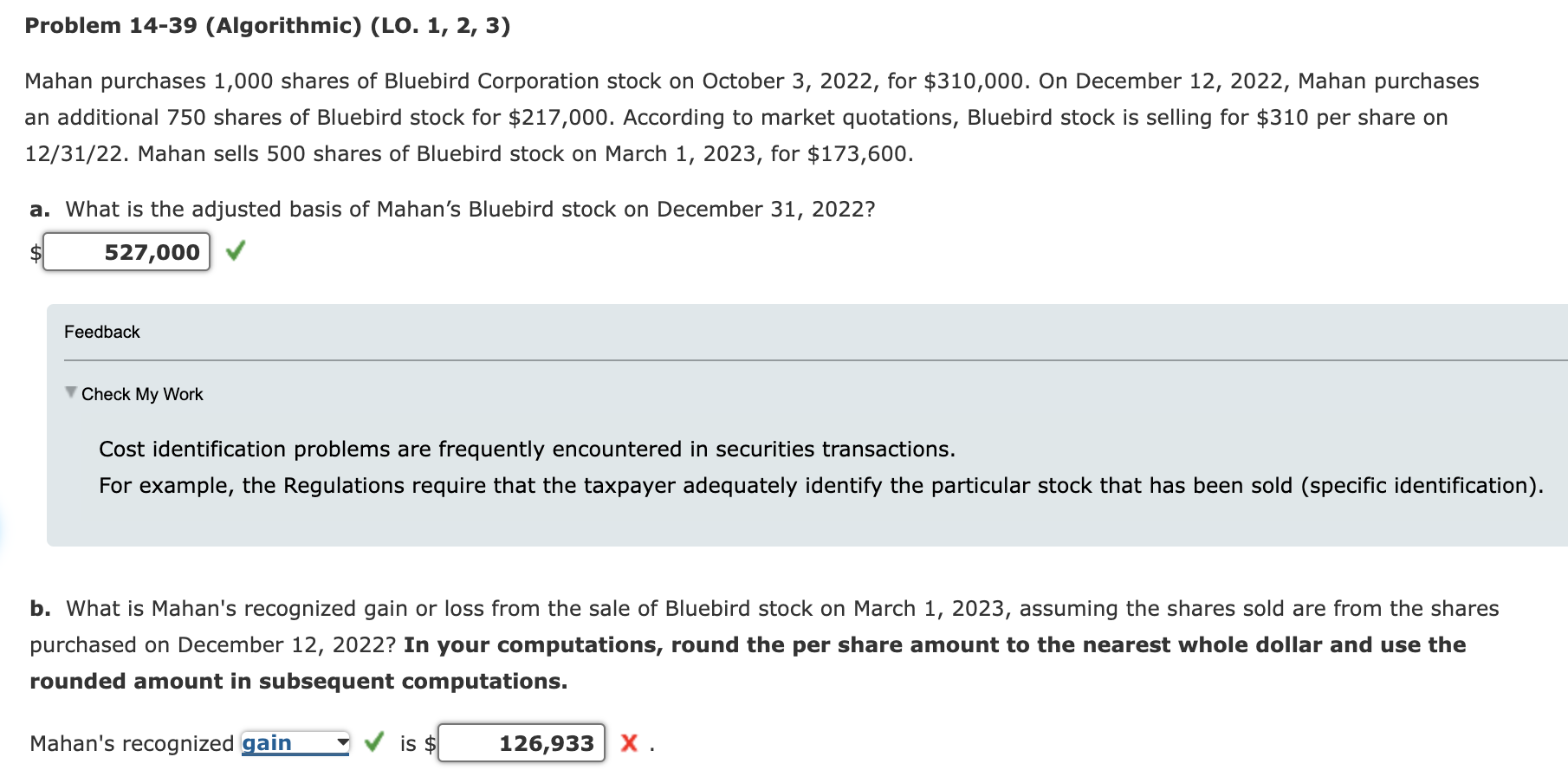

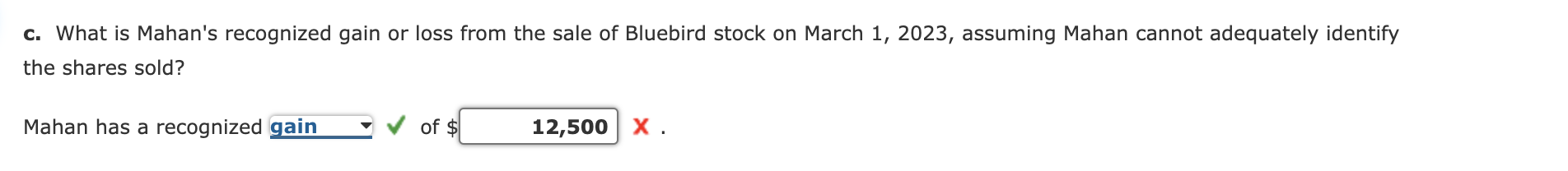

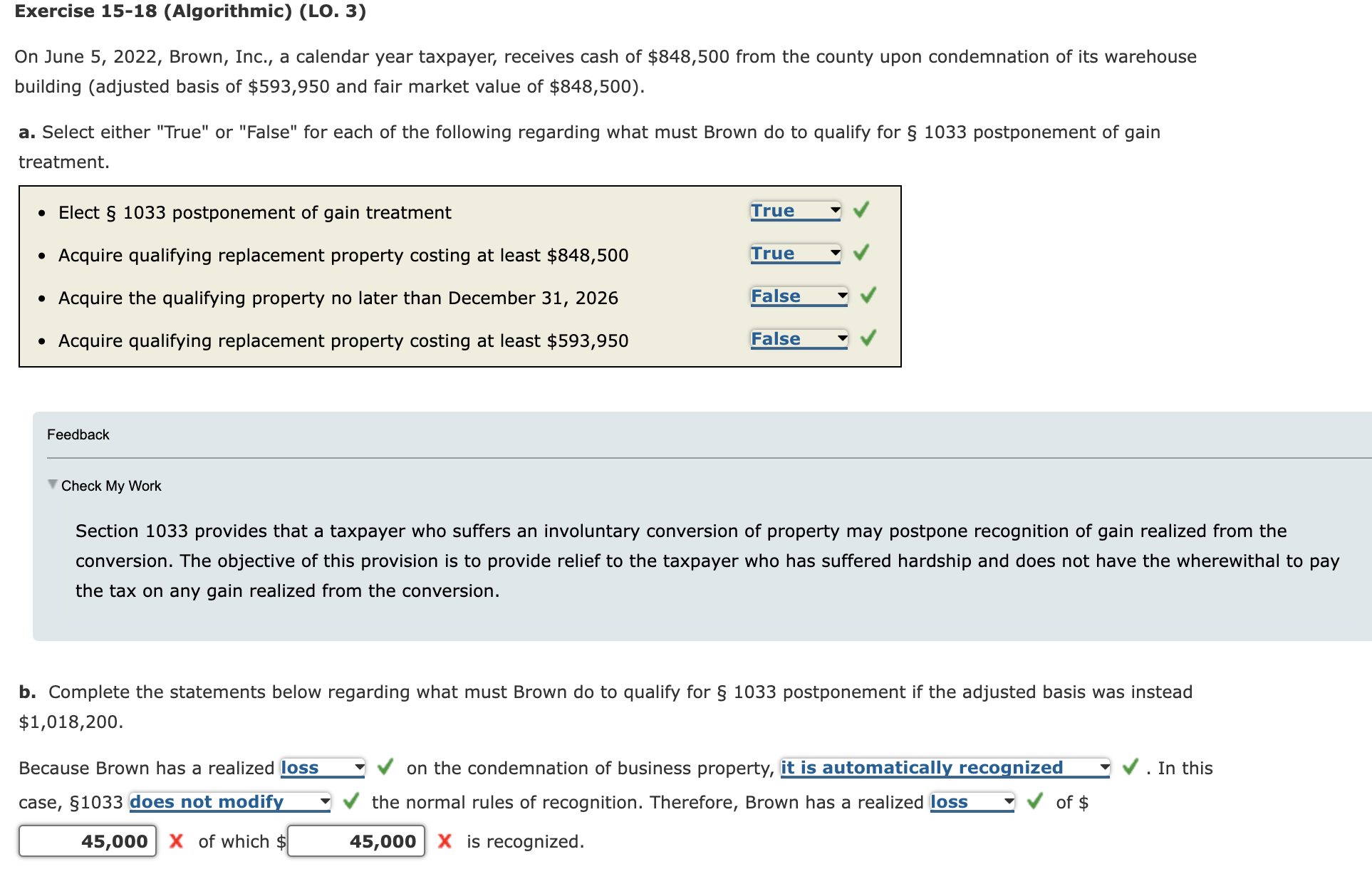

Problem 14-39 (Algorithmic) (LO. 1, 2, 3) Mahan purchases 1,000 shares of Bluebird Corporation stock on October 3, 2022, for \$310,000. On December 12, 2022, Mahan purchases an additional 750 shares of Bluebird stock for $217,000. According to market quotations, Bluebird stock is selling for $310 per share on 12/31/22. Mahan sells 500 shares of Bluebird stock on March 1, 2023, for $173,600. a. What is the adjusted basis of Mahan's Bluebird stock on December 31, 2022? Feedback Check My Work Cost identification problems are frequently encountered in securities transactions. For example, the Regulations require that the taxpayer adequately identify the particular stock that has been sold (specific identification). b. What is Mahan's recognized gain or loss from the sale of Bluebird stock on March 1, 2023, assuming the shares sold are from the shares purchased on December 12,2022 ? In your computations, round the per share amount to the nearest whole dollar and use the rounded amount in subsequent computations. Mahan's recognized is \$ X. c. What is Mahan's recognized gain or loss from the sale of Bluebird stock on March 1 , 2023, assuming Mahan cannot adequately identify the shares sold? Mahan has a recognized of $ X. On June 5, 2022, Brown, Inc., a calendar year taxpayer, receives cash of $848,500 from the county upon condemnation of its warehouse building (adjusted basis of $593,950 and fair market value of $848,500 ). a. Select