Answered step by step

Verified Expert Solution

Question

1 Approved Answer

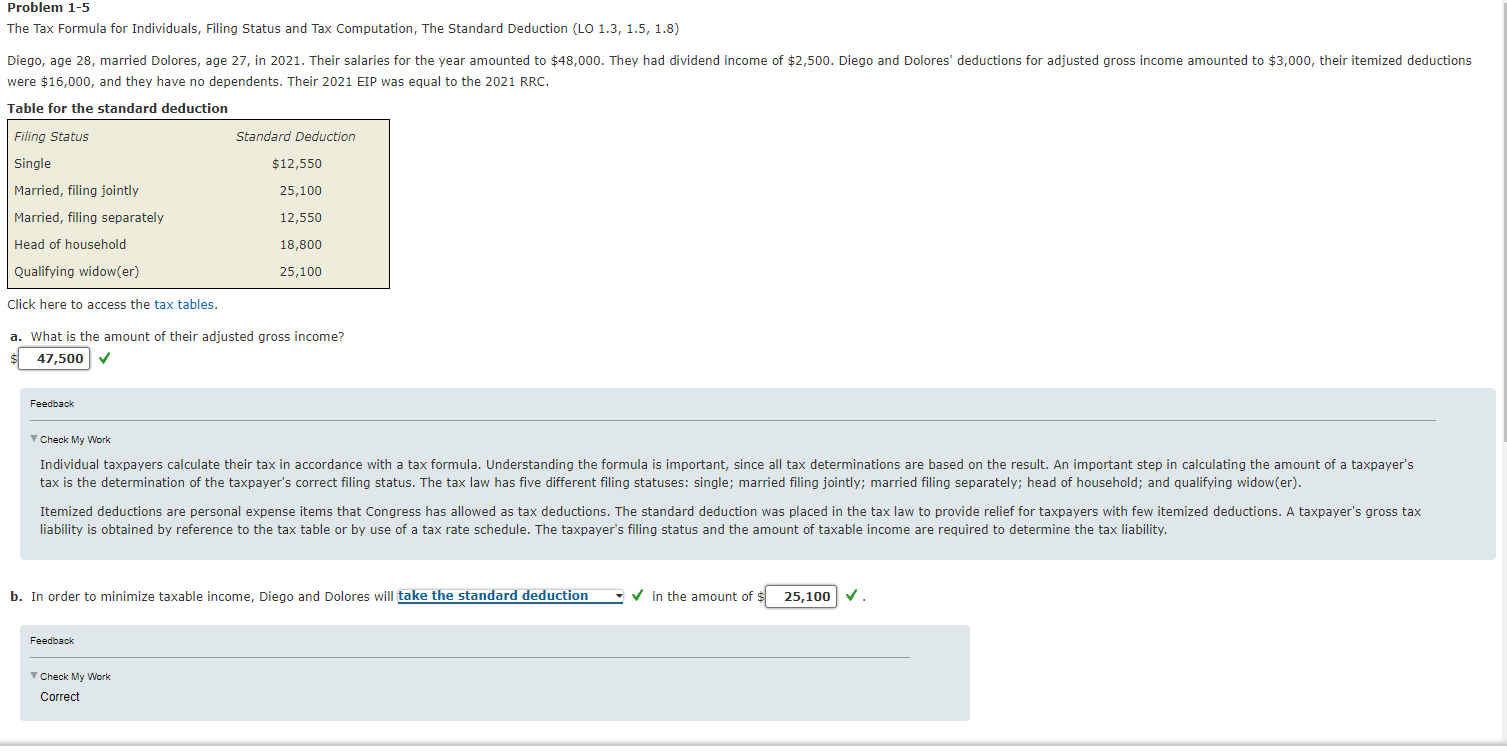

Problem 1-5 The Tax Formula for Individuals, Filing Status and Tax Computation, The Standard Deduction (LO 1.3, 1.5, 1.8) were $16,000, and they have no

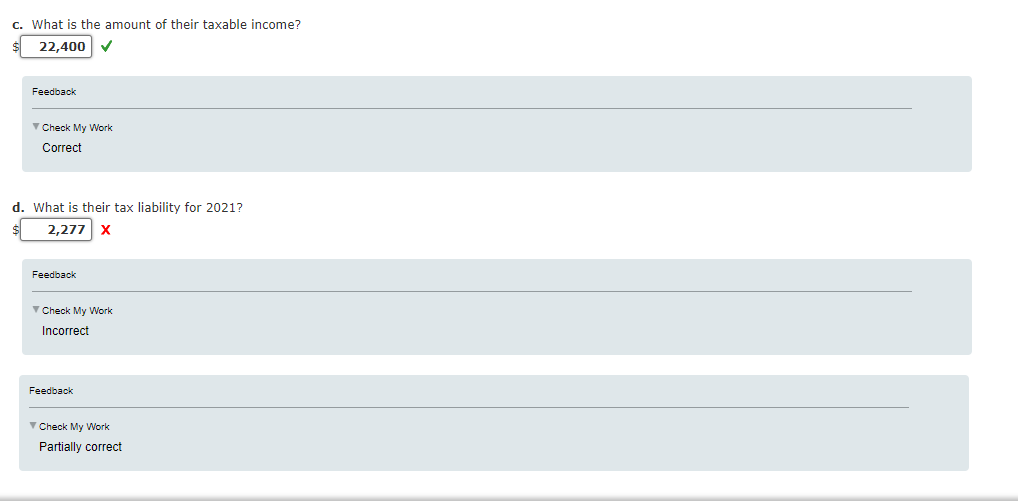

Problem 1-5 The Tax Formula for Individuals, Filing Status and Tax Computation, The Standard Deduction (LO 1.3, 1.5, 1.8) were $16,000, and they have no dependents. Their 2021EIP was equal to the 2021RRC. Table for the standard deduction Click here to access the tax tables. a. What is the amount of their adjusted gross income? Feedback Check My Work liability is obtained by reference to the tax table or by use of a tax rate schedule. The taxpayer's filing status and the amount of taxable income are required to determine the tax liability. b. In order to minimize taxable income, Diego and Dolores will take the standard deduction in the amount of ? Feedback Check My Work Correct c. What is the amount of their taxable income? $ Feedback Check My Work Correct d. What is their tax liability for 2021 ? \$ x Feedback Check My Work Incorrect Feedback Check My Work Partially correct

Problem 1-5 The Tax Formula for Individuals, Filing Status and Tax Computation, The Standard Deduction (LO 1.3, 1.5, 1.8) were $16,000, and they have no dependents. Their 2021EIP was equal to the 2021RRC. Table for the standard deduction Click here to access the tax tables. a. What is the amount of their adjusted gross income? Feedback Check My Work liability is obtained by reference to the tax table or by use of a tax rate schedule. The taxpayer's filing status and the amount of taxable income are required to determine the tax liability. b. In order to minimize taxable income, Diego and Dolores will take the standard deduction in the amount of ? Feedback Check My Work Correct c. What is the amount of their taxable income? $ Feedback Check My Work Correct d. What is their tax liability for 2021 ? \$ x Feedback Check My Work Incorrect Feedback Check My Work Partially correct Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started