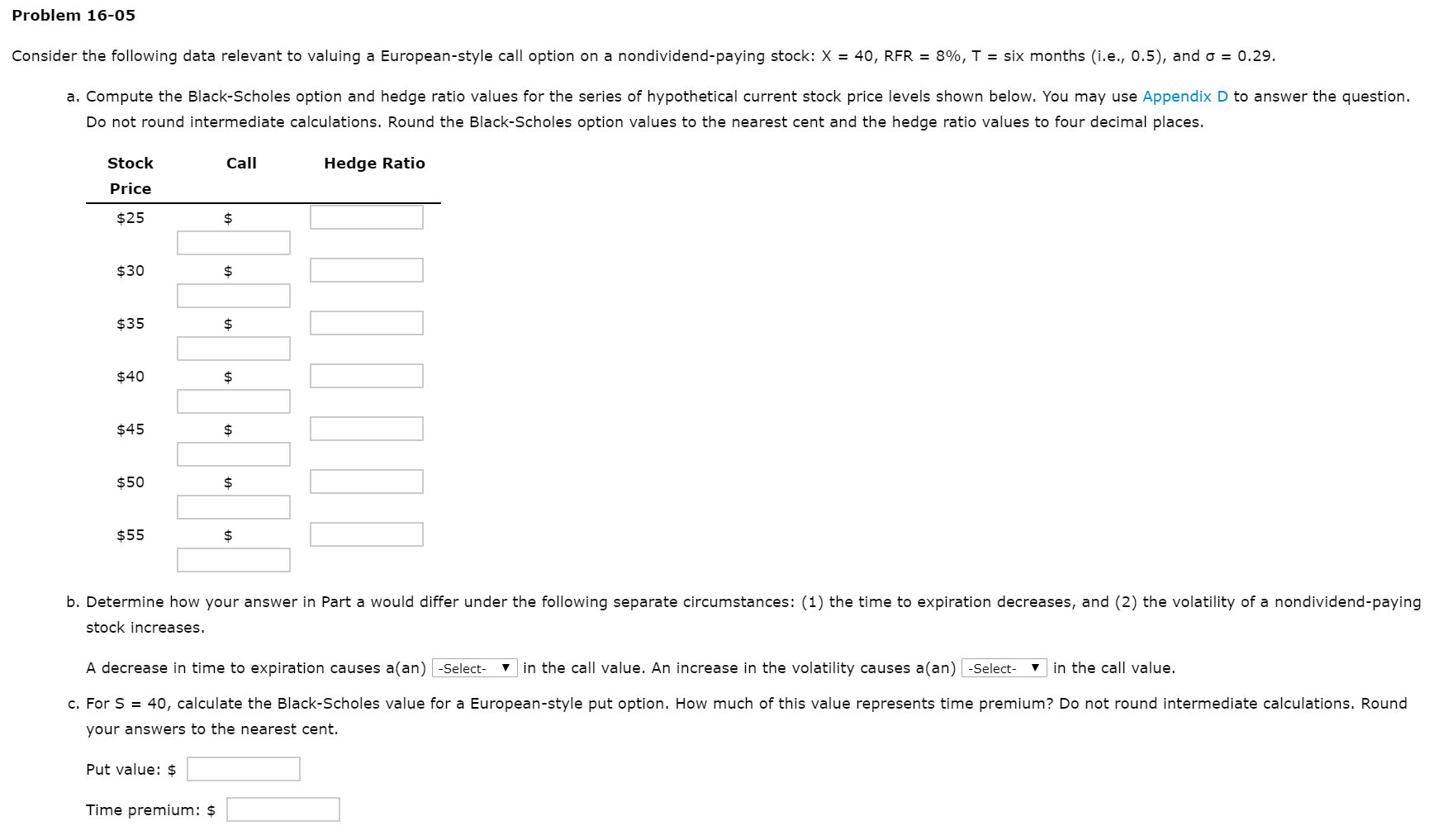

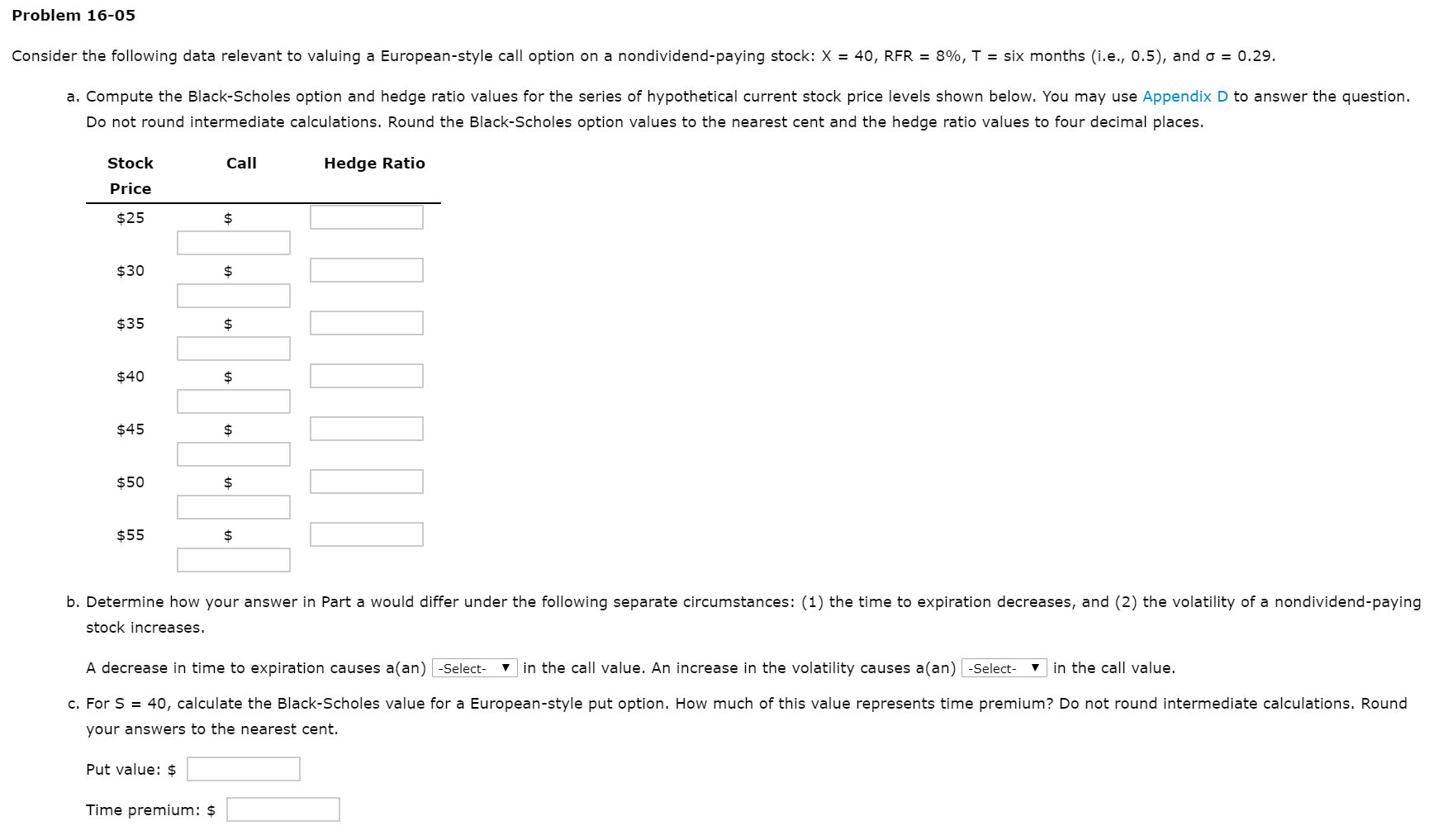

Problem 16-05 Consider the following data relevant to valuing a European-style call option on a nondividend paying stock: X = 40, RFR = 8%, T = six months i.e., 0.5), and o = 0.29. a. Compute the Black-Scholes option and hedge ratio values for the series of hypothetical current stock price levels shown below. You may use Appendix D to answer the question. Do not round intermediate calculations. Round the Black-Scholes option values to the nearest cent and the hedge ratio values to four decimal places. Call Hedge Ratio Stock Price $25 $30 $35 $40 $45 $50 $55 b. Determine how your answer in Part a would differ under the following separate circumstances: (1) the time to expiration decreases, and (2) the volatility of a nondividend-paying stock increases. A decrease in time to expiration causes a(an) -Select- in the call value. An increase in the volatility causes a(an) -Select- in the call value. c. For s = 40, calculate the Black-Scholes value for a European-style put option. How much of this value represents time premium? Do not round intermediate calculations. Round your answers to the nearest cent. Put value: $ Time premium: $ Problem 16-05 Consider the following data relevant to valuing a European-style call option on a nondividend paying stock: X = 40, RFR = 8%, T = six months i.e., 0.5), and o = 0.29. a. Compute the Black-Scholes option and hedge ratio values for the series of hypothetical current stock price levels shown below. You may use Appendix D to answer the question. Do not round intermediate calculations. Round the Black-Scholes option values to the nearest cent and the hedge ratio values to four decimal places. Call Hedge Ratio Stock Price $25 $30 $35 $40 $45 $50 $55 b. Determine how your answer in Part a would differ under the following separate circumstances: (1) the time to expiration decreases, and (2) the volatility of a nondividend-paying stock increases. A decrease in time to expiration causes a(an) -Select- in the call value. An increase in the volatility causes a(an) -Select- in the call value. c. For s = 40, calculate the Black-Scholes value for a European-style put option. How much of this value represents time premium? Do not round intermediate calculations. Round your answers to the nearest cent. Put value: $ Time premium: $