Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 18-15 Calculate the intrinsic value of GE in each of the following scenarios by using the three-stage growth model of Spreadsheet 18.1. Treat each

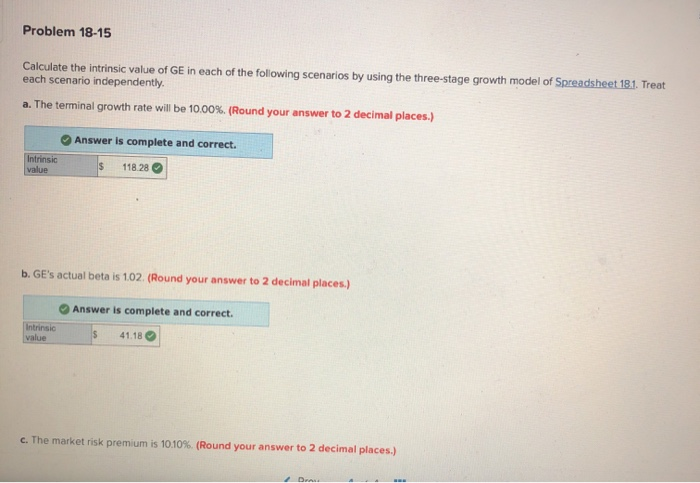

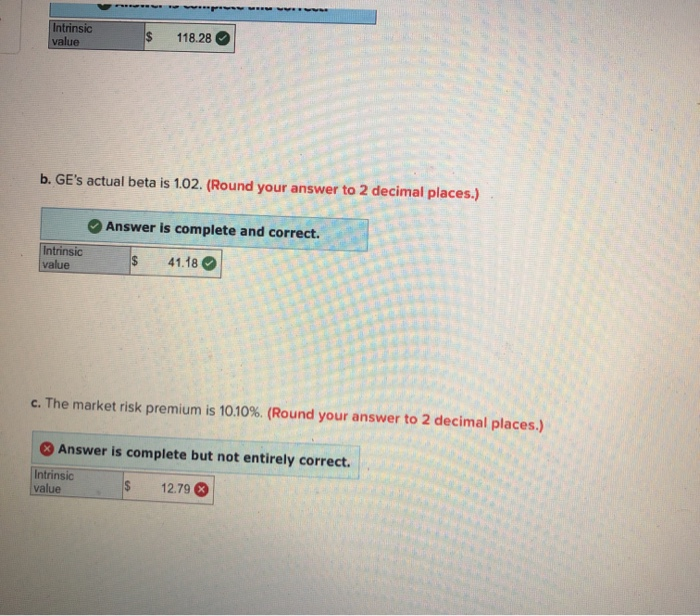

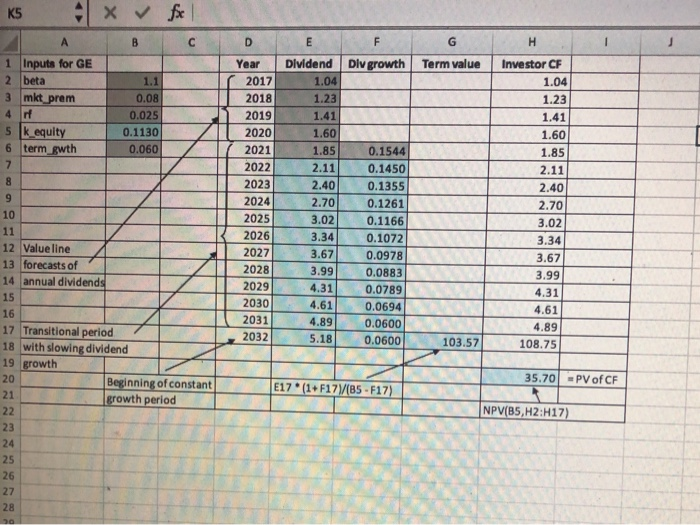

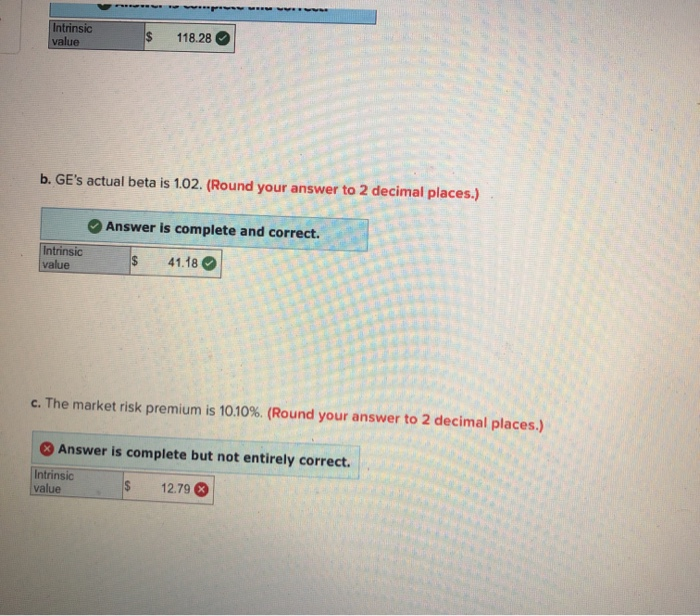

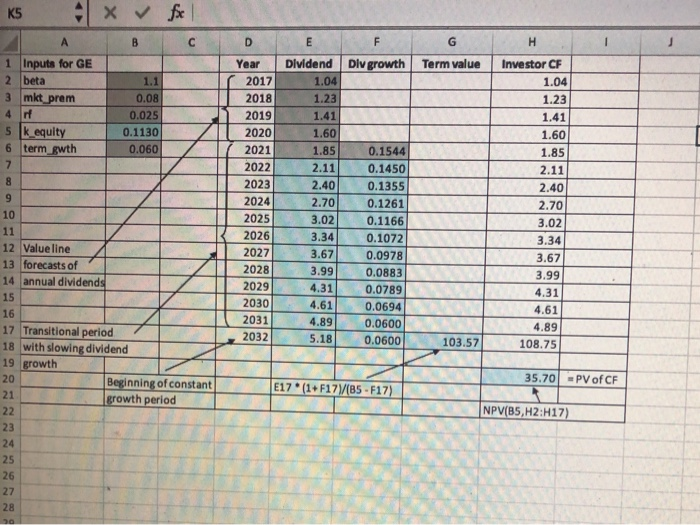

Problem 18-15 Calculate the intrinsic value of GE in each of the following scenarios by using the three-stage growth model of Spreadsheet 18.1. Treat each scenario independently. a. The terminal growth rate will be 10.00%. (Round your answer to 2 decimal places.) Intrinsic Answer is complete and correct. 118.28 b. GE's actual beta is 102. (Round your answer to 2 decimal places.) Answer is complete and correct. Intrinsic $ value 41.18 c. The market risk premium is 10.10% (Round your answer to 2 decimal places.) Intrinsic value 118.28 b. GE's actual beta is 1.02. (Round your answer to Answer is complete and correct. Intrinsic value 41.18 c. The market risk premium is 10.10% (Round your answer to 2 decimal places.) Answer is complete but not entirely correct. Intrinsic value 12.79 fel D G Term value Div growth K5 x ABC 1 Inputs for GE 2 beta 1.1 3 mkt prem 0.08 4 rf 0.025 5 k_equity 0.1130 6 term gwth 0.060 Year Dividend 2017 1.04 2018 1.23 2019 1.41 2020 1.60 2021 1.85 2022 2.11 2023 2.40 2024 2.70 20253 2026 2027 2028 2029 2030) 2031 4.89 2032) HIJ Investor CF 1.04 1.23 1.41 1.60 1.85 2.11 2.40 2.70 3.02 3.34 3.67 3.99 4.31 4.61 4.89 108.75 0.1544 0.1450 0.1355 0.1261 0.1166 0.1072 0.0978 0.0883 0.0789 0.0694 0.0600 0.0600 12 Value line 13 forecasts of 14 annual dividends 15 16 A 17 Transitional period 18 with slowing dividend 19 growth Beginning of constant growth period 5.18 103.57 35.70 PV of CF E17 (1+F17V(B5 - F17) NPV(B5,H2:17)

