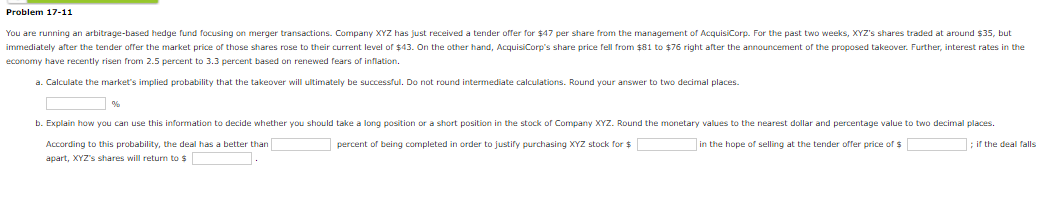

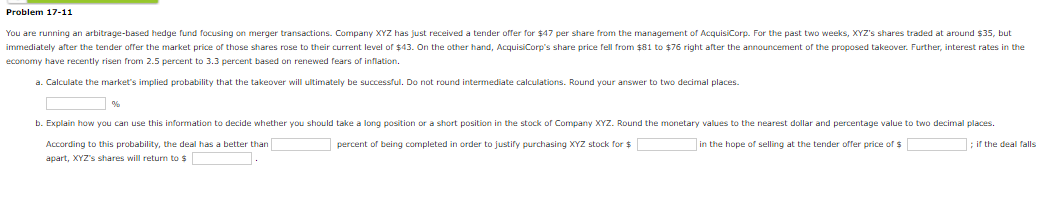

Problem 17-11 You are running an arbitrage-based hedge fund focusing on merger transactions. Company XYZ has just received a tender offer for $47 per share from the management of AcquisiCorp. For the past two weeks, XYZ's shares traded at around $35, but immediately after the tender offer the market price of those shares rose to their current level of $43. On the other hand, AcquisiCorp's share price fell from $81 to $76 right after the announcement of the proposed takeover. Further, interest rates in the economy have recently risen from 2.5 percent to 3.3 percent based on renewed fears of inflation. a. Calculate the market's implied probability that the takeover will ultimately be successful. Do not round intermediate calculations. Round your answer to two decimal places. b. Explain how you can use this information to decide whether you should take a long position or a short position in the stock of Company XYZ. Round the monetary values to the nearest dollar and percentage value to two decimal places. According to this probability, the deal has a better than percent of being completed in order to justify purchasing XYZ stock for $ in the hope of selling at the tender offer price of $ ; if the deal falls apart, XYZ's shares will return to $ Problem 17-11 You are running an arbitrage-based hedge fund focusing on merger transactions. Company XYZ has just received a tender offer for $47 per share from the management of AcquisiCorp. For the past two weeks, XYZ's shares traded at around $35, but immediately after the tender offer the market price of those shares rose to their current level of $43. On the other hand, AcquisiCorp's share price fell from $81 to $76 right after the announcement of the proposed takeover. Further, interest rates in the economy have recently risen from 2.5 percent to 3.3 percent based on renewed fears of inflation. a. Calculate the market's implied probability that the takeover will ultimately be successful. Do not round intermediate calculations. Round your answer to two decimal places. b. Explain how you can use this information to decide whether you should take a long position or a short position in the stock of Company XYZ. Round the monetary values to the nearest dollar and percentage value to two decimal places. According to this probability, the deal has a better than percent of being completed in order to justify purchasing XYZ stock for $ in the hope of selling at the tender offer price of $ ; if the deal falls apart, XYZ's shares will return to $