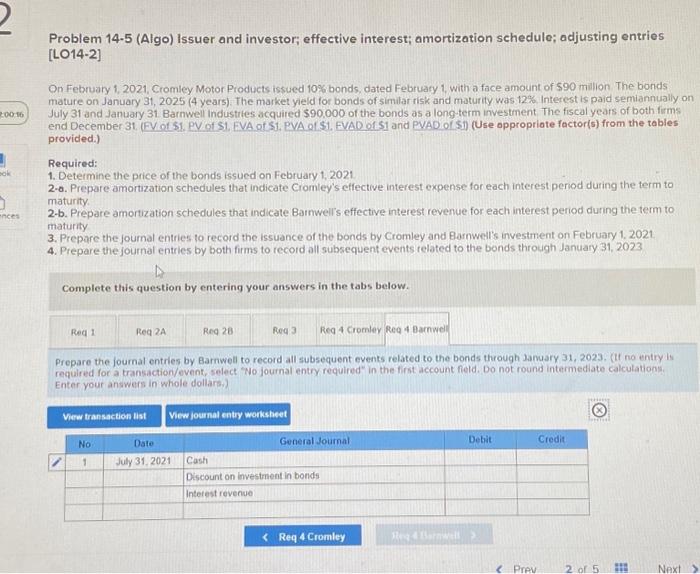

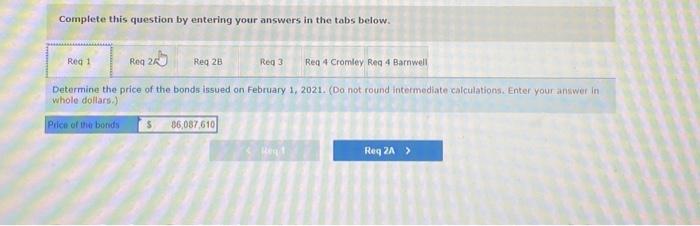

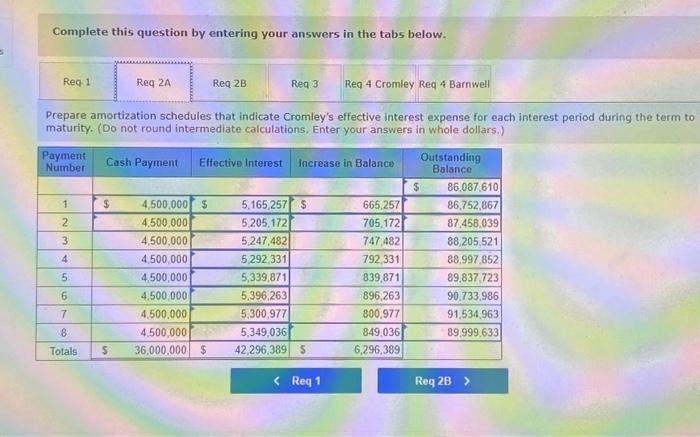

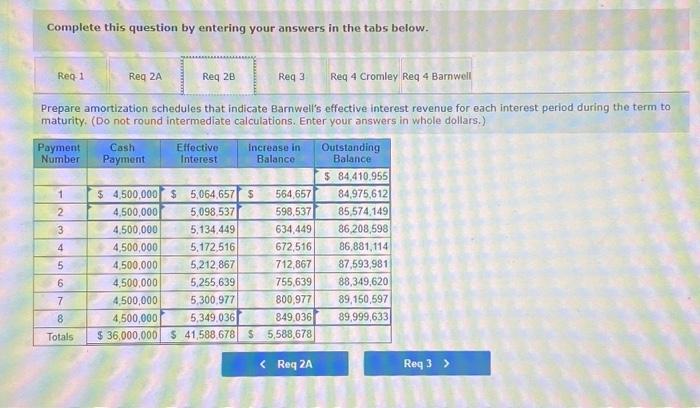

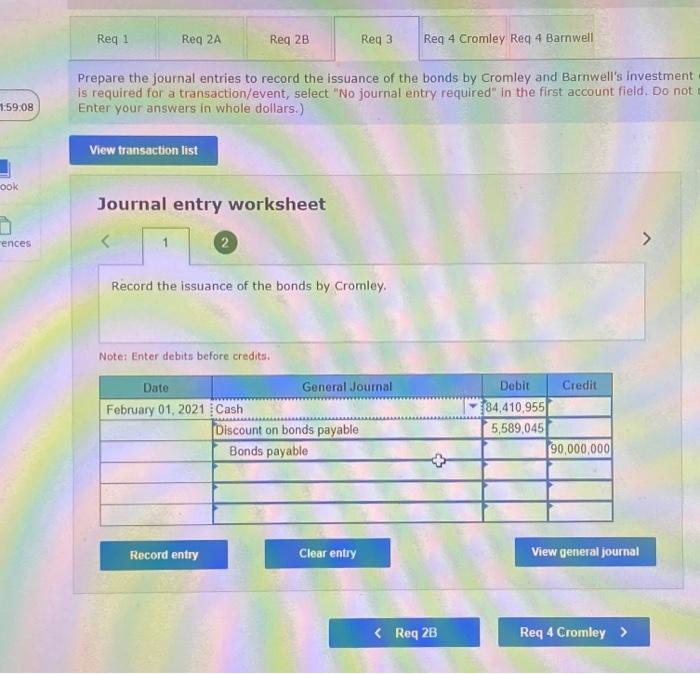

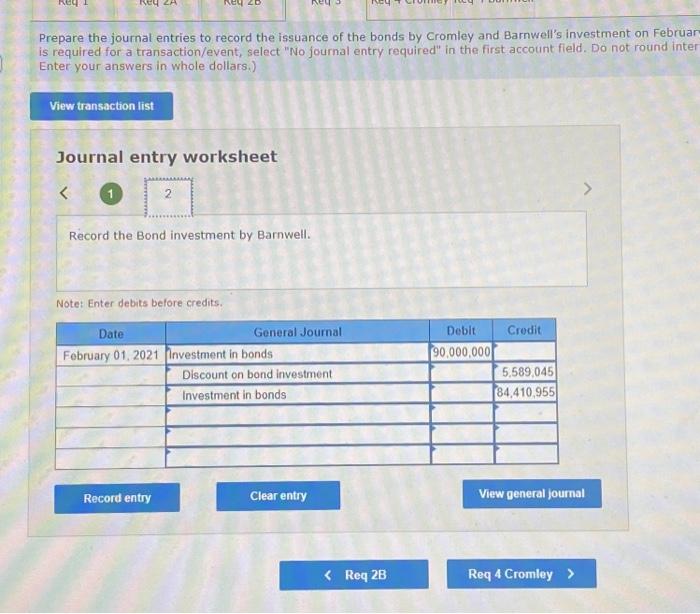

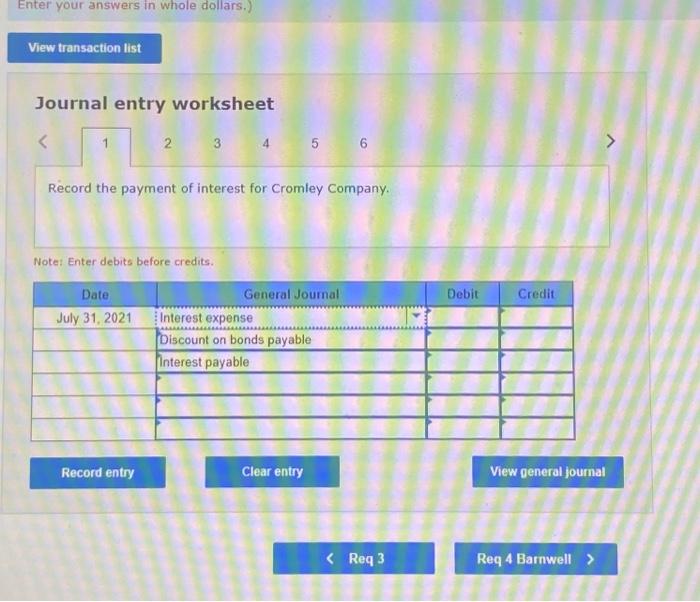

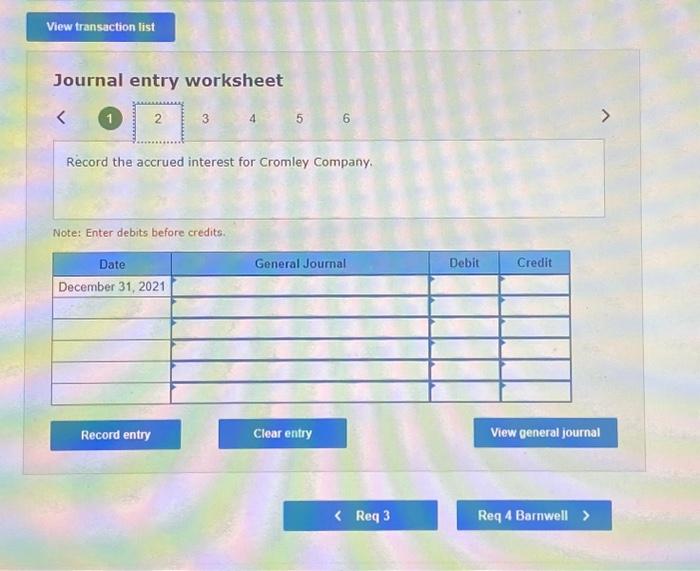

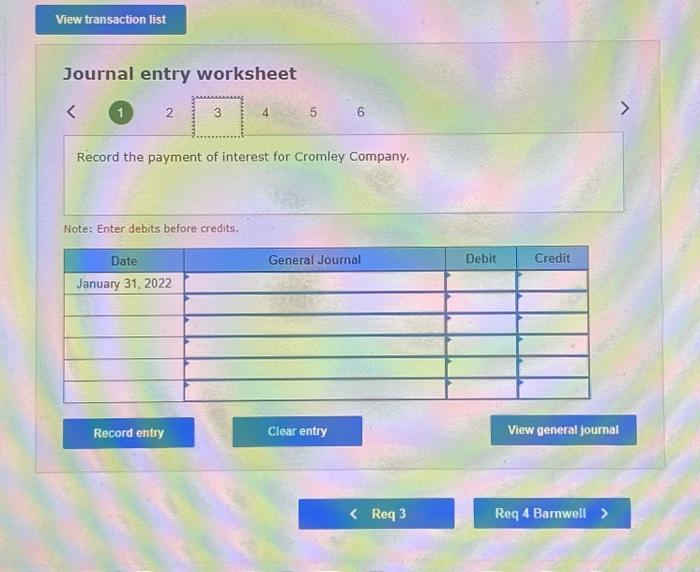

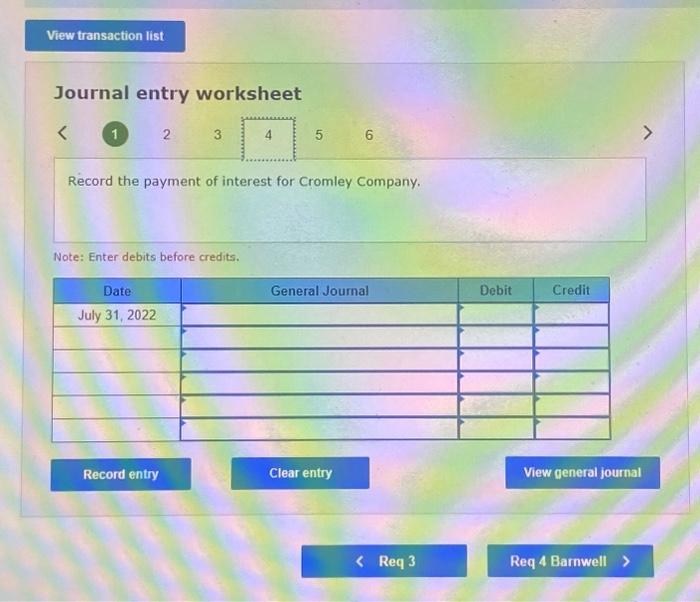

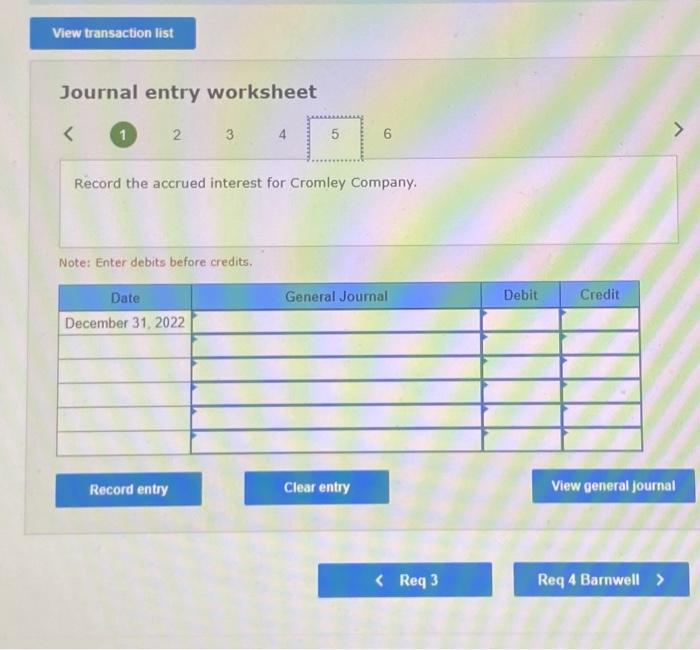

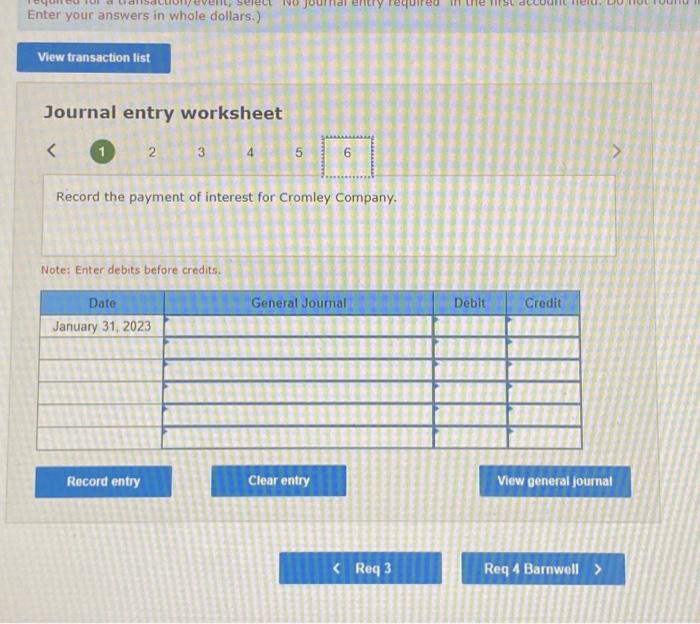

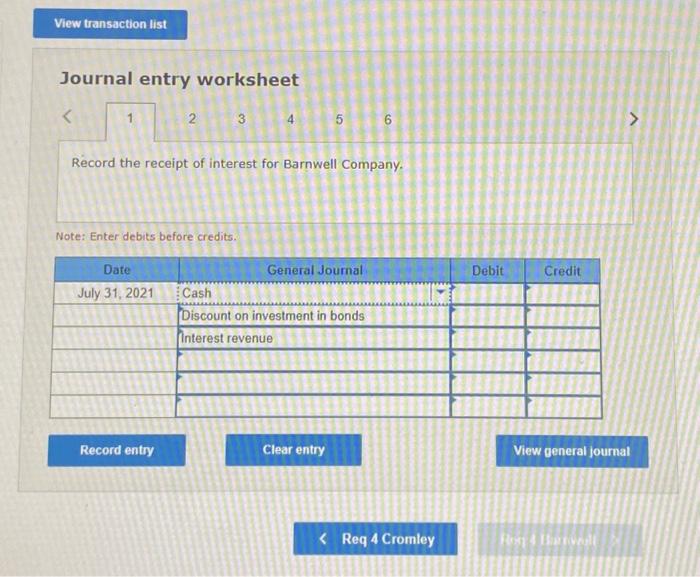

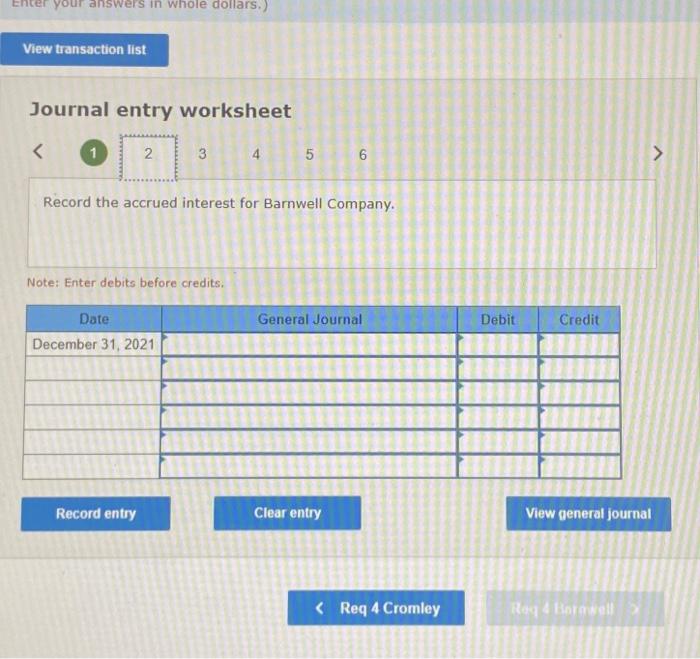

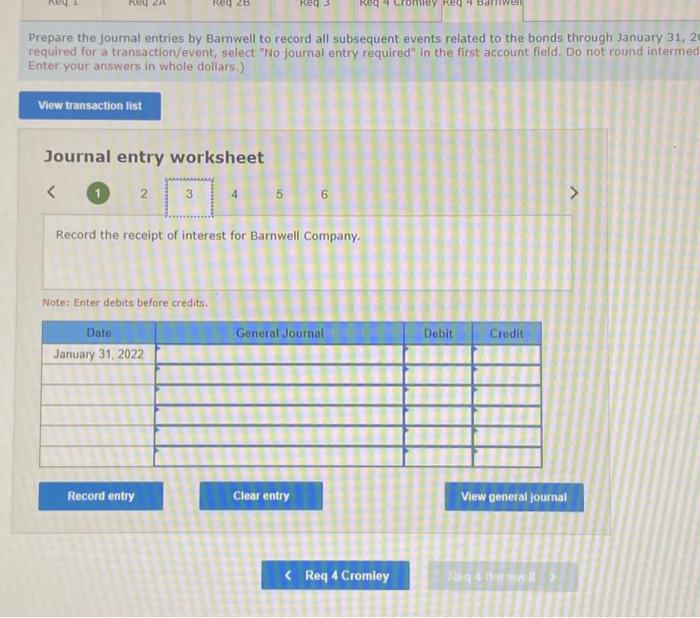

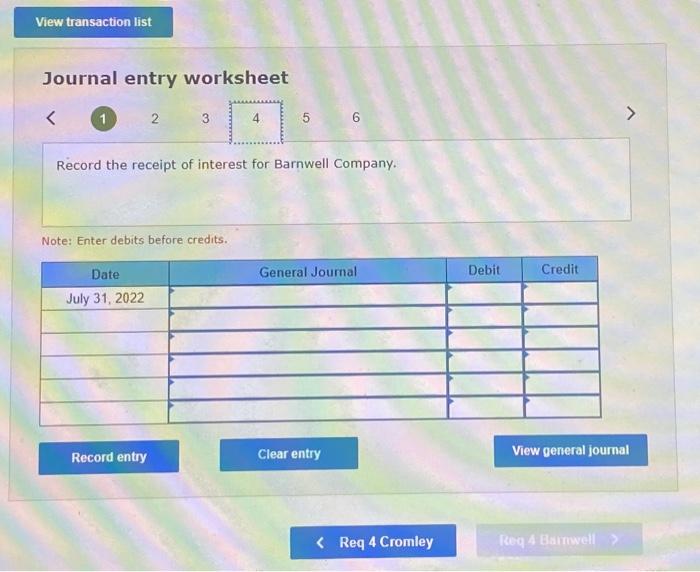

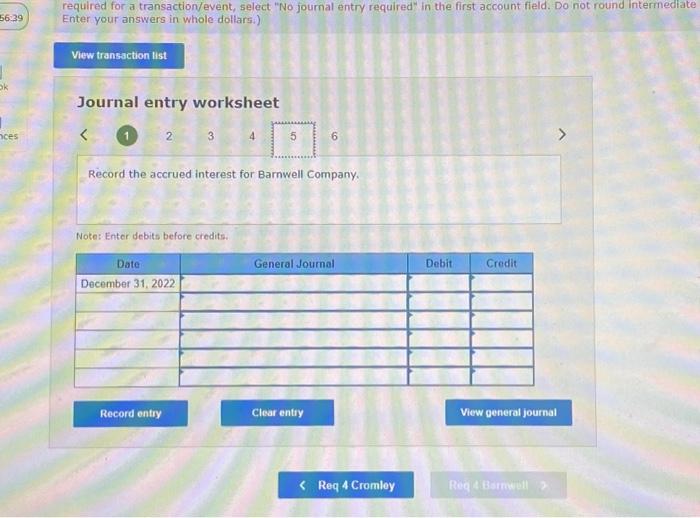

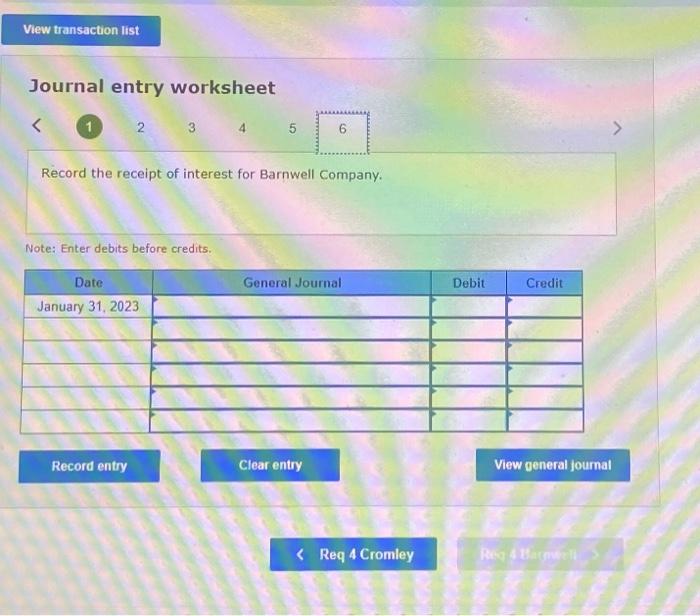

Problem 14-5 (Algo) Issuer and investor; effective interest; amortization schedule; adjusting entries [LO14-2] On February 1, 2021, Cromley Motor Products issued 10% bonds, dated Februaty 1, with a face amount of $90 milion The bonds mature on January 31, 2025 (4 years). The market yield for bonds of simiar risk and maturity was 12%. Interest is paid semiannually on July 31 and January 31 Barnwell industites acquired $90,000 of the bonds as a long-term investment The fiscal years of both firms end December 31. (EV of S1. PV of S1. EVA