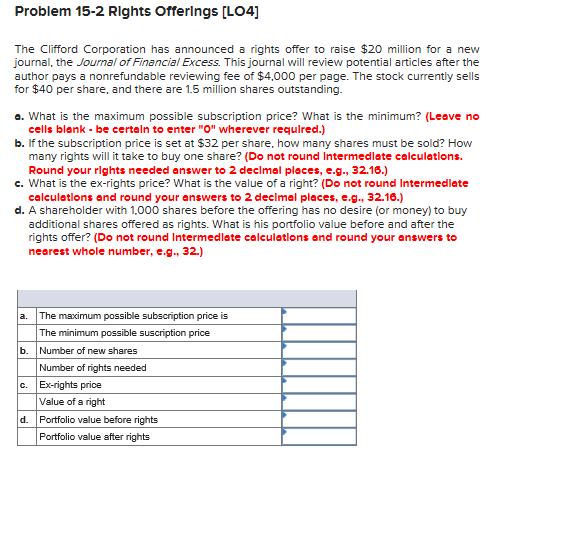

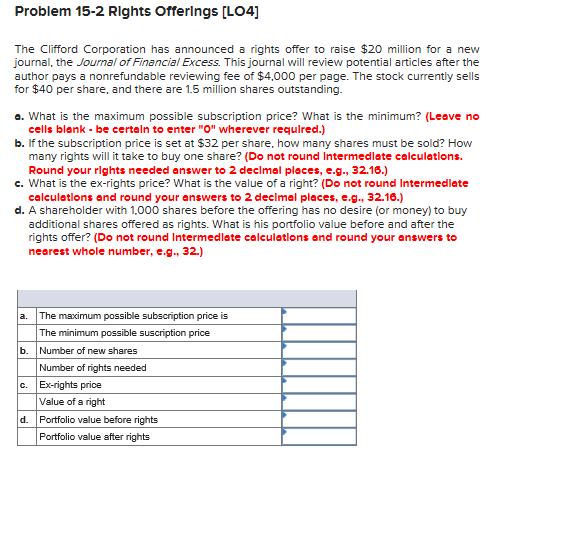

Problem 15-2 Rights Offerings [LO4] The Clifford Corporation has announced a rights offer to raise $20 milion for a new journal, the Journal of Financial Excess. This journal will review potential articles after the author pays a nonrefundable reviewing fee of $4,000 per page. The stock currently sells for $40 per share, and there are 1.5 million shares outstanding o. What is the maximum possible subscription price? What is the minimum? (Leave no cells blank be certaln to enter "O" wherever requlred.) b. If the subscription price is set at $32 per share, how many shares must be sold? How many rights will it take to buy one share? (Do not round Intermedlete calculatlons. Round your rights needed answer to 2 declmal pleces, e.g., 32.16.) c. what is the ex-rights price? what is the value of a right? (Dnot round intermediate calculatlons and round your answers to 2 declmal places, e.g., 32.16.) d. A shareholder with 1,000 shares before the offering has no desire (or money) to buy additional shares offered as rights. What is his portfolio value before and after the rights offer? (Do not round Intermedlate calculetlons and round your answers to nearest whole number, e.g., 32.) a. The maximum possible subscription price is The minimum possible suscription price b. Number of new shares Number of rights needed c. Ex-rights price Value of a right d. Portfolio value before rights Portfolio value after rights Problem 15-2 Rights Offerings [LO4] The Clifford Corporation has announced a rights offer to raise $20 milion for a new journal, the Journal of Financial Excess. This journal will review potential articles after the author pays a nonrefundable reviewing fee of $4,000 per page. The stock currently sells for $40 per share, and there are 1.5 million shares outstanding o. What is the maximum possible subscription price? What is the minimum? (Leave no cells blank be certaln to enter "O" wherever requlred.) b. If the subscription price is set at $32 per share, how many shares must be sold? How many rights will it take to buy one share? (Do not round Intermedlete calculatlons. Round your rights needed answer to 2 declmal pleces, e.g., 32.16.) c. what is the ex-rights price? what is the value of a right? (Dnot round intermediate calculatlons and round your answers to 2 declmal places, e.g., 32.16.) d. A shareholder with 1,000 shares before the offering has no desire (or money) to buy additional shares offered as rights. What is his portfolio value before and after the rights offer? (Do not round Intermedlate calculetlons and round your answers to nearest whole number, e.g., 32.) a. The maximum possible subscription price is The minimum possible suscription price b. Number of new shares Number of rights needed c. Ex-rights price Value of a right d. Portfolio value before rights Portfolio value after rights