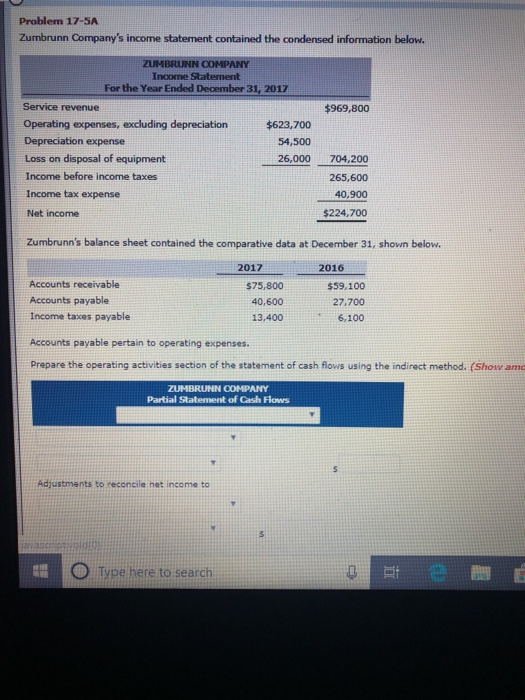

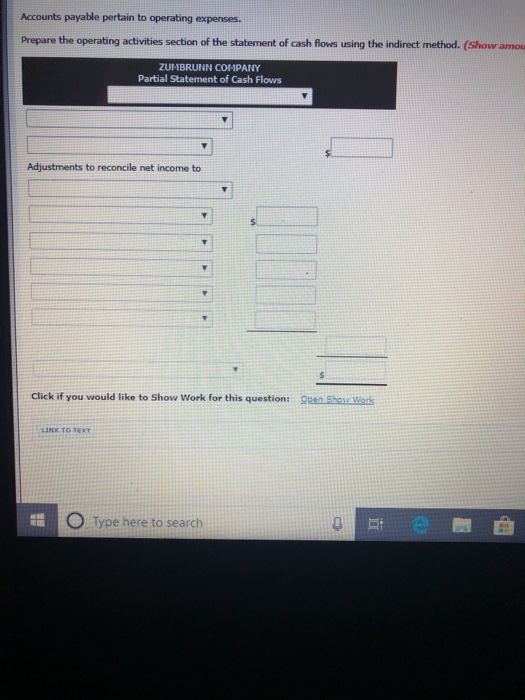

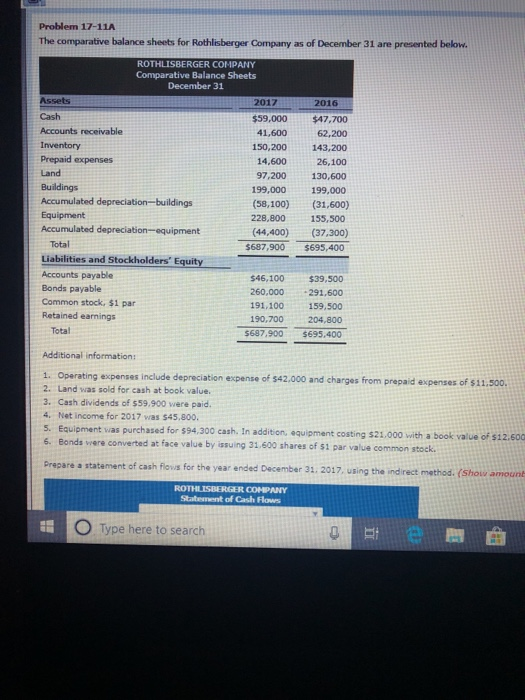

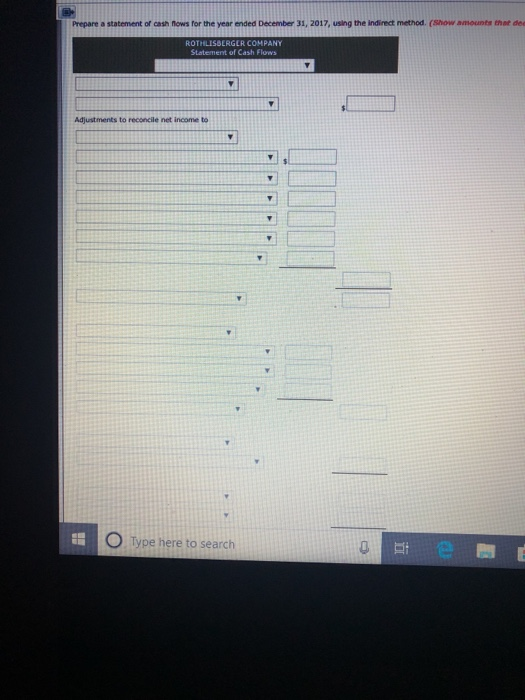

Problem 17-5A Zumbrunn Company's income statement contained the condensed information below. ZUMBRUNN COMPANY For the Year Ended December 31, 2017 Service revenue $969,800 $623,700 Depreciation expense Loss on disposal of equipment Income before income taxes Income tax expense Net income 54,500 26,000704,200 265,600 40,900 $224,700 Zumbrunn's balance sheet contained the comparative data at December 31, shown below 2017 2016 Accounts receivable Accounts payable Income taxes payable $75,800 40,600 13,400 $59,100 27,700 6,100 Accounts payable pertain to operating expenses. Prepare the operating activities section of the statement of cash flows using the indirect method. (Show amo Partial Statement of Cash Flows Adjustments to reconcile het income to OiType here to search Accounts payable pertain to operating expenses. Prepare the operating activities section of the statement of cash flows using the indirect method. (Show amos ZUMBRUNN COMPANY Partial Statement of Cash Flows Adjustments to reconcile net income to Click if you would like to Show Work for this question: O Type here to search rA Problem 17-11A The comparative balance sheets for Rothlisberger Company as of December 31 are presented below. ROTHLISBERGER COMPANY Comparative Balance Sheets December 31 Assets Cash Accounts receivable Inventory Prepaid expenses Land Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation-equipment 2017 2016 $59,000$47,700 41,60062,200 150,200143,200 14,60026,100 97,200 130,600 199,000199,000 (58,100)(31,600) 228,800 155,500 (44,400)(37,300) $687,900 $695,400 Total Liabilities and Stockholders' Equity Bonds payable Common stock, $1 par Retained earnings $46,100$39,500 260.000 291,600 191,100159.500 190,700204,800 $687,900 $695,400 Total Additional information: 1. Operatin 2. Land was sold for cash at book value. 3. Cash dividends of $59.900 were paid. 4. Net income for 2017 was $45,800. 5. Equipment was purchased for $94.300 addition, equipment 6. Bonds were converted at face value by issuing 31.600 shares of $1 par value common stock g expenses include depreciation expense of s42.000 and charges from prepaid expenses of $11.500 o cash. In addition, equipment costing $21.000 with a book value of $12.600 Prepare a statement of cash flovis for the year ended December 31. 2017, using the indirect method. (Show amount Statement of Cash Flows O Type here to search Prepare a statement of cash nows for the year ended December 31, 2017, using the indirect method. (Show amounts thet dee ROTILS8ERGER COMPANY Statement of Cash Flows Adjustments to reconcile net income to O Type here to search VncLOWeygandt, Accounting Principles, 12e Click if you would like to Show Work for this question: 0 Type here to search