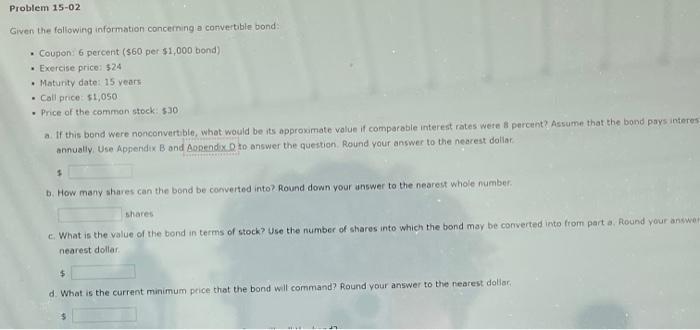

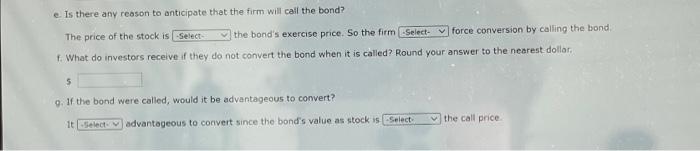

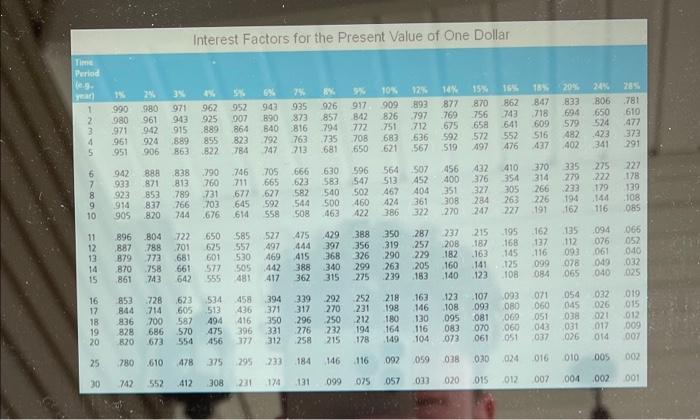

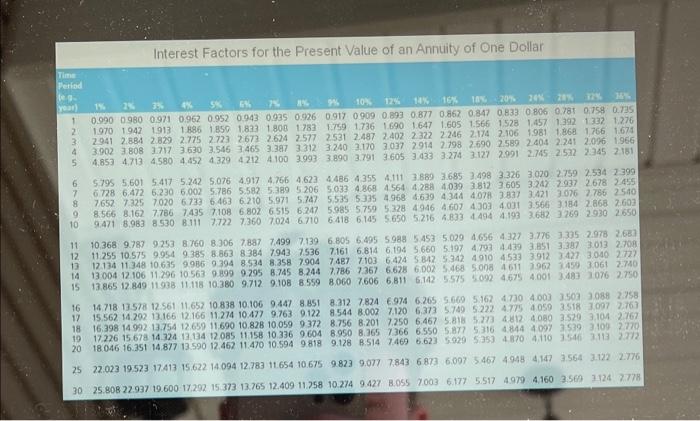

Problem 15-02 Given the following information concerning a convertible bond: Coupon: 6 percent ($60 per $1,000 bond) Exercise price: $24 Maturity date: 15 years Call price: $1,050 Price of the common stock: 5.30 a If this bond were no convertible, what would be its approximate value if comparable interest rates were percent Assume that the bond pays interes annually. Use Appendix Bond Apendix to answer the question. Round your answer to the nearest dollar $ b. How many shares can the bond be converted into Round down your answer to the nearest whole number, shares c. What is the value of the bond in terms of stock? Use the number of shares into which the bond may be converted into from part a Round your answer nearest dollar $ d. What is the current minimum price that the bond will command? Round your answer to the nearest dollar e. Is there any reason to anticipate that the firm will call the bond? The price of the stock is select the bond's exercise price. So the firm Select force conversion by calling the bond f. What do investors receive if they do not convert the bond when it is called? Round your answer to the nearest dollar 5 9. If the bond were called, would it be advantageous to convert? the call price it Select advantageous to convert since the bond's value as stock is Select Interest Factors for the Present Value of One Dollar 971 967 2 295 610 EEZ 024 016 552 308 174 131 099 075 100 033 012 200 Interest Factors for the Present Value of an Annuity of One Dollar Time Period ar 1 2 3 4 5 14 2 39 5 2 94 10 14% 16% 18% 20% 20% 20% 0.990 0900 0.971 0.962 0.952 0943 0.035 0.926 0.917 0909 0.893 0.877 0.862 0.847 0.833 0 806 0.781 0.758 0.735 1.970 1942 1913 1886 1850 1823 1808 1.783 759 1736 1690 1647 1.605 1.566 1528 1.4571.392 1332 1.276 2.9412.884 2.829 2.775 2.723 2672 2624 2577 2531 2.487 2.402 2322 2246 2.174 2.106 1981 1868 1766 1674 3.902 3808 3.717 3.630 3.5463 465 3.387 3312 3240 2.1703037 2914 2.798 2.690 2589 2404 2.241 2.096 1966 4,853 4.713 4.580 4.452 43294212 4100 3.9933890 3.791 3.605 3.433 3274 3.12% 2.991 2.745 2.522 2.345 2151 6 5.795 5601 5.417 5.242 5.076 4917 4.766 4623 4.486 4355 4.111 3.889 3.685 3.498 3.326 3.020 2.759 2534 2399 7 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5 206 5033 4.868 4564 4.288 4039 2812 3.605 3.242 29372678 2455 8 76527325 7020 6733 6.463 6.210 5.971 5.7475.535 5335 4968 469 4344 4.078 3837 3.4213.076 2.786 2500 9 8.566 8.1627.786 7435 71086 802 6515 6.2475.985 5759 5328 4946 4 607 4003 4031 3.566 3184 2.868 2603 10 9.471 8.983 8 530 8.111 