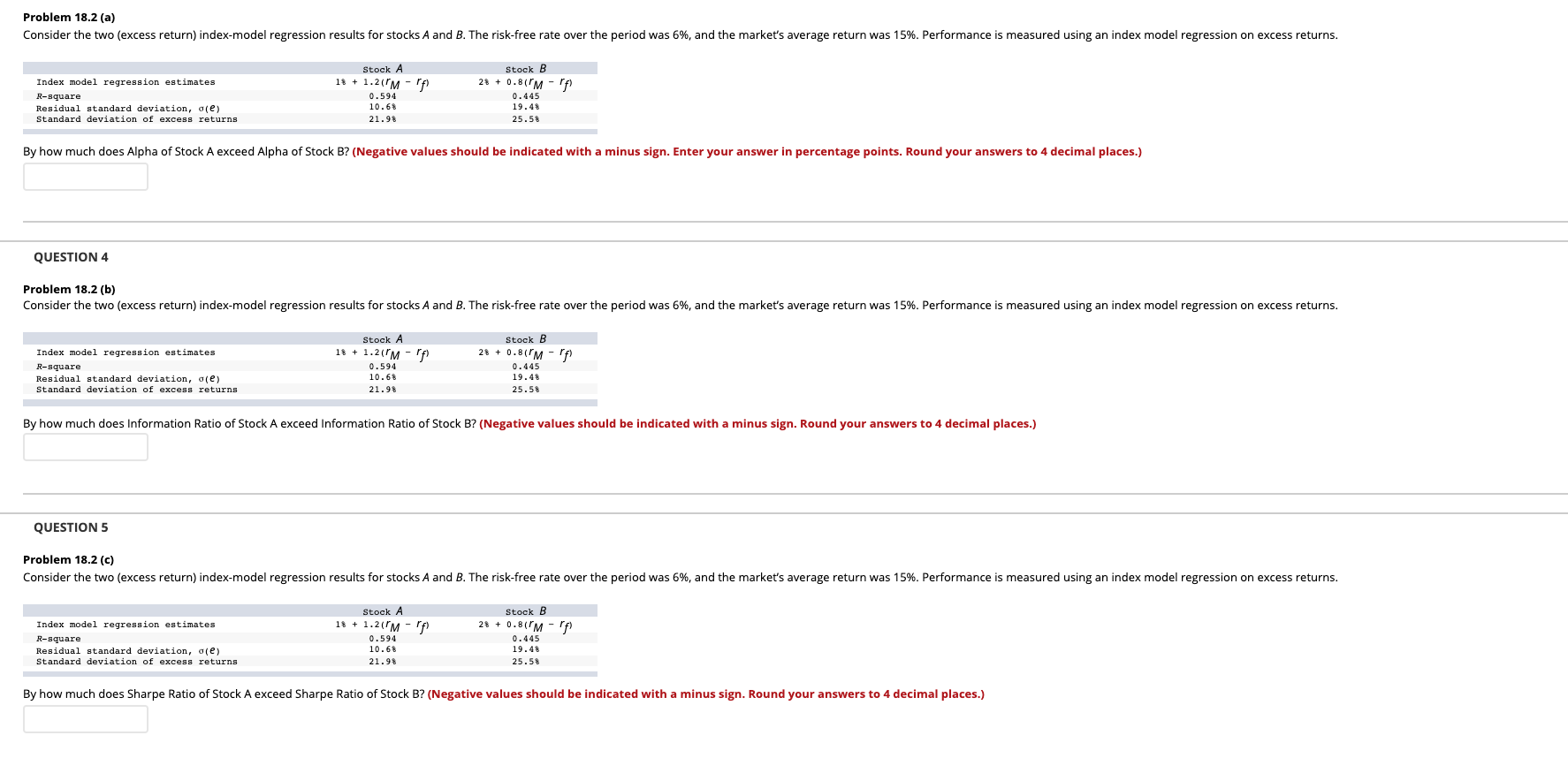

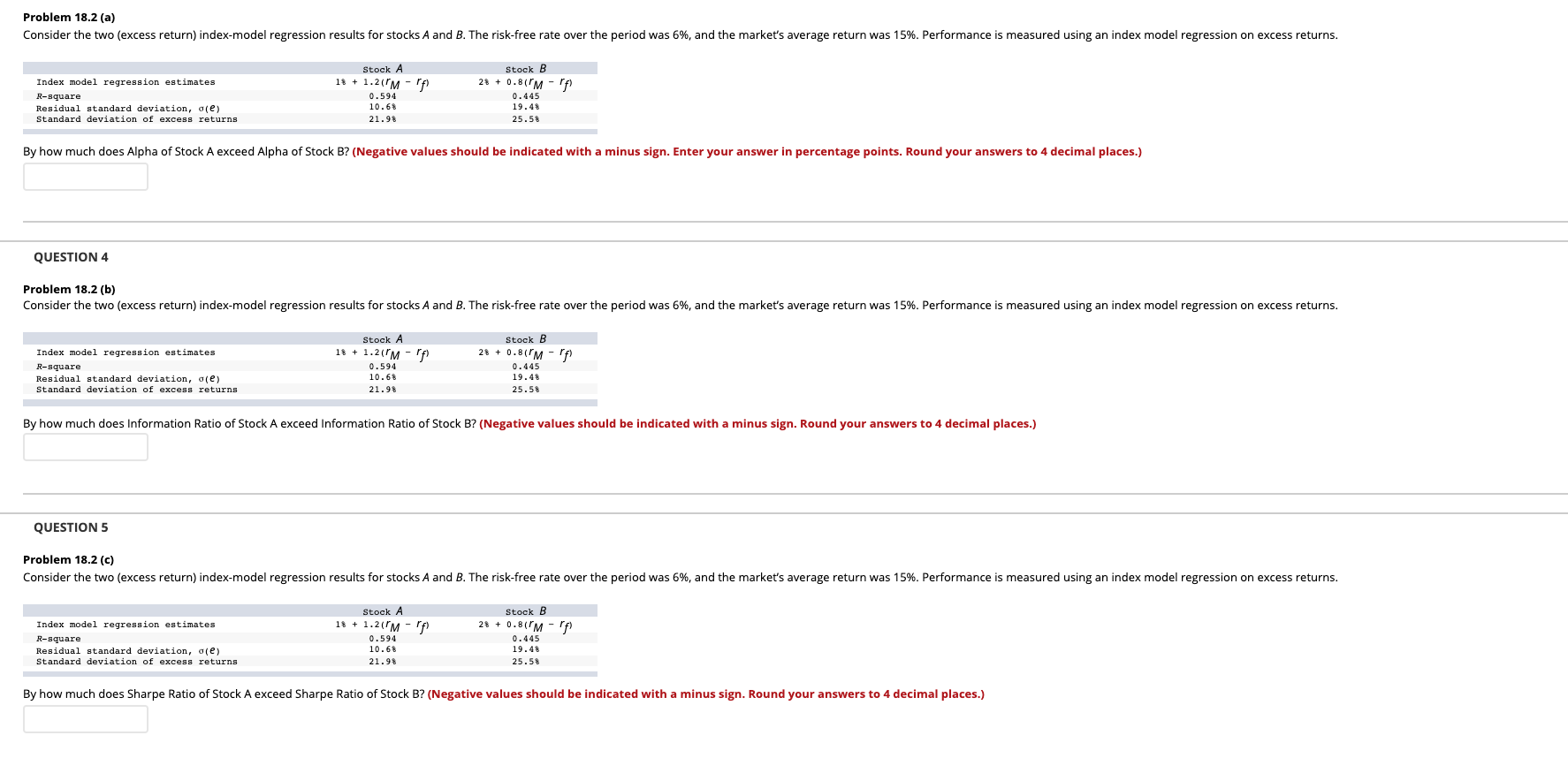

Problem 18.2 (a) Consider the two (excess return) index-model regression results for stocks A and B. The risk-free rate over the period was 6%, and the market's average return was 15%. Performance is measured using an index model regression on excess returns. Index model regression estimates R-square Residual standard deviation, ole) Standard deviation of excess returns Stock A 18 + 1.211M - Tf 0.594 10.6% 21.98 Stock B 28 +0.811M - rf 0.445 19.48 25.58 By how much does Alpha of Stock A exceed Alpha of Stock B? (Negative values should be indicated with a minus sign. Enter your answer in percentage points. Round your answers to 4 decimal places.) QUESTION 4 Problem 18.2 (b) Consider the two (excess return) index-model regression results for stocks A and B. The risk-free rate over the period was 6%, and the market's average return was 15%. Performance is measured using an index model regression on excess returns. Stock A Stock B Index model regression estimates R-square Residual standard deviation, die) Standard deviation of excess returns 18 + 1.211M -"f 0.594 10.6% 21.99 28 + 0.81M-'f 0.445 19.48 25.58 By how much does Information Ratio of Stock A exceed Information Ratio of Stock B? (Negative values should be indicated with minus sign. Round your answers to 4 decimal places.) QUESTION 5 Problem 18.2 (c) Consider the two (excess return) index-model regression results for stocks A and B. The risk-free rate over the period was 6%, and the market's average return was 15%. Performance is measured using an index model regression on excess returns. Stock A 18 + 1.211M -'f Index model regression estimates R-square Residual standard deviation, ole) Standard deviation of excess returns 0.594 10.68 21.98 Stock B 21 +0.81M-f 0.445 19.40 25.5% By how much does Sharpe Ratio of Stock A exceed Sharpe Ratio of Stock B? (Negative values should be indicated with a minus