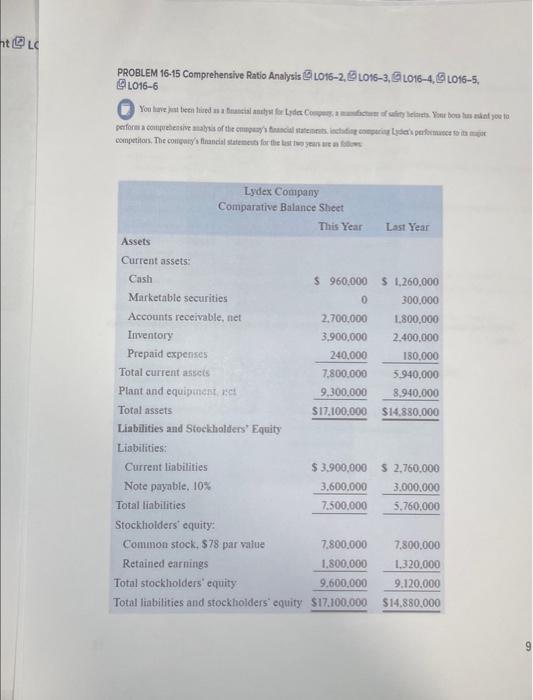

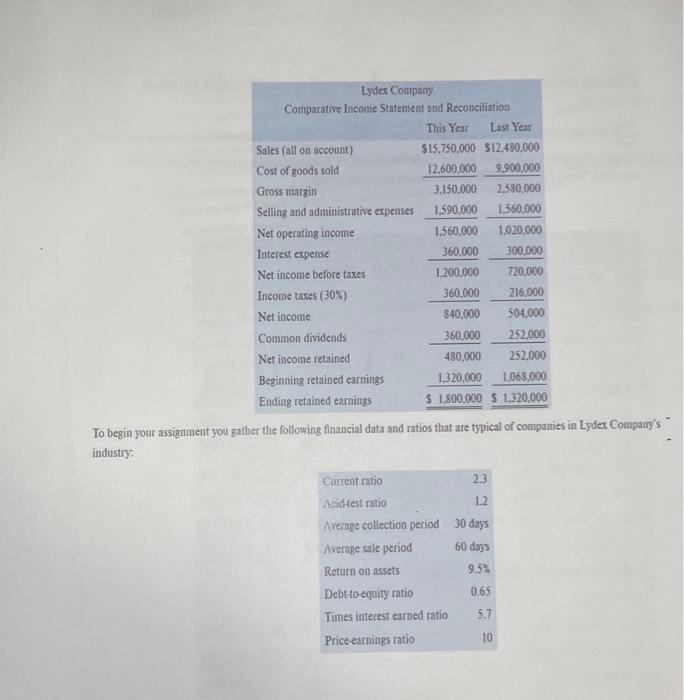

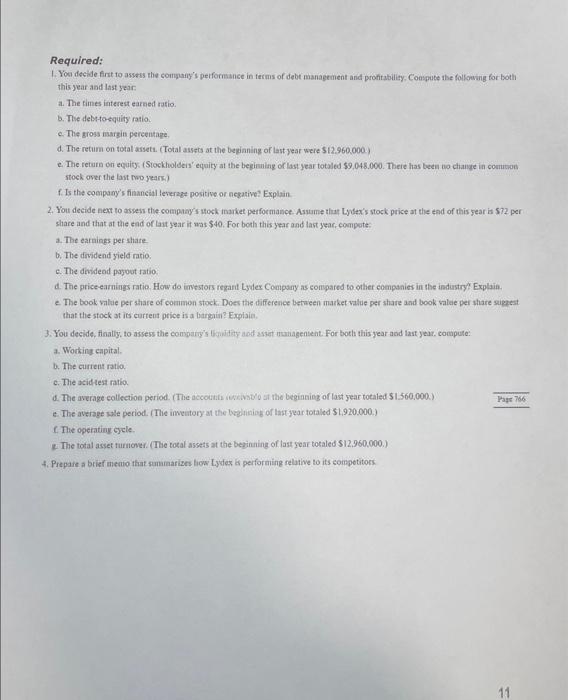

PROBLEM 16-15 Comprehensive Ratio Analysis (G) LO16-2, G L016-3, G9 LO16-4, (9) L016-5, (4) L016-6 competion. The coughry's finandal suteneua far the Lat tho year ais a fibeve To begin your assignment you gather the following financial data and ratios that are typical of companies in Lyder Company's industry: Required: 1. Yoe declde first to aswess the company 's performance in terms of debe management and profitabilisy. Congute the following for both thisyear and last year: a. The fimes interest earaed ratio. b. The debtosquity ratio. e. The sross marsin percentape. d. The retum on total asset. (Total assets at the bepinning of last year were $12.960000.) e. The returs on equity: (Stockholdeis' equity at the beginulag of last year totaled $9.048.000. Theie has been bo change in comusos stock over the lant fwo yearm.) f. Is the coompany's financial lenerage positive or negative? Explain 2. You decide next to assens the compan's Hosk inarket petformance. Assume that Lysex's stock price at the end of this year in 572 per share and that at the end of lait year it wat $40. For both this y ear and last year, compete: a. The earnings per shate. b. The dividend yield ratio. e. The divdend pryout ratio: d. The price earnings ratio. How do imestors regart Lydex Compary as compared to other companies in the indiastry? Explaia. e. The book vilue per share of common stock. Doer the difference befween makket walue per share and book value per share siggest that the stock at its curtent price is a bargiin? Expiaid. 3. You decide, finally, to assess the combary's bignidity aod assit managentent. For both this year and last year, compute: 3. Wocking capital. b. The current ratio. c. The acidtest ratio. d. The average collection period. (The accoulifs ingeivovo at the beginniog of last jear totaled $1.560.000.) e. The average wle period. (Thie imentory at the beghinaing of last year totaled $1,920,000.) C. The operatiny cycle. 7. The total asset furnower. (The total assets at the beginning of last jear totaled $12,960,000.) 4. Prepare a brief memio that sumanarizes tiow Lydes is performing relative to its sompetitors