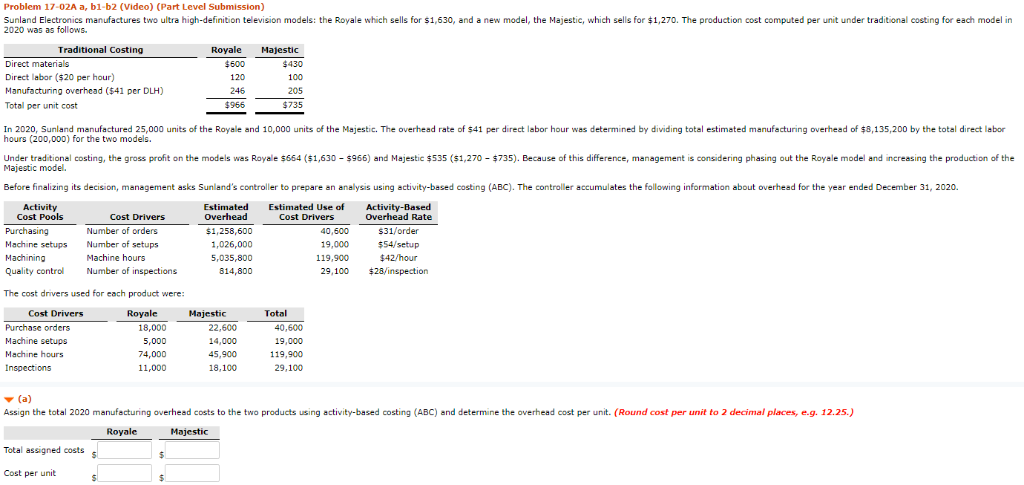

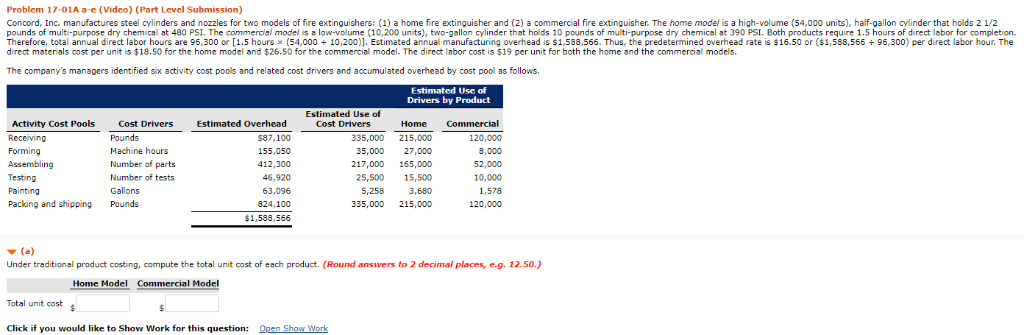

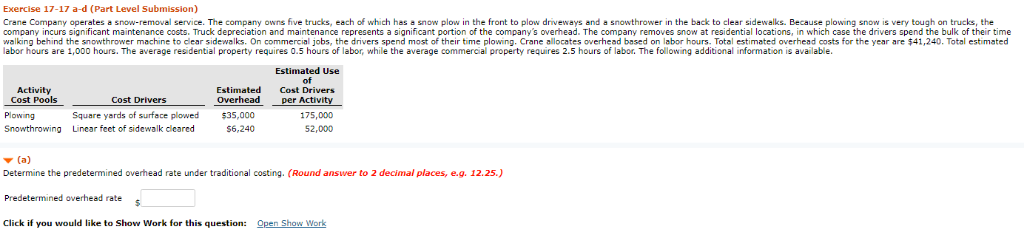

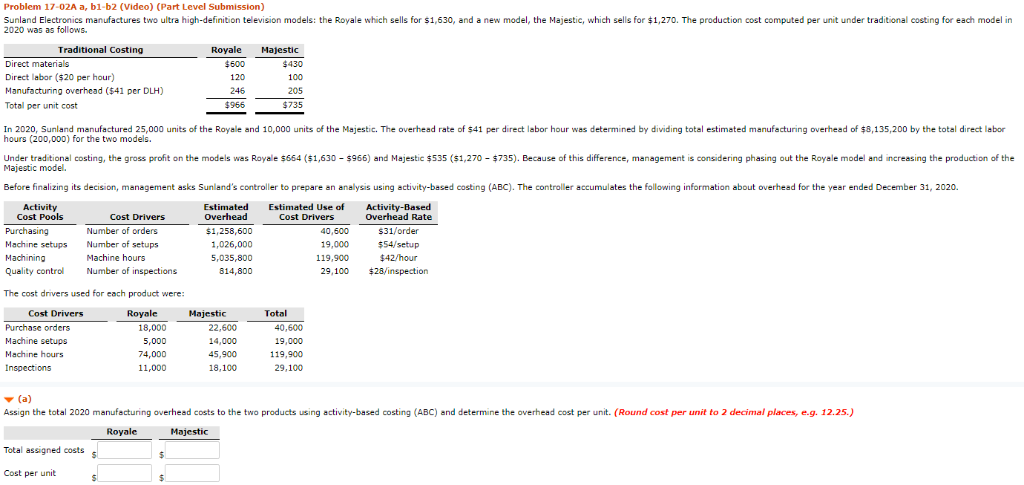

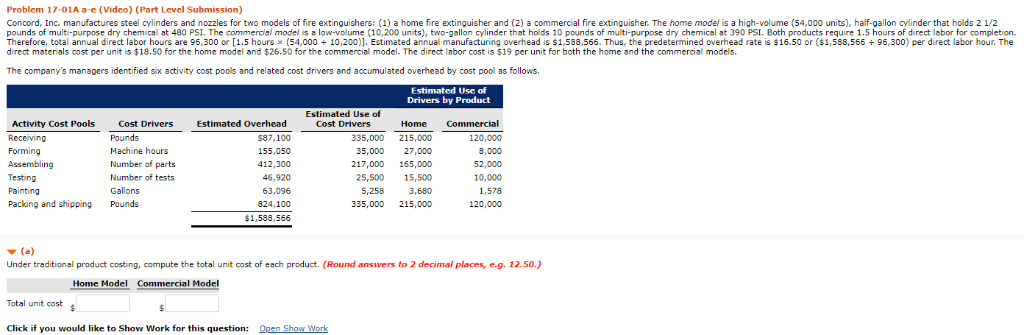

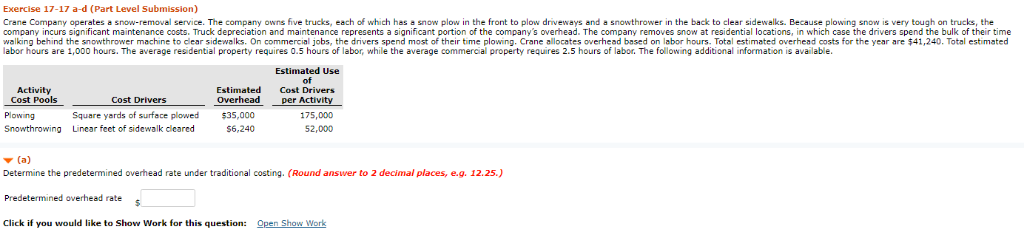

Problem 17-02A a, b1-b2 (Video) (Part Level Submission) Sunland Electronics manufactures two ultra high-definition television models the Royale which sells or s1 630 and a new model, the Majestic which sells or1,270. The production cost computed per unit under tradito al costing or each model in 2020 was as follows Traditional Costing Royale ajestic Direct materials Direct labor ($20 per hour) Manufacturing overhead ($41 per DLH) Total per unit cost $600 120 246 $956 $430 100 205 735 In 2020, Sunland manufactured 25,000 units of the Royale and 10,000 units of the Majestic. The overhead rate of $41 per direct labor hour was determined by dividing total estimated manufacturing overhead of $8,135,200 by the total direct labor hours (200,000) for the two models. Under traditional costing, the gross profit on the models was Royale $664 ($1,630 $966) and Majestic $535 (s1,270 $735). Because of this difference, management is considering phasing out the Royale model and increasing the production of the Majestic model. Before finalizing its decision, management asks Sunland's controller to prepare an analysis using activity-based costing (ABC). The controller accumulates the following information about overhead for the year ended December 31, 2020 Estimated Estimated Use of Activity-Based Overhead Cost Pools Purchasing Machine setups Number of setups Machining Quality contro Number of inspections Cost Drivers Cost Drivers Overhead Rate $31/order $54/setup Number of orders $1,258,600 1,026,000 5,035,800 814,800 19,000 119,900 29, 100 Machine hours 28/inspection The cost drivers used for each product were: Cost Drivers Royale Majestic Total Purchase orders Machine setups Machine hours 18,000 5,000 74,000 11,000 22,600 14,000 45,900 18,100 40,600 19,000 119,900 29,100 (a) Assign the total 2020 manufacturing overhead costs to the two products using activity-based costing (ABC) and determine the overhead cost per unit. (Round cost per unit to 2 decimal places, e.g. 12.25.) Total assigned costs Cost per unit Problem 17-01A a-e (Video) (Part Level Submission) Concord, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi-purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of Therefore, total