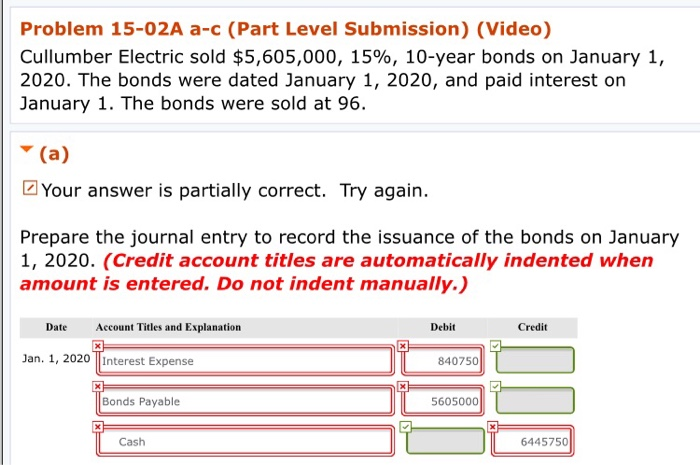

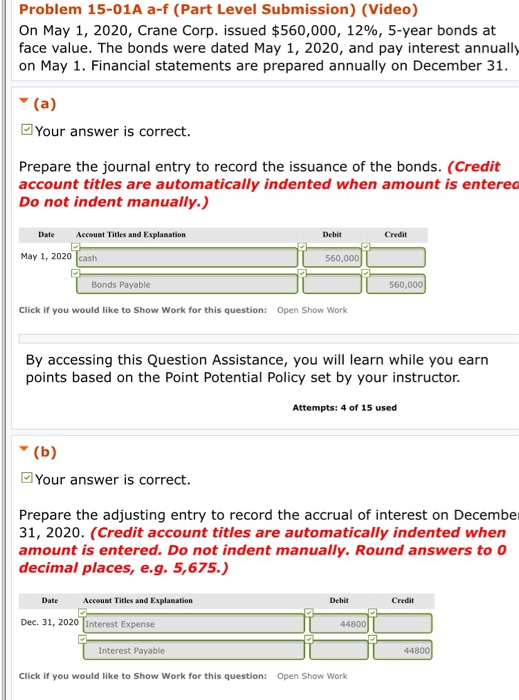

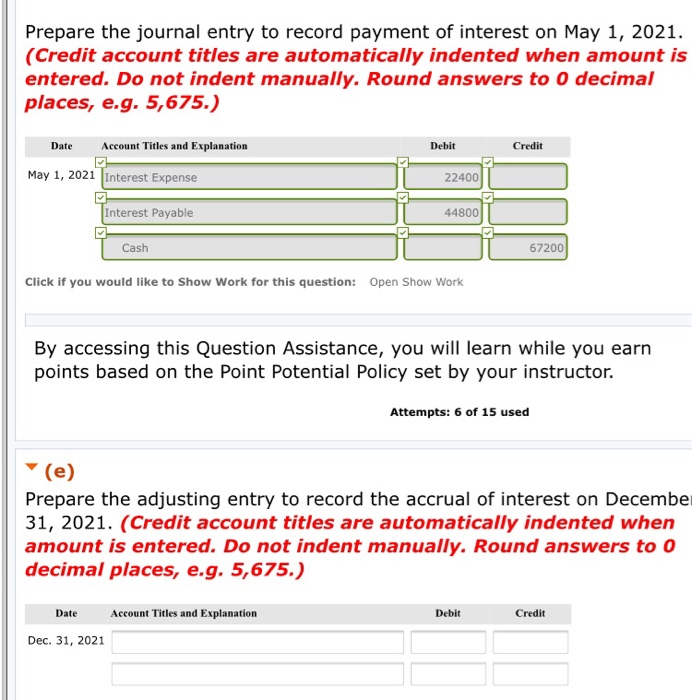

Problem 15-02A a-c (Part Level Submission) (Video) Cullumber Electric sold $5,605,000, 15%, 10-year bonds on January 1, 2020. The bonds were dated January 1, 2020, and paid interest on January 1. The bonds were sold at 96 (a) Your answer is partially correct. Try again Prepare the journal entry to record the issuance of the bonds on January 1, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Jan. 1, 2020 Interest Expense 840750 Bonds Payable 5605000 6445750 Cash Problem 15-01A a-f (Part Level Submission) (Video) On May 1, 2020, Crane Corp. issued $560,000, 12%, 5-year bonds at face value. The bonds were dated May 1, 2020, and pay interest annually on May 1. Financial statements are prepared annually on December 31 (a) Your answer is correct Prepare the journal entry to record the issuance of the bonds. (Credit account titles are automatically indented when amount is enterec Do not indent manually.) Date Credit Account Titles and Explanation Debit May 1, 2020 cash 560,000 Bonds Payable 560,000 Click if you would like to Show Work for this question: Open Show Work By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor. Attempts: 4 of 15 used (b) Your answer is correct. Prepare the adjusting entry to record the accrual of interest on Decembe 31, 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to o decimal places, e.g. 5,675.) Date Account Titles and Explanation Debit Credit Dec. 31, 2020 Interest Expense 44800 Interest Payable 44800 Click if you would like to Show Work for this question: Open Show Work Prepare the journal entry to record payment of interest on May 1, 2021. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g.5,6 75.) Credit Date Account Titles and Explanation Debit May 1, 2021 Interest Expense 22400 Interest Payable 44800 67200 Cash Click if you would like to Show Work for this question: Open Show Work By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor. Attempts: 6 of 15 used (e) Prepare the adjusting entry to record the accrual of interest on December 31, 2021. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g. 5,675.) Date Account Titles and Explanation Debit Credit Dec. 31, 2021