Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 15-18 (Algo) Features associated with a stock distribution [LO15-3] Midland Corporation has a net income of $20 million and 8 million shares outstanding. Its

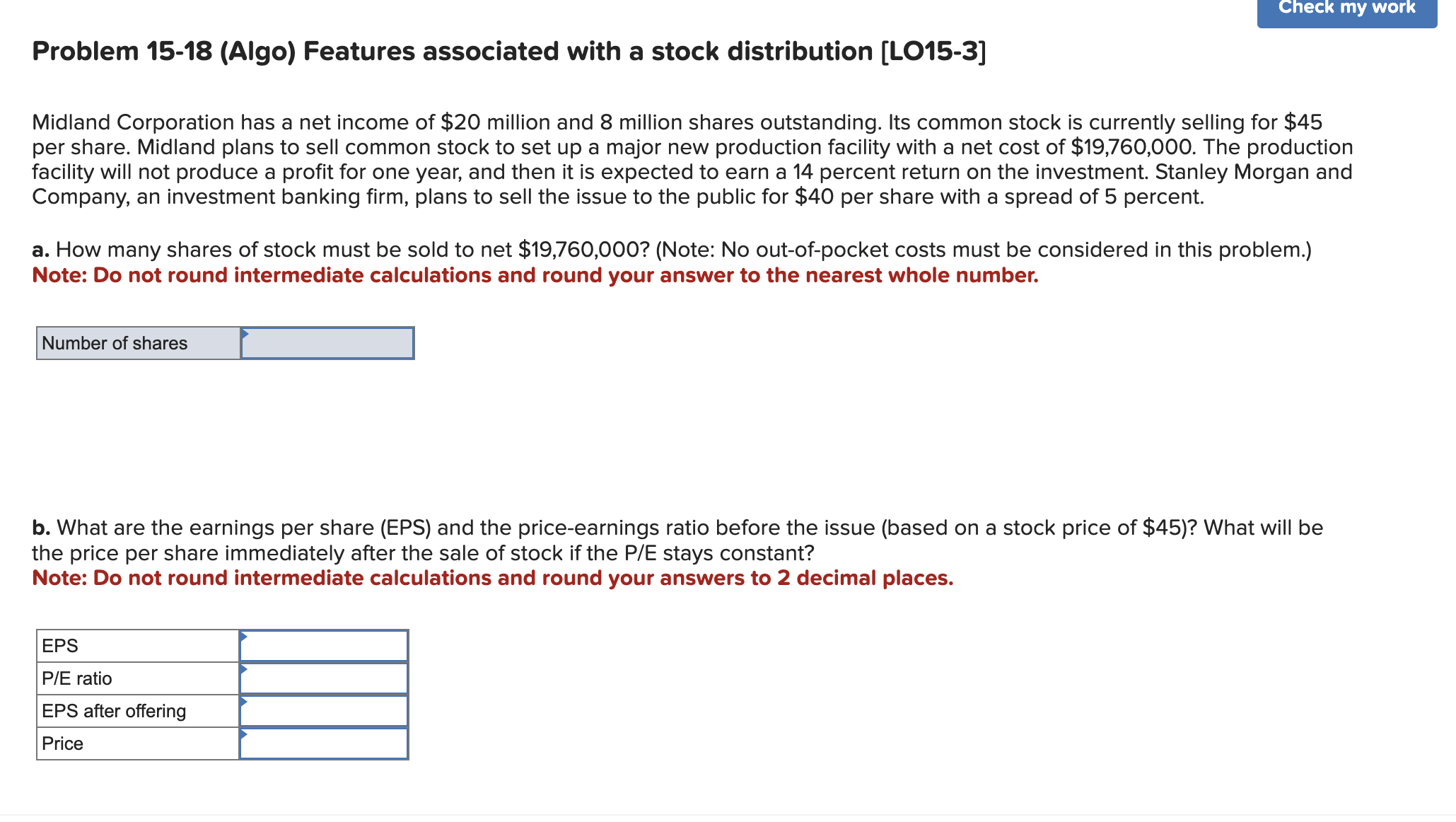

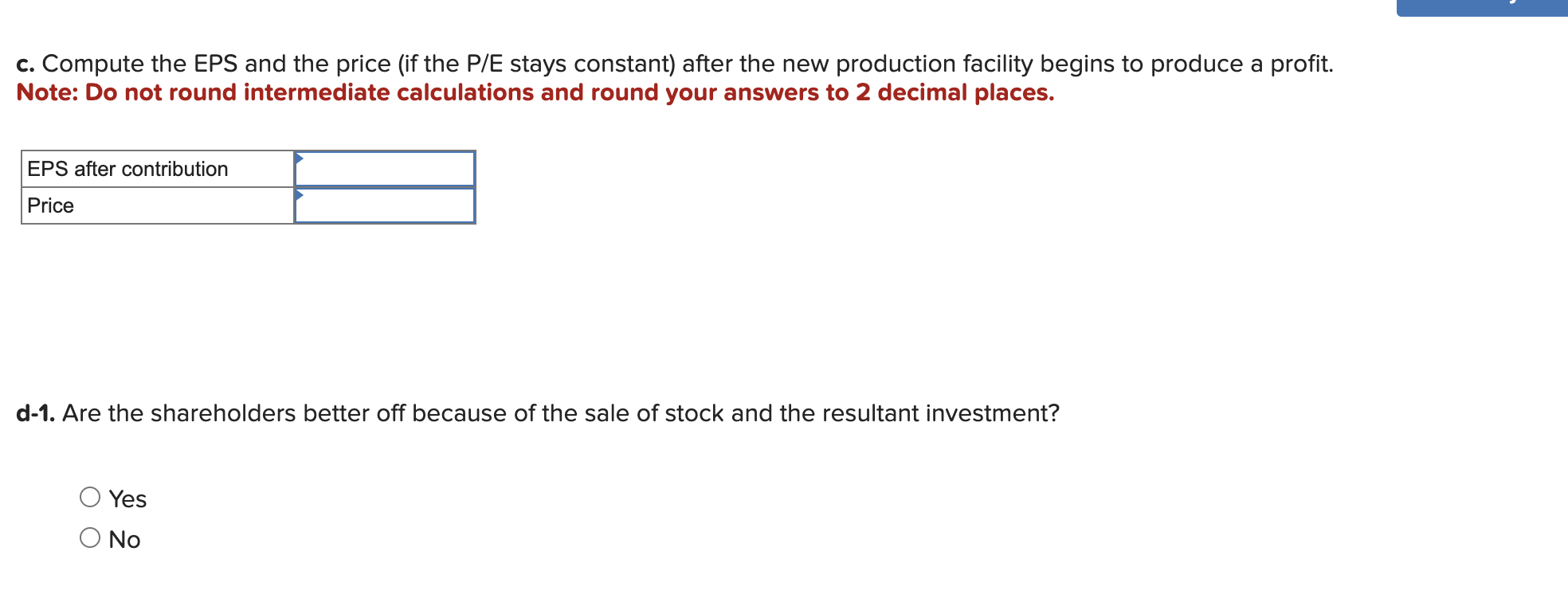

Problem 15-18 (Algo) Features associated with a stock distribution [LO15-3] Midland Corporation has a net income of $20 million and 8 million shares outstanding. Its common stock is currently selling for $45 per share. Midland plans to sell common stock to set up a major new production facility with a net cost of $19,760,000. The production facility will not produce a profit for one year, and then it is expected to earn a 14 percent return on the investment. Stanley Morgan and Company, an investment banking firm, plans to sell the issue to the public for $40 per share with a spread of 5 percent. a. How many shares of stock must be sold to net $19,760,000 ? (Note: No out-of-pocket costs must be considered in this problem.) Note: Do not round intermediate calculations and round your answer to the nearest whole number. b. What are the earnings per share (EPS) and the price-earnings ratio before the issue (based on a stock price of $45 )? What will be the price per share immediately after the sale of stock if the P/E stays constant? Note: Do not round intermediate calculations and round your answers to 2 decimal places. c. Compute the EPS and the price (if the P/E stays constant) after the new production facility begins to produce a profit. Note: Do not round intermediate calculations and round your answers to 2 decimal places. d-1. Are the shareholders better off because of the sale of stock and the resultant investment? Yes No d-2. What other financing strategy could the company have tried to increase earnings per share? Note: You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. ? Combination of debt and stock

Problem 15-18 (Algo) Features associated with a stock distribution [LO15-3] Midland Corporation has a net income of $20 million and 8 million shares outstanding. Its common stock is currently selling for $45 per share. Midland plans to sell common stock to set up a major new production facility with a net cost of $19,760,000. The production facility will not produce a profit for one year, and then it is expected to earn a 14 percent return on the investment. Stanley Morgan and Company, an investment banking firm, plans to sell the issue to the public for $40 per share with a spread of 5 percent. a. How many shares of stock must be sold to net $19,760,000 ? (Note: No out-of-pocket costs must be considered in this problem.) Note: Do not round intermediate calculations and round your answer to the nearest whole number. b. What are the earnings per share (EPS) and the price-earnings ratio before the issue (based on a stock price of $45 )? What will be the price per share immediately after the sale of stock if the P/E stays constant? Note: Do not round intermediate calculations and round your answers to 2 decimal places. c. Compute the EPS and the price (if the P/E stays constant) after the new production facility begins to produce a profit. Note: Do not round intermediate calculations and round your answers to 2 decimal places. d-1. Are the shareholders better off because of the sale of stock and the resultant investment? Yes No d-2. What other financing strategy could the company have tried to increase earnings per share? Note: You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. ? Combination of debt and stock Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started