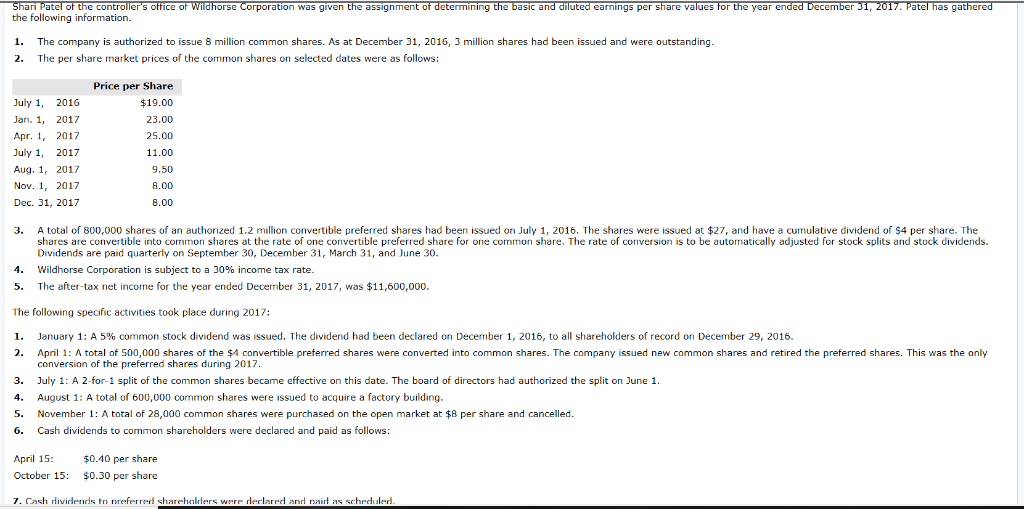

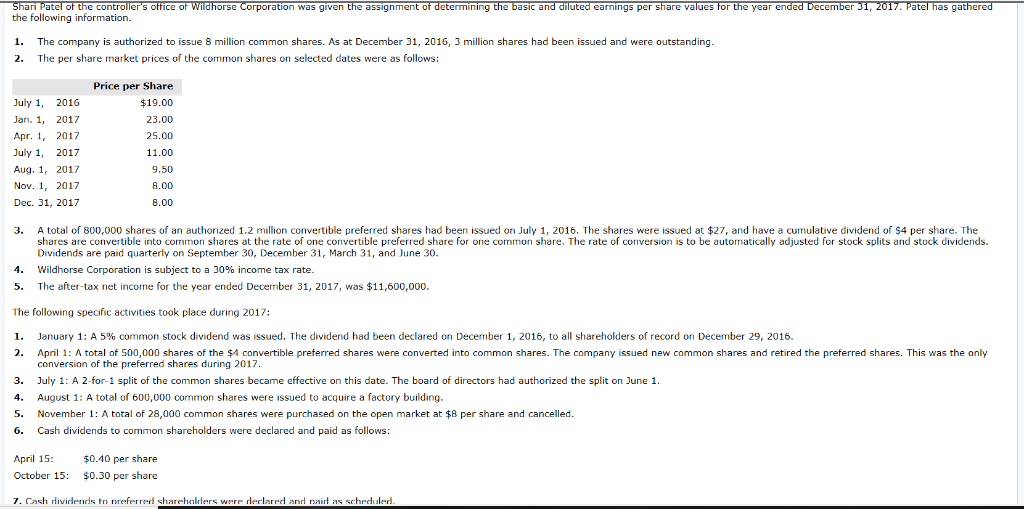

Problem 17-7 (Part Level Submission)

controller's office rse Corporation was given assignment o etermiing uted eamings per share values for year the following information. 1. The company is authorized to issue 8 million common shares. As at December 31, 2016, 3 million shares had been issued and were outstanding. 2. The per share market prices of the common shares on selected dates were as follows: July 1, 2016 Jan. 1, 2017 Apr. , 2017 July 1, 2017 Aug. 1, 2017 Nov. 1, 2017 Dec. 31, 2017 Price per Share $19.00 23.00 25.00 11.00 9.50 8.00 8.00 3. A total of 800,000 shares of an authrized 1.2 million convertible preferred shares had been issued on July 1, 2016. The shares were issued at $27, and have a cumulative dividend of $4 per share. The shares are convertible into common shares at the rate of one convertible preferred share for one common share. The rate of conversion is to be automatically adjusted for stock splits and stock dividends. Dividends are paid quarterly on September 30, December 31, March 31, and lune 30. Wildhorse Corporation is subject to a 30% income tax rate The after-tax net income for the year ended December 31, 2017, was $11,600,000 4. 5. The following specific activities took place during 2017: 1. January 1: A 5% common stock dividend was issued. The dividend had been declared on December 1, 2016, to all shareholders of record on December 29, 2016. April 1: A total of 500,000 shares of the $4 convertible preferred shares were converted into common shares. The company issued new common shares and retired the preferred shares. This was the only conversion of the preferred shares during 2017 2. 3. July 1: A 2-for-1 split of the common shares became effective on this date. The board of directors had authorized the split on June 1 4. August 1: A total of 600,000 common shares were issued to acquire a factory building 5. November 1: A total of 28,000 common shares were purchased on the open market at 8 per share and canceled. 6. Cash dividends to common shareholders were declared and paid as follows $0.40 per share $0.30 per share April 15: October 15: Determine the number of shares to use in calculating basic earnings per share for the year ended December 31, 2017.(Round answer to 0 decimal places, e.g. 5,275) Number of shares shares