Problem 18-15 Calculate the intrinsic value of GE in each of the following scenarios by using the three-stage growth model of Spreadsheet 18.1. Treat each scenario independently. a. The terminal growth rate will be 10.00%. (Round your answer to 2 decimal places.) Intrinsic Answer is complete and correct. 118.28 b. GE's actual beta is 102. (Round your answer to 2 decimal places.) Answer is complete and correct. Intrinsic $ value 41.18 c. The market risk premium is 10.10% (Round your answer to 2 decimal places.) Intrinsic value 118.28 b. GE's actual beta is 1.02. (Round your answer to Answer is complete and correct. Intrinsic value 41.18 c. The market risk premium is 10.10% (Round your answer to 2 decimal places.) Answer is complete but not entirely correct. Intrinsic value 12.79 fel D G Term value Div growth K5 x ABC 1 Inputs for GE 2 beta 1.1 3 mkt prem 0.08 4 rf 0.025 5 k_equity 0.1130 6 term gwth 0.060 Year Dividend 2017 1.04 2018 1.23 2019 1.41 2020 1.60 2021 1.85 2022 2.11 2023 2.40 2024 2.70 20253 2026 2027 2028 2029 2030) 2031 4.89 2032) HIJ Investor CF 1.04 1.23 1.41 1.60 1.85 2.11 2.40 2.70 3.02 3.34 3.67 3.99 4.31 4.61 4.89 108.75 0.1544 0.1450 0.1355 0.1261 0.1166 0.1072 0.0978 0.0883 0.0789 0.0694 0.0600 0.0600 12 Value line 13 forecasts of 14 annual dividends 15 16 A 17 Transitional period 18 with slowing dividend 19 growth Beginning of constant growth period 5.18 103.57 35.70 PV of CF E17 (1+F17V(B5 - F17) NPV(B5,H2:17)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started