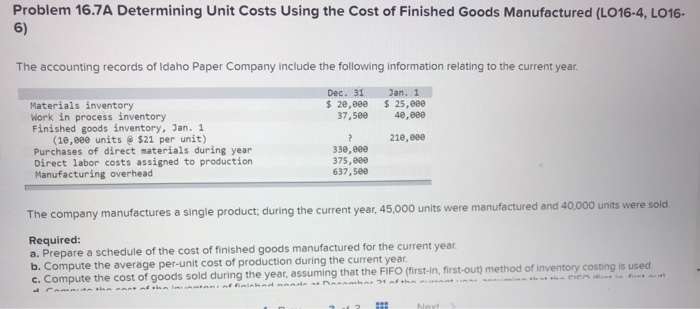

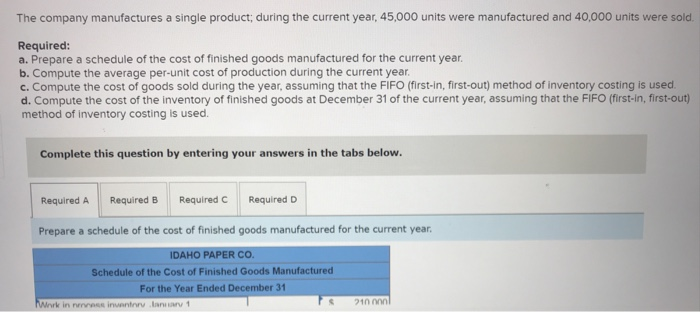

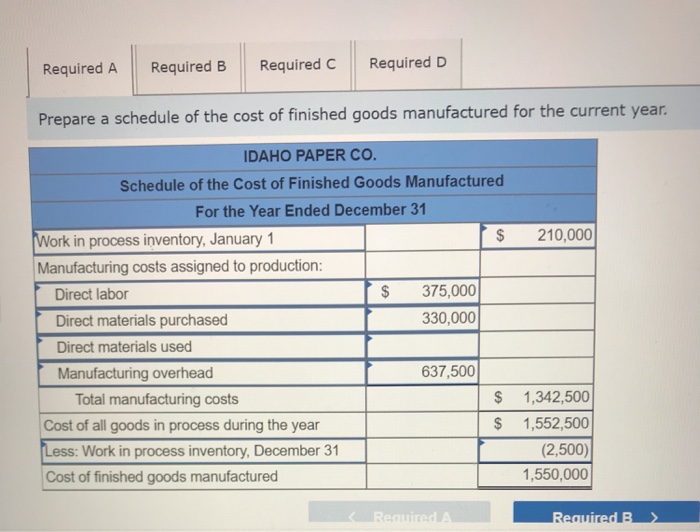

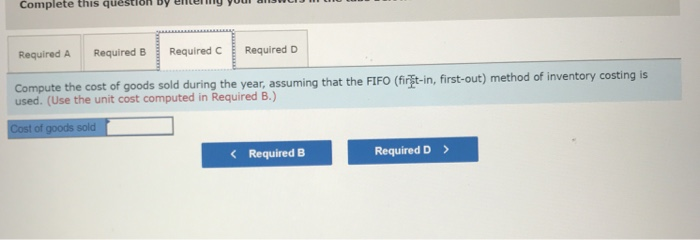

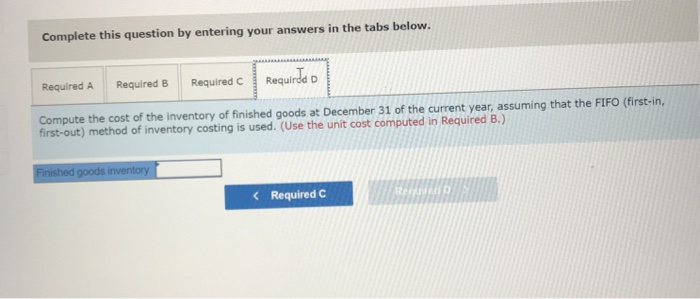

Problem 16.7A Determining Unit Costs Using the Cost of Finished Goods Manufactured (L016-4, LO16- 6) The accounting records of Idaho Paper Company include the following information relating to the current year Dec. 31an. 1 Materials inventory Work in process inventory Finished goods inventory, Jan. 1 s 20,800 25,eee 37,5e0 40,880 210,0e0 (18,880 units$21 per unit) Purchases of direct materials during year Direct labor costs assigned to production Manufacturing overhead 33e,eee 375,000 637,500 ,000 units were sold The company manufactures a single product, during the current year, 45,000 units were manufactured and 40 Required: a. Prepare a schedule of the cost of finished goods manufactured for the current b. Compute the average per-unit cost of production during the current year c. Compute the cost of goods sold during the year, assuming that the FIFO (first-in, first-out) method of inventory costing is used The company manufactures a single product, during the current year, 45,000 units were manufactured and 40,000 units were sold. Required: a. Prepare a schedule of the cost of finished goods manufactured for the current year b. Compute the average per-unit cost of production during the current year c. Compute the cost of goods sold during the year, assuming that the FIFO (first-in, first-out) method of inventory costing is used d. Compute the cost of the inventory of finished goods at December 31 of the current year, assuming that the FIFO (first-in, first-out) method of inventory costing is used. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Prepare a schedule of the cost of finished goods manufactured for the current year. IDAHO PAPER CO. Schedule of the Cost of Finished Goods Manufactured For the Year Ended December 31 21 Work in nenress inventore aay1 Required ARequired B Required CRequired D Prepare a schedule of the cost of finished goods manufactured for the current year. IDAHO PAPER CO Schedule of the Cost of Finished Goods Manufactured For the Year Ended December 31 $ 210,000 Work in process inventory, January 1 Manufacturing costs assigned to production $ 375,000 330,000 Direct labor Direct materials purchased Direct materials used Manufacturing overhead 637,500 $ 1,342,500 $ 1,552,500 (2,500) 1,550,000 Total manufacturing costs Cost of all goods in process during the year Work in process inventory, December 31 Cost of finished goods manufactured d. Compute the cost of the inventory of finished goods at December 31 of the current year, assuming that the FIFO (first-in, method of inventory costing is used. Complete this question by entering your answers in the tabs below. Required A Required B Required C RequiredD Compute the average per-unit cost of production during the current year. (Round unit cost to the nearest whole dollar) age unit cost