of S1. PVA of S1. FVAD of S1 and PVAD of Si) (Use oppropriate factor(5) from the tables provided.) Required: 1. Determine the price of the bonds issued on February 1,2021 2-0. Prepare amortization schedules that indicate Cromley's effective interest expense for each interest period during the term to maturity. 2-b. Prepare amortization schedules that indicate Barmwell's effective interest revenue for each interest period during the term to maturity 3. Prepare the journal entries to record the issuance of the bonds by Cromley and Barnwelis investment on February 1, 2021 4. Prepare the journal entries by both firms to record all subsequent events related to the bonds through January 31,2023 Complete this question by entering your answers in the tabs below. Prepare the journal entries by Barnwell to record all subsequent events related to the bonds through Jamuary 31,2023 . (II no entry is required for a transaction/event, select No journal entry required in the first account field. Do not round intermediate calculations. Enter your answers in whole dollars.) Complete this question by entering your answers in the tabs below. Determine the price of the bonds issued on February 1, 2021. (Do not round intermediate calculations. Enter your answer in whole dollars.) Complete this question by entering your answers in the tabs below. Prepare amortization schedules that indicate Cromley's effective interest expense for each interest period during the term to maturity. (Do not round intermediate calculations, Enter your answers in whole dollars.) Complete this question by entering your answers in the tabs below. Prepare amortization schedules that indicate Barnwell's effective interest revenue for each interest period during the term to maturity. (Do not round intermediate calculations. Enter your answers in whole dollars.) Prepare the journal entries to record the issuance of the bonds by Cromley and Barnwell's investment is required for a transaction/event, select "No journal entry required" in the first account field. DO not Enter your answers in whole dollars.) Journal entry worksheet Note: Enter debits before credits. Prepare the journal entries to record the issuance of the bonds by Cromley and Barnwell's investment on Februar is required for a transaction/event, select "No journal entry required" in the first account field. Do not round inter Enter your answers in whole dollars.) Journal entry worksheet Note: Enter debits before credits. Enter your answers in whole dollars.) Journal entry worksheet 6 Record the payment of interest for Cromley Company. Note: