Answered step by step

Verified Expert Solution

Question

1 Approved Answer

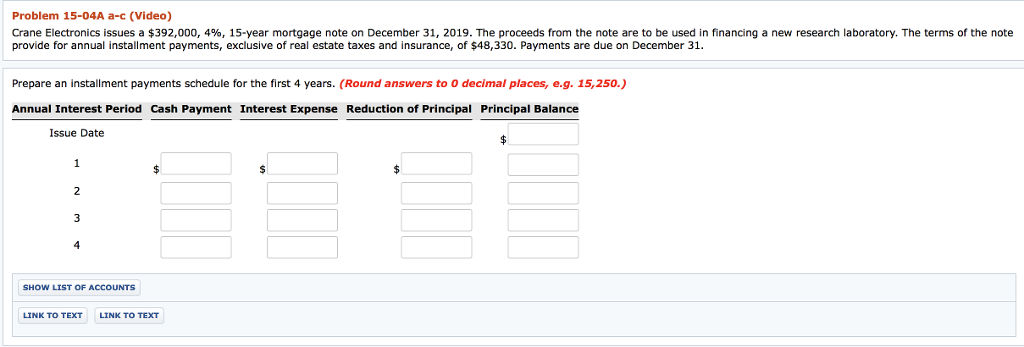

Problem 15-04A a-c (Video) Crane Electronics issues a $392,000, 4%, 15-year mortgage note on December 31, 2019. The proceeds from the note are to be

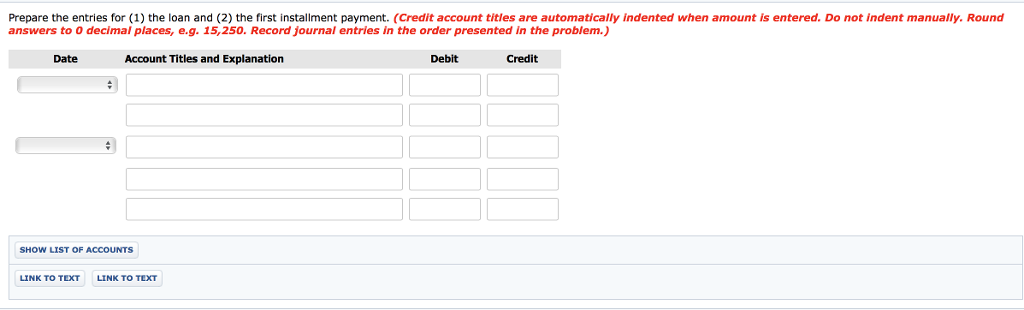

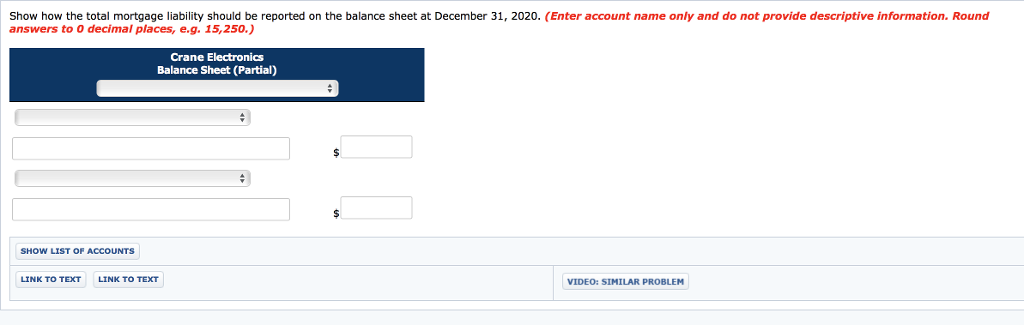

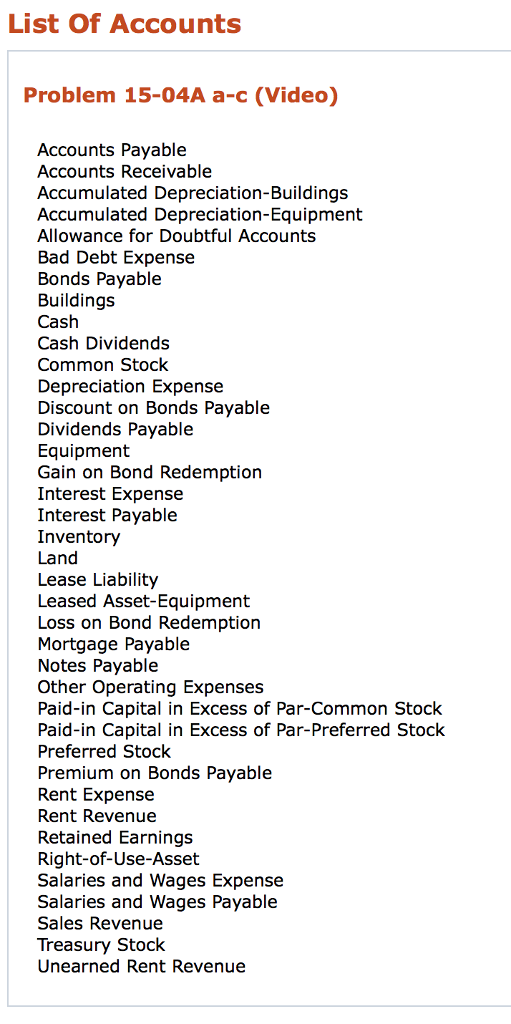

Problem 15-04A a-c (Video) Crane Electronics issues a $392,000, 4%, 15-year mortgage note on December 31, 2019. The proceeds from the note are to be used in financing a new research laboratory. The terms of the note provide for annual installment payments, exclusive of real estate taxes and insurance, of $48,330. Payments are due on December 31. Prepare an installment payments schedule for the first 4 years. (Round answers to O decimal places, e.g. 15,250.) Annual Interest Period Cash Payment Interest Expense Reduction of Principal Principal Balance Issue Date 4 SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT Prepare the entries for (1) the loan and (2) the first installment payment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to O decimal places, e.g. 15,250. Record journal entries in the order presented in the problem) Date Account Titles and Explanation Debit Credit SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT Show how the total mortgage liability should be reported on the balance sheet at December 31, 2020. (Enter account name only and do not provide descriptive information. Round answers to 0 decimal places, e.g. 15,250.,) Crane Electronics Balance Sheet (Partial) SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT VIDE O: SIMILAR PROBLEM List Of Accounts Problem 15-04A a-c (Video) Accounts Payable Accounts Receivable Accumulated Depreciation-Building:s Accumulated Depreciation-Equipment Allowance for Doubtful Accounts Bad Debt Expense Bonds Payable Buildings Cash Cash Dividends Common Stock Depreciation Expense Discount on Bonds Payable Dividends Payable Equipment Gain on Bond Redemption Interest Expense Interest Payable Inventory Land Lease Liability Leased Asset-Equipment Loss on Bond Redemption Mortgage Payable Notes Payable Other Operating Expenses Paid-in Capital in Excess of Par-Common Stock Paid-in Capital in Excess of Par-Preferred Stock Preferred Stock Premium on Bonds Payable Rent Expense Rent Revenue Retained Earnings Right-of-Use-Asset Salaries and Wages Expense Salaries and Wages Payable Sales Revenue Treasury Stock Unearned Rent Revenue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started