sign. Round your answers to 4 decimal places.) Problem 18.2 (a) Consider the two (excess return) index-model regression results for stocks A and B. The risk-free rate over the period was 6%, and the market's average return was 15%. Performance is measured using an index model regression on excess returns. Index model regression estimates R-square Residual standard deviation, ole) Standard deviation of excess returns Stock A 18 + 1.211M - Tf 0.594 10.6% 21.98 Stock B 28 +0.811M - rf 0.445 19.48 25.58 By how much does Alpha of Stock A exceed Alpha of Stock B? (Negative values should be indicated with a minus sign. Enter your answer in percentage points. Round your answers to 4 decimal places.) QUESTION 4 Problem 18.2 (b) Consider the two (excess return) index-model regression results for stocks A and B. The risk-free rate over the period was 6%, and the market's average return was 15%. Performance is measured using an index model regression on excess returns. Stock A Stock B Index model regression estimates R-square Residual standard deviation, die) Standard deviation of excess returns 18 + 1.211M -"f 0.594 10.6% 21.99 28 + 0.81M-'f 0.445 19.48 25.58 By how much does Information Ratio of Stock A exceed Information Ratio of Stock B? (Negative values should be indicated with minus sign. Round your answers to 4 decimal places.) QUESTION 5 Problem 18.2 (c) Consider the two (excess return) index-model regression results for stocks A and B. The risk-free rate over the period was 6%, and the market's average return was 15%. Performance is measured using an index model regression on excess returns. Stock A 18 + 1.211M -'f Index model regression estimates R-square Residual standard deviation, ole) Standard deviation of excess returns 0.594 10.68 21.98 Stock B 21 +0.81M-f 0.445 19.40 25.5% By how much does Sharpe Ratio of Stock A exceed Sharpe Ratio of Stock B? (Negative values should be indicated with a minus sign. Round your answers to 4 decimal places.)