Enter debits before credits. Journal entry worksheet 456 Record the accrued interest for Cromley Company. Note: Enter debits before credits. Journal entry worksheet Record the payment of interest for Cromley Company. Note: Enter debits before credits. Journal entry worksheet 26 Record the payment of interest for Cromley Company. Note: Enter debits before credits. Journal entry worksheet Record the accrued interest for Cromley Company. Note: Enter debits before credits. Enter your answers in whole dollars.) Journal entry worksheet 3 Record the payment of interest for Cromley Company. Note: Enter debits before credits. Journal entry worksheet 56 Record the receipt of interest for Barnwell Company. Note: Enter debits before credits. Journal entry worksheet 6 Record the accrued interest for Barnwell Company. Note: Enter debits before credits. Prepare the journal entries by Barnwell to record all subsequent events related to the bonds through January 31,2 required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermec Enter your answers in whole dollars:) Journal entry worksheet Record the receipt of interest for Barnwell Company. Note: Enter debits before credits. Journal entry worksheet 6 Record the receipt of interest for Barnwell Company. Note: Enter debits before credits. required for a transactionvevent, select "No joumal entry required" in the first account field. Do not round intermediate Enter your answers in whole dollars.) Journal entry worksheet Record the accrued interest for Barnwell Company. Note: Enter debits before credits. Journal entry worksheet Record the receipt of interest for Barnwell Company. Note: Enter debits before credits. Problem 14-5 (Algo) Issuer and investor; effective interest; amortization schedule; adjusting entries [LO14-2] On February 1, 2021, Cromley Motor Products issued 10% bonds, dated Februaty 1, with a face amount of $90 milion The bonds mature on January 31, 2025 (4 years). The market yield for bonds of simiar risk and maturity was 12%. Interest is paid semiannually on July 31 and January 31 Barnwell industites acquired $90,000 of the bonds as a long-term investment The fiscal years of both firms end December 31. (EV of S1. PV of S1. EVA of S1. PVA of S1. FVAD of S1 and PVAD of Si) (Use oppropriate factor(5) from the tables provided.) Required: 1. Determine the price of the bonds issued on February 1,2021 2-0. Prepare amortization schedules that indicate Cromley's effective interest expense for each interest period during the term to maturity. 