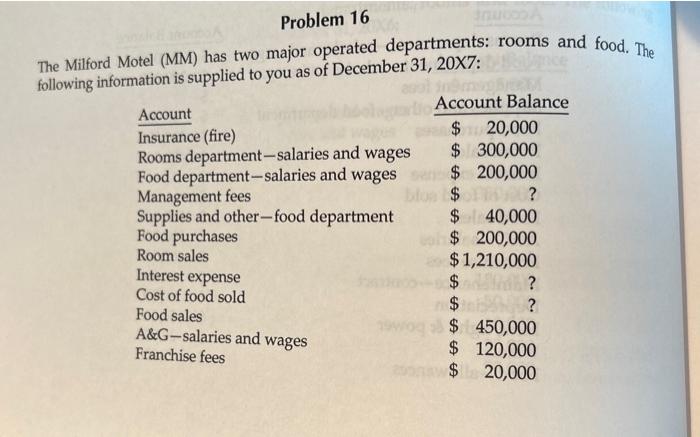

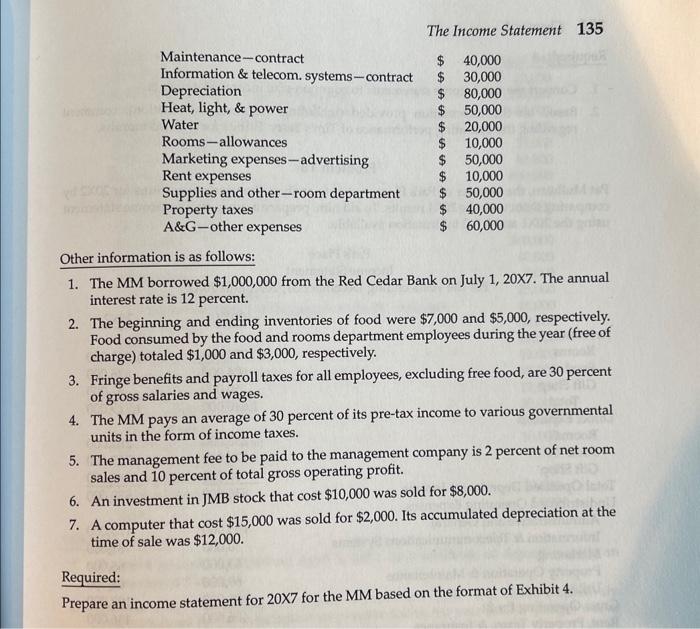

Problem 16 The Milford Motel (MM) has two major operated departments: rooms and food. The following information is supplied to you as of December 31,207 : 1. The MM borrowed $1,000,000 from the Red Cedar Bank on July 1, 207. The annual interest rate is 12 percent. 2. The beginning and ending inventories of food were $7,000 and $5,000, respectively. Food consumed by the food and rooms department employees during the year (free of charge) totaled $1,000 and $3,000, respectively. 3. Fringe benefits and payroll taxes for all employees, excluding free food, are 30 percent of gross salaries and wages. 4. The MM pays an average of 30 percent of its pre-tax income to various governmental units in the form of income taxes. 5. The management fee to be paid to the management company is 2 percent of net room sales and 10 percent of total gross operating profit. 6. An investment in JMB stock that cost $10,000 was sold for $8,000. 7. A computer that cost $15,000 was sold for $2,000. Its accumulated depreciation at the time of sale was $12,000. Required: Prepare an income statement for 20X7 for the MM based on the format of Exhibit 4. Problem 16 The Milford Motel (MM) has two major operated departments: rooms and food. The following information is supplied to you as of December 31,207 : 1. The MM borrowed $1,000,000 from the Red Cedar Bank on July 1, 207. The annual interest rate is 12 percent. 2. The beginning and ending inventories of food were $7,000 and $5,000, respectively. Food consumed by the food and rooms department employees during the year (free of charge) totaled $1,000 and $3,000, respectively. 3. Fringe benefits and payroll taxes for all employees, excluding free food, are 30 percent of gross salaries and wages. 4. The MM pays an average of 30 percent of its pre-tax income to various governmental units in the form of income taxes. 5. The management fee to be paid to the management company is 2 percent of net room sales and 10 percent of total gross operating profit. 6. An investment in JMB stock that cost $10,000 was sold for $8,000. 7. A computer that cost $15,000 was sold for $2,000. Its accumulated depreciation at the time of sale was $12,000. Required: Prepare an income statement for 20X7 for the MM based on the format of Exhibit 4