Answered step by step

Verified Expert Solution

Question

1 Approved Answer

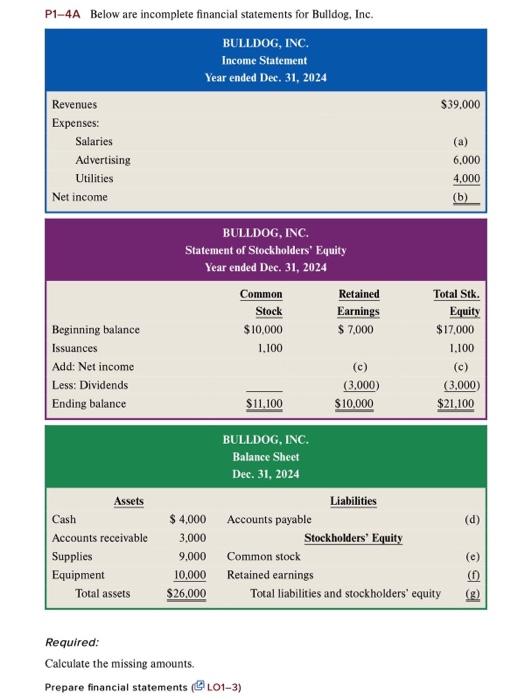

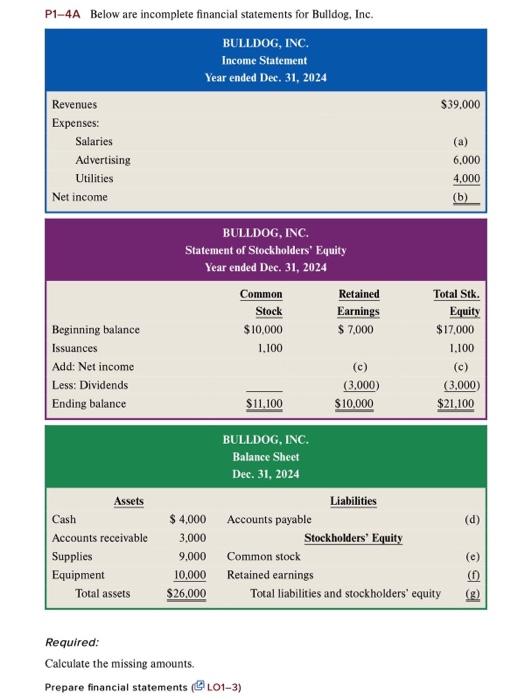

Problem 1-4A P1-4A Below are incomplete financial statements for Bulldog, Inc. BULLDOG, INC. Income Statement Year ended Dec. 31, 2024 Revenues Expenses: Salaries Advertising Utilities

Problem 1-4A

P1-4A Below are incomplete financial statements for Bulldog, Inc. BULLDOG, INC. Income Statement Year ended Dec. 31, 2024 Revenues Expenses: Salaries Advertising Utilities Net income $39.000 (a) 6,000 4.000 (b) BULLDOG, INC. Statement of Stockholders' Equity Year ended Dec. 31, 2024 Common Retained Stock Earnings $10,000 $ 7,000 1,100 (c) (3.000) $11,100 $10,000 Beginning balance Issuances Add: Net income Less: Dividends Ending balance Total Stk. Equity $17,000 1.100 (c) (3.000) $21.100 BULLDOG, INC. Balance Sheet Dec. 31, 2024 Liabilities $ 4,000 Accounts payable 3,000 Stockholders' Equity 9,000 Common stock 10,000 Retained earnings $26.000 Total liabilities and stockholders' equity Assets Cash Accounts receivable Supplies Equipment Total assets (d) (e) SI (9 Required: Calculate the missing amounts. Prepare financial statements (L01-3) L01-3 Determine how financial accounting information is communicated through financial statements. We've discussed that different business activities produce assets, liabilities, stockholders' equity, dividends, revenues, and expenses, and that the first important role of financial accounting is to measure the relevant transactions of a company. Its second vital role is to communicate these business activities to those outside the company. The primary means of communicating business activities is through financial statements. Financial statements are periodic reports published by the company for the purpose of providing information to external users. There are four primary financial statements: 1. Income statement 2. Statement of stockholders' equity 3. Balance sheet 4. Statement of cash flows These financial statements give investors and creditors the key information they need when making decisions about a company: Should I buy the company's stock? Should I lend money to the company? Is management efficiently operating the company? Without these financial statements, it would be difficult for those outside the company to see what's going on inside. Let's go through a simple set of financial statements to see what they look like. We'll page 10 continue with our example of Eagle Soccer Academy. Actual companies' financial statements often report items you haven't yet encountered. However, because actual companies' financial information will be useful in helping you understand certain accounting topics, we'll sample them often throughout this book. INCOME STATEMENT The income statement is a financial statement that reports the company's revenues and expenses over an interval of time. It shows whether the company was able to generate enough revenue to cover the expenses of running the business. If revenues exceed expenses. then the company reports net income: Revenues - Expenses = Net Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started