2-b. Prepare amortization schedules that indicate Barmwell's effective interest revenue for each interest period during the term to maturity 3. Prepare the journal entries to record the issuance of the bonds by Cromley and Barnwelis investment on February 1, 2021 4. Prepare the journal entries by both firms to record all subsequent events related to the bonds through January 31,2023 Complete this question by entering your answers in the tabs below. Prepare the journal entries by Barnwell to record all subsequent events related to the bonds through Jamuary 31,2023 . (II no entry is required for a transaction/event, select No journal entry required in the first account field. Do not round intermediate calculations. Enter your answers in whole dollars.) Complete this question by entering your answers in the tabs below. Determine the price of the bonds issued on February 1, 2021. (Do not round intermediate calculations. Enter your answer in whole dollars.) Complete this question by entering your answers in the tabs below. Prepare amortization schedules that indicate Cromley's effective interest expense for each interest period during the term to maturity. (Do not round intermediate calculations, Enter your answers in whole dollars.) Complete this question by entering your answers in the tabs below. Prepare amortization schedules that indicate Barnwell's effective interest revenue for each interest period during the term to maturity. (Do not round intermediate calculations. Enter your answers in whole dollars.) Prepare the journal entries to record the issuance of the bonds by Cromley and Barnwell's investment is required for a transaction/event, select "No journal entry required" in the first account field. DO not Enter your answers in whole dollars.) Journal entry worksheet Note: Enter debits before credits. Prepare the journal entries to record the issuance of the bonds by Cromley and Barnwell's investment on Februar is required for a transaction/event, select "No journal entry required" in the first account field. Do not round inter Enter your answers in whole dollars.) Journal entry worksheet Note: Enter debits before credits. Enter your answers in whole dollars.) Journal entry worksheet 6 Record the payment of interest for Cromley Company. Note: Enter debits before credits. Journal entry worksheet 456 Record the accrued interest for Cromley Company. Note: Enter debits before credits. Journal entry worksheet Record the payment of interest for Cromley Company. Note: Enter debits before credits. Journal entry worksheet 26 Record the payment of interest for Cromley Company. Note: Enter debits before credits. Journal entry worksheet Record the accrued interest for Cromley Company. Note: Enter debits before credits. Enter your answers in whole dollars.) Journal entry worksheet 3 Record the payment of interest for Cromley Company. Note: Enter debits before credits. Journal entry worksheet 56 Record the receipt of interest for Barnwell Company. Note: Enter debits before credits. Journal entry worksheet 6 Record the accrued interest for Barnwell Company. Note: Enter debits before credits. Prepare the journal entries by Barnwell to record all subsequent events related to the bonds through January 31,2 required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermec Enter your answers in whole dollars:) Journal entry worksheet Record the receipt of interest for Barnwell Company. Note: Enter debits before credits. Journal entry worksheet 6 Record the receipt of interest for Barnwell Company. Note: Enter debits before credits. required for a transactionvevent, select "No joumal entry required" in the first account field. Do not round intermediate Enter your answers in whole dollars.) Journal entry worksheet Record the accrued interest for Barnwell Company. Note: Enter debits before credits. Journal entry worksheet Record the receipt of interest for Barnwell Company. Note: Enter debits before credits