772273607024 6710 6.418 6145 5650 5.216 4833 494 4.193 3.682 3 269 2.930 2650 11 10.368 9.787 9253 8.760 8.306 7.887 7.499 2139 6.805 6.495 5988 5.453 5.029 4.656 4327 3.776 3305 2.978 2.687 12 11.255 10.575 9.954 9.385 8.863 8384 7943 7536 7.161 6.814 6.194 5660 5.197 4.793 4.439 3851 3.387 3.013 2.708 13 12.134 11348 10635 9986 9 394 8 534 8.358 7.904 7487 7103 6424 S 842 5342 4910 4533 3912 3.427 3010 2727 14 13.004 12 106 11.296 10.563 0899 9.295 8.745 8.244 7.786 7367 6.628 6.002 5.468 5.008 4611 3962 3450 3061 2.740 15 13.865 12 849 11.938 11.118 10.380 9.712 9.108 8559 8060 7606 6,811 6.142 5575 5.092 4.675 4001 3483 1076 2750 16 14.718 13.578 12.561 11652 10 838 10.106 9447 8.851 8.312 7.824 974 6.265 5.660 5162 4.730 400) 3502 088 2.758 17 15.562 14.202 13.166 2166 11.274 10.477 9.763 9.122 8544 8.002 7120 6373 5.749 5222 4.775 4.050 3.518 3097 2.767 18 16.398 14992 13.754 12.659 11.690 10.828 10.059 9 372 8.756 8.2017.250 6.467 5.818 5.273 48124.08035293104 2767 19 17.226 15.678 14.324 13,134 12085 11158 10.336 9.604 8950 8.365 7366 6.550 5.877 53164844 4097 3539 2109 2770 20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.128 8.514 7460 6.623 5.929 525) 46704/110 3.546 2113772 25 22.023 19.523 17.413 15.622 14 094 12783 11654 10.675 9.823 9.077 7843 68736007 5467 4948 4.147 35642122 2.776 30 25.80B 22.937 19.600 17.292 15 373 13.765 12.409 11.258 10.274 9.427 BOSS 7003 6.177 5.517 4.979 4.160 3.560 1124 2.778 Problem 15-02 Given the following information concerning a convertible bond: Coupon: 6 percent ($60 per $1,000 bond) Exercise price: $24 Maturity date: 15 years Call price: $1,050 Price of the common stock: 5.30 a If this bond were no convertible, what would be its approximate value if comparable interest rates were percent Assume that the bond pays interes annually. Use Appendix Bond Apendix to answer the question. Round your answer to the nearest dollar $ b. How many shares can the bond be converted into Round down your answer to the nearest whole number, shares c. What is the value of the bond in terms of stock? Use the number of shares into which the bond may be converted into from part a Round your answer nearest dollar $ d. What is the current minimum price that the bond will command? Round your answer to the nearest dollar e. Is there any reason to anticipate that the firm will call the bond? The price of the stock is select the bond's exercise price. So the firm Select force conversion by calling the bond f. What do investors receive if they do not convert the bond when it is called? Round your answer to the nearest dollar 5 9. If the bond were called, would it be advantageous to convert? the call price it Select advantageous to convert since the