Question

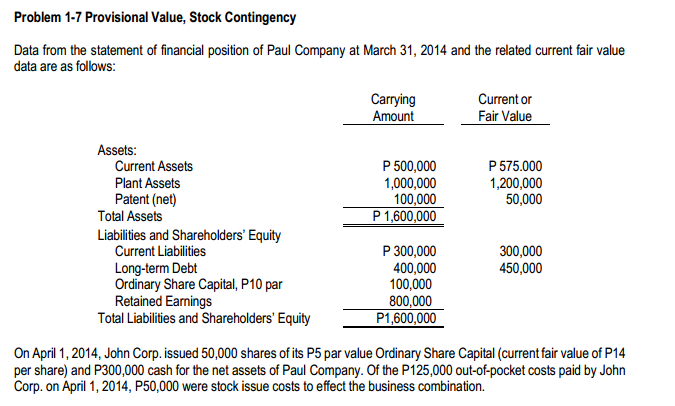

Problem 1-7 Provisional Value, Stock Contingency Data from the statement of financial position of Paul Company at March 31, 2014 and the related current fair

Problem 1-7 Provisional Value, Stock Contingency Data from the statement of financial position of Paul Company at March 31, 2014 and the related current fair value data are as follows:  Instructions: 1. Prepare the necessary journal entry or entries to record the business combination in the accounting records of John Corp.

Instructions: 1. Prepare the necessary journal entry or entries to record the business combination in the accounting records of John Corp.

2. Assuming the value of the plant assets were provisionally determined on April 1, 2014. On December 15, 2014, John Corp. received the final value from the independent appraiser indicating the fair value at acquisition date at P1,500,000. Give the entry to reflect the adjustment. 3. Assuming that in addition to the share issue, John Corp. also agreed to issue 5,000 additional shares of ordinary share capital to the former shareholders of Paul Company if the average post-combination earnings for 2014 and 2015 of P200,000 were achieved. The 5,000 shares are valued at P30,000. Give the entries on the acquisition date and on January 1, 2016 when it was determined that the earnings of Paul Company for the last two years were more than P200,000. 4. Assuming that in addition to the share issue, John Corp. also agreed to issue 4,000 additional shares of ordinary share capital to the former shareholders of Paul Company if the average post-combination earnings for 2014 and 2015 of P200,000 were achieved. Give the entry on January 1, 2016 when it was determined that earnings of Paul Company for the last two years were more than P200,000. How will the contingency be reported prior to termination? 5. Assuming that in addition to the share issue, John Corp. also agreed to issue additional shares of ordinary share capital, on January 1, 2016, to former shareholders of Paul Company. This is to compensate for any fall in the value of John Corp. shares below PI4 per share. Give the entry on January 1, 2016 when it was determined that the market price of John Corp. shares dropped to P10. How will the contingency be reported prior to termination?

Problem 1-7 Provisional Value, Stock Contingency Data from the statement of financial position of Paul Company at March 31, 2014 and the related current fair value data are as follows: Carrying Amount Current or Fair Value P 500,000 1,000,000 100,000 P 1,600,000 P 575.000 1,200,000 50,000 Assets: Current Assets Plant Assets Patent (net) Total Assets Liabilities and Shareholders' Equity Current Liabilities Long-term Debt Ordinary Share Capital, P10 par Retained Earnings Total Liabilities and Shareholders' Equity 300,000 450,000 P 300,000 400,000 100,000 800,000 P1,600,000 On April 1, 2014, John Corp. issued 50,000 shares of its P5 par value Ordinary Share Capital (current fair value of P14 per share) and P300,000 cash for the net assets of Paul Company. Of the P125,000 out-of-pocket costs paid by John Corp. on April 1, 2014, P50,000 were stock issue costs to effect the business combination Problem 1-7 Provisional Value, Stock Contingency Data from the statement of financial position of Paul Company at March 31, 2014 and the related current fair value data are as follows: Carrying Amount Current or Fair Value P 500,000 1,000,000 100,000 P 1,600,000 P 575.000 1,200,000 50,000 Assets: Current Assets Plant Assets Patent (net) Total Assets Liabilities and Shareholders' Equity Current Liabilities Long-term Debt Ordinary Share Capital, P10 par Retained Earnings Total Liabilities and Shareholders' Equity 300,000 450,000 P 300,000 400,000 100,000 800,000 P1,600,000 On April 1, 2014, John Corp. issued 50,000 shares of its P5 par value Ordinary Share Capital (current fair value of P14 per share) and P300,000 cash for the net assets of Paul Company. Of the P125,000 out-of-pocket costs paid by John Corp. on April 1, 2014, P50,000 were stock issue costs to effect the business combinationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started