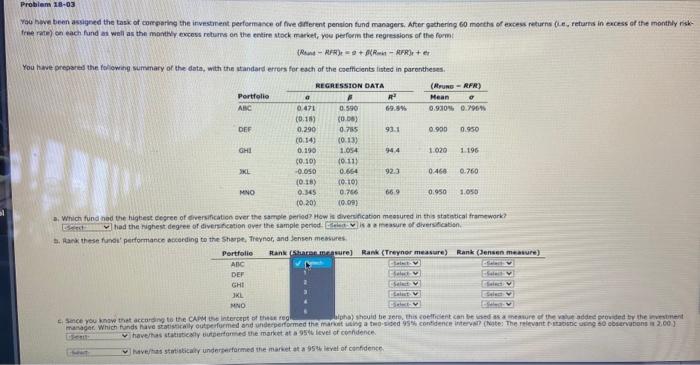

Problem 18-03 wou hw been assigned the task of comparing the investiment performance of five different pension fund managers. After gathering 60 months of excess returns (e, returns in excess of the monthly risk free) on each und as well as the many excess returns on the entire stock market, you perform the regressions of the form The-RR) = 9+ - AFR) You have prepared the following summary of the data, with the standard errors for each of the coefficients listed in parentheses REGRESSION DATA (Rrums - RFR) Portfolio Mean o ANG 0.471 0.590 69. 0.930% 0.7964 (0.15) 0.00) DEF 0.290 0.755 93.1 0.900 0.950 (0:14) (0.13) GHI 0.190 1.054 94.4 1.020 1.196 0.10) (011) SKL -0.050 0.664 92.3 0466 0.760 10-18) (10) MNO 0.345 0.766 66.9 0.950 1.050 10.203 a. Which fund had the highest degree of diversification over the same period? How is diversification measured in this statistical framework had the Nighest degree of diversation over the sample period mewure of diversion 1. Rank these performance according to the Sharpe, Treyner, and Jensen measures Portfolio Rank (Stree measure) Rank (Treynor measure) Rank (Jensen measure) ADC DEF GHI Elv JKL MNO Since you know that according to the CAPM Intercept of these a) should beer, this coefficient can be used as a measure of the lead roded by the intent manager. Which funds have statically outperformed and underperformed the man wing a two-sid 95% confidence tervatte: The relevanten 80 bervation 2.00) have/has statistically performed the market at a level of condence. has statistically underperformed the market 95level of confidence 10.09 Problem 18-03 wou hw been assigned the task of comparing the investiment performance of five different pension fund managers. After gathering 60 months of excess returns (e, returns in excess of the monthly risk free) on each und as well as the many excess returns on the entire stock market, you perform the regressions of the form The-RR) = 9+ - AFR) You have prepared the following summary of the data, with the standard errors for each of the coefficients listed in parentheses REGRESSION DATA (Rrums - RFR) Portfolio Mean o ANG 0.471 0.590 69. 0.930% 0.7964 (0.15) 0.00) DEF 0.290 0.755 93.1 0.900 0.950 (0:14) (0.13) GHI 0.190 1.054 94.4 1.020 1.196 0.10) (011) SKL -0.050 0.664 92.3 0466 0.760 10-18) (10) MNO 0.345 0.766 66.9 0.950 1.050 10.203 a. Which fund had the highest degree of diversification over the same period? How is diversification measured in this statistical framework had the Nighest degree of diversation over the sample period mewure of diversion 1. Rank these performance according to the Sharpe, Treyner, and Jensen measures Portfolio Rank (Stree measure) Rank (Treynor measure) Rank (Jensen measure) ADC DEF GHI Elv JKL MNO Since you know that according to the CAPM Intercept of these a) should beer, this coefficient can be used as a measure of the lead roded by the intent manager. Which funds have statically outperformed and underperformed the man wing a two-sid 95% confidence tervatte: The relevanten 80 bervation 2.00) have/has statistically performed the market at a level of condence. has statistically underperformed the market 95level of confidence 10.09