either "True" or "False" for each of the following regarding what must Brown do to qualify for 1033 postponement of gain treatment. Feedback Check My Work Section 1033 provides that a taxpayer who suffers an involuntary conversion of property may postpone recognition of gain realized from the conversion. The objective of this provision is to provide relief to the taxpayer who has suffered hardship and does not have the wherewithal to the tax on any gain realized from the conversion. b. Complete the statements below regarding what must Brown do to qualify for 1033 postponement if the adjusted basis was instead $1,018,200. Because Brown has a realized case, 1033 on the condemnation of business property, the normal rules of recognition. Therefore, Brown has a realized X is recognized. x of which $ . In this of $

Problem 14-39 (Algorithmic) (LO. 1, 2, 3) Mahan purchases 1,000 shares of Bluebird Corporation stock on October 3, 2022, for \$310,000. On December 12, 2022, Mahan purchases an additional 750 shares of Bluebird stock for $217,000. According to market quotations, Bluebird stock is selling for $310 per share on 12/31/22. Mahan sells 500 shares of Bluebird stock on March 1, 2023, for $173,600. a. What is the adjusted basis of Mahan's Bluebird stock on December 31, 2022? Feedback Check My Work Cost identification problems are frequently encountered in securities transactions. For example, the Regulations require that the taxpayer adequately identify the particular stock that has been sold (specific identification). b. What is Mahan's recognized gain