Answered step by step

Verified Expert Solution

Question

1 Approved Answer

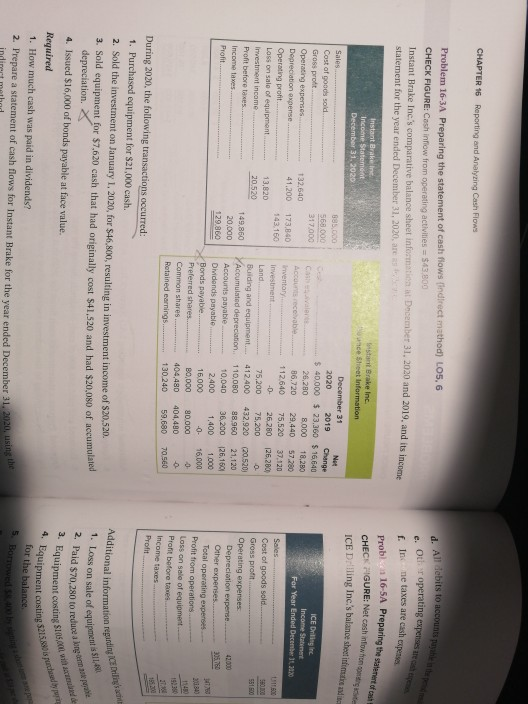

problem 16 3 A Thx CHAPTER 16 Reporting and Analyzing Cash Flows Problem 16-3A Preparing the statement of cash flows indirect mathod) LO5, 6 CHECK

problem 16 3 A Thx

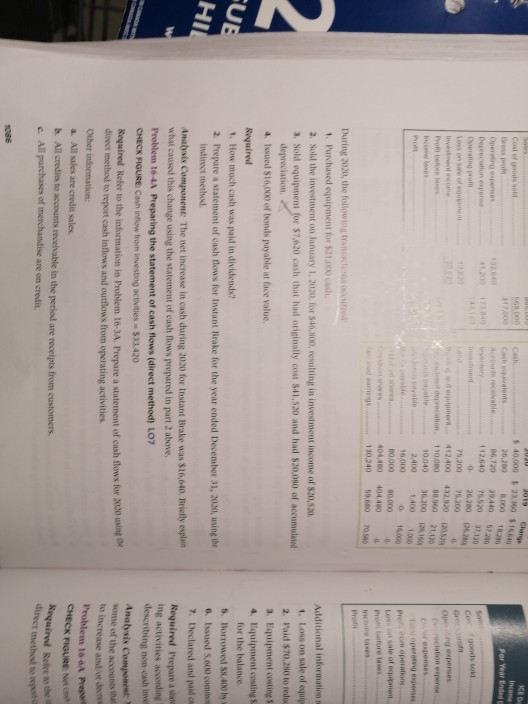

CHAPTER 16 Reporting and Analyzing Cash Flows Problem 16-3A Preparing the statement of cash flows indirect mathod) LO5, 6 CHECK FIGURE: Cash inflow from operating activities = $43.800 Instant Brake Inc.'s comparative balance sheet information December 31, 2020 and 2019. and its income statement for the year ended December 31, 2020. are d. All debits to accounts payable Otir operating f. Int e taxes are cash expenses Start Brake Inc. unce Sheet Information bl 16-5A Preparing the state CHECK GURE Netcash notion ICE Driling Inc. balance sheet inf BU5,000 560.000 317.000 Instant Brake in Income Statement December 31, 2020 Sales Cost of goods sold Gross profit Operating expenses 132,640 Depreciation expense... 41.200 Operating pront Loss on sale of equipment 13.820 investment income 20.520 Pront before taxes... Income taxes.. Profit.. ICE Drilling the Income Statement For Year Ended December 2120 173.840 143,160 Ac c evable.. Inventory Investment. Land Some December 31 Net 2020 2019 Change $ 40,000 $ 23,360 $ 16.640 26,280 8.000 18.280 86,720 29,440 57.280 112.640 75,520 37,120 D 26.280 26.2001 75,200 75,200 412 400 432,920 (20.520 110,080 98.960 21,120 10,040 36,200 126.160 2.400 1,400 1.000 16.000 - 16.000 80,000 80.000 404,480 404,490 130.240 59,680 70.560 Building and equipment. Y Accumulated depreciation Accounts payable Didonds payable Bonds payable. Preferred shares... Common shares. Retained earnings 149,860 20,000 129.860 Sales Cost of goods sold..... Gross profit.... Operating expenses Depreciation expense...... Other expenses. Total operating expenses - Profit from operations Loss on sale of equipment.-- Pront before taxes Income taxes Profit g formation regardin During 2020, the following transactions occurred: 1. Purchased equipment for $21,000 cash. 2. Sold the investment on January 1, 2020, for $46,800, resulting in investment income of $20.520 3. Sold equipment for $7,620 cash that had originally cost $41,520 and had $20,080 of accumulate depreciation. 4. Issued $16,000 of bonds payable at face value. Required 1. How much cash was paid in dividends? 2. Prepare a statement of cash flows for Instant Brake for the year ended December Additional information 1. Loss on sale of equipment 2. Paid $70,280 to reduce a long equipments o 2. Equipment costum 4. Equipment cu went contine Sisca wit Pnent costinesisch for the balance indirect method 2015 Charge 40.000 2 016 0.00 ICED Income For Year Ended 132.64 On penses Pront le 36.720 29.40 S7 112.6075520 0 26.000 75.200 75.00 412.400 41210 DO 110.000 60 21.30 10040 6.2006 2.400 1.400 000 10,000 0 .000 0,000 30,000 404,400 404400 130.240 50 60 Total Operating expenses Promo Operations Locale of Protetores Income Pret During 2030, the following red 1. Purchased equipment for $1.00) 2. Sold the investment on January 1, 2030, for $46,800, resulting in investment income of 530,520 3. Sol equipment for 7.030 cash that had originally cost $41.520 and had $20,000 of accumula depreciation 4. Issued 16,000 of bonds payable at face value. Required 1. How much cash was paid in dividends? 2. Prepare a statement of cash flows for instant Brake for the year ended December 31, 2030, sing the indirect method UB HIL Additional information 1. Loss on sale of equip 2. Paid $70,280 to redu 3. Equipment stings 4. Equipment costings for the balance 5. Borrowed $8.400 6. Issued 5.600 cm 7. Declared and paid Required Prepare a stat ing activities coording describing non cash Analysis Component some of the accounts that Analysis Component The net increase in cash during 2020 for Instant Brake was $16,640. Billy explam what cause this change using the statement of cash flows prepared in part above Problem 16-4A Preparing the statement of cash flows (direct method) LOT CHECK FIGURE Cash flow from investing activities - $33.420 Keyword Refer to the information in Problem 16-3A. Prepare a statement of cash flows for 120 direct method to report cash intlows and outflows from operating activities Other information: All sales are credit sales All credits to receivable in the period are receipts from customers c. All purchases of merchandise are on credit Problem - CHECK FIGUREN Neywine Retete 1085Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started