bond's value as stock is Select Interest Factors for the Present Value of One Dollar 971 967 2 295 610 EEZ 024 016 552 308 174 131 099 075 100 033 012 200 Interest Factors for the Present Value of an Annuity of One Dollar Time Period ar 1 2 3 4 5 14 2 39 5 2 94 10 14% 16% 18% 20% 20% 20% 0.990 0900 0.971 0.962 0.952 0943 0.035 0.926 0.917 0909 0.893 0.877 0.862 0.847 0.833 0 806 0.781 0.758 0.735 1.970 1942 1913 1886 1850 1823 1808 1.783 759 1736 1690 1647 1.605 1.566 1528 1.4571.392 1332 1.276 2.9412.884 2.829 2.775 2.723 2672 2624 2577 2531 2.487 2.402 2322 2246 2.174 2.106 1981 1868 1766 1674 3.902 3808 3.717 3.630 3.5463 465 3.387 3312 3240 2.1703037 2914 2.798 2.690 2589 2404 2.241 2.096 1966 4,853 4.713 4.580 4.452 43294212 4100 3.9933890 3.791 3.605 3.433 3274 3.12% 2.991 2.745 2.522 2.345 2151 6 5.795 5601 5.417 5.242 5.076 4917 4.766 4623 4.486 4355 4.111 3.889 3.685 3.498 3.326 3.020 2.759 2534 2399 7 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5 206 5033 4.868 4564 4.288 4039 2812 3.605 3.242 29372678 2455 8 76527325 7020 6733 6.463 6.210 5.971 5.7475.535 5335 4968 469 4344 4.078 3837 3.4213.076 2.786 2500 9 8.566 8.1627.786 7435 71086 802 6515 6.2475.985 5759 5328 4946 4 607 4003 4031 3.566 3184 2.868 2603 10 9.471 8.983 8 530 8.111 772273607024 6710 6.418 6145 5650 5.216 4833 494 4.193 3.682 3 269 2.930 2650 11 10.368 9.787 9253 8.760 8.306 7.887 7.499 2139 6.805 6.495 5988 5.453 5.029 4.656 4327 3.776 3305 2.978 2.687 12 11.255 10.575 9.954 9.385 8.863 8384 7943 7536 7.161 6.814 6.194 5660 5.197 4.793 4.439 3851 3.387 3.013 2.708 13 12.134 11348 10635 9986 9 394 8 534 8.358 7.904 7487 7103 6424 S 842 5342 4910 4533 3912 3.427 3010 2727 14 13.004 12 106 11.296 10.563 0899 9.295 8.745 8.244 7.786 7367 6.628 6.002 5.468 5.008 4611 3962 3450 3061 2.740 15 13.865 12 849 11.938 11.118 10.380 9.712 9.108 8559 8060 7606 6,811 6.142 5575 5.092 4.675 4001 3483 1076 2750 16 14.718 13.578 12.561 11652 10 838 10.106 9447 8.851 8.312 7.824 974 6.265 5.660 5162 4.730 400) 3502 088 2.758 17 15.562 14.202 13.166 2166 11.274 10.477 9.763 9.122 8544 8.002 7120 6373 5.749 5222 4.775 4.050 3.518 3097 2.767 18 16.398 14992 13.754 12.659 11.690 10.828 10.059 9 372 8.756 8.2017.250 6.467 5.818 5.273 48124.08035293104 2767 19 17.226 15.678 14.324 13,134 12085 11158 10.336 9.604 8950 8.365 7366 6.550 5.877 53164844 4097 3539 2109 2770 20 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.128 8.514 7460 6.623 5.929 525) 46704/110 3.546 2113772 25 22.023 19.523 17.413 15.622 14 094 12783 11654 10.675 9.823 9.077 7843 68736007 5467 4948 4.147 35642122 2.776 30 25.80B 22.937 19.600 17.292 15 373 13.765 12.409 11.258 10.274 9.427 BOSS 7003 6.177 5.517 4.979 4.160 3.560 1124 2.778