annual direct labor hours are 96,300 or 1.5 hours 54,000 10,200 Estimated annual manufacturing overhead is S1 588 566. Thus, the predetermined overhead rate is s 16.50 or $1,588,566 96,300 per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial models. dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. The company's managers identified six activity cost pools and related cost drivers and accumulated overhead by cost pool as follows Estimated Usc of Drivers by Product Estimated Use of Cost Drivers Estimated Overhead Home Commercial 120,000 8,000 52,000 10,000 1,578 120,000 Activity Cost Pools Forming Assembling Testing Painting Packing and shipping Cost Drivers Pounds Machine hours Number of parts Number of tests Gallons Pounds $87,100 155,050 412,300 46,920 63,096 824,100 $1,588,566 335,000 215,000 35,000 27,000 217,000 165,000 25,500 15,500 5,258 3,680 335,000 215,000 (a) Under traditional product costing, compute the total unit cost of each product. (Round answers to 2 decimal places, e.g. 12.5o.) Home Model Commercial Model Total unit cost Click if you would like to Show Work for this question: Exercise 17-17 a-d (Part Level Submission) Crane Company operates a snow-removal service. The company owns five trucks, each of which has a snow plow in the front to plow driveways and a snowthrower in the back to clear sidewalks. Because plowing snow is very tough on trucks, the company incurs significant maintenance costs. Truck depreciation and maintenance represents a significant portion of the company's overhead. The company removes snow at residential locations, in which case the drivers spend the bulk of their time ng behind the sno thro er machine to cear sidewalks. On commercial jobs, the dnvers spend most of their tme plowing Crane allocates overhead based on labor hours. Total estimated overhead costs for the year are41,240 Total estim labor hours are 1,000 hours. The average residential property requires 0.5 hours of labor, while the average commercial property requires 2.5 hours of labor. The following additional information is available. Estimated Use of Activity Cost Pools Cost Drivers Square yards of surface plowed Linear feet of sidewalk dleared Estimated Cost Drivers Overhead per Activity 175,000 52,000 $35,000 56,240 Plowing Snowthrowing Determine the predetermined overhead rate under traditional costing. (Round answer to 2 decimal places, e.g. 12.25.) Click if you would like to Show Work for this