or loss from the sale of Bluebird stock on March 1, 2023, assuming the shares sold are from the shares purchased on December 12,2022 ? In your computations, round the per share amount to the nearest whole dollar and use the rounded amount in subsequent computations. Mahan's recognized is \$ X. c. What is Mahan's recognized gain or loss from the sale of Bluebird stock on March 1 , 2023, assuming Mahan cannot adequately identify the shares sold? Mahan has a recognized of $ X. On June 5, 2022, Brown, Inc., a calendar year taxpayer, receives cash of $848,500 from the county upon condemnation of its warehouse building (adjusted basis of $593,950 and fair market value of $848,500 ). a. Select either "True" or "False" for each of the following regarding what must Brown do to qualify for 1033 postponement of gain treatment. Feedback Check My Work Section 1033 provides that a taxpayer who suffers an involuntary conversion of property may postpone recognition of gain realized from the conversion. The objective of this provision is to provide relief to the taxpayer who has suffered hardship and does not have the wherewithal to the tax on any gain realized from the conversion. b. Complete the statements below regarding what must Brown do to qualify for 1033 postponement if the adjusted basis was instead $1,018,200. Because Brown has a realized case, 1033 on the condemnation of business property, the normal rules of recognition. Therefore, Brown has a realized X is recognized. x of which $ . In this of $ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started