Answered step by step

Verified Expert Solution

Question

1 Approved Answer

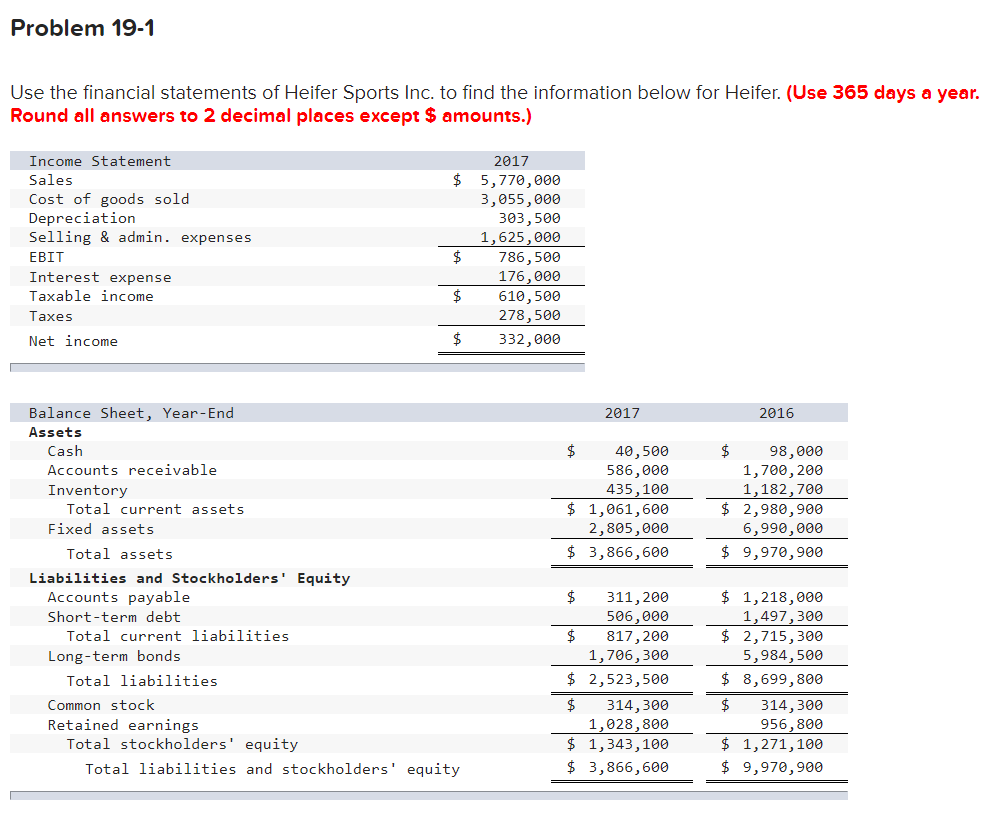

Problem 19-1 Use the financial statements of Heifer Sports Inc. to find the information below for Heifer. (Use 365 days a year. Round all answers

Problem 19-1

Use the financial statements of Heifer Sports Inc. to find the information below for Heifer. (Use 365 days a year. Round all answers to 2 decimal places except $ amounts.)

| Income Statement | 2017 | ||

| Sales | $ | 5,770,000 | |

| Cost of goods sold | 3,055,000 | ||

| Depreciation | 303,500 | ||

| Selling & admin. expenses | 1,625,000 | ||

| EBIT | $ | 786,500 | |

| Interest expense | 176,000 | ||

| Taxable income | $ | 610,500 | |

| Taxes | 278,500 | ||

| Net income | $ | 332,000 | |

| Balance Sheet, Year-End | 2017 | 2016 | |||||

| Assets | |||||||

| Cash | $ | 40,500 | $ | 98,000 | |||

| Accounts receivable | 586,000 | 1,700,200 | |||||

| Inventory | 435,100 | 1,182,700 | |||||

| Total current assets | $ | 1,061,600 | $ | 2,980,900 | |||

| Fixed assets | 2,805,000 | 6,990,000 | |||||

| Total assets | $ | 3,866,600 | $ | 9,970,900 | |||

| Liabilities and Stockholders' Equity | |||||||

| Accounts payable | $ | 311,200 | $ | 1,218,000 | |||

| Short-term debt | 506,000 | 1,497,300 | |||||

| Total current liabilities | $ | 817,200 | $ | 2,715,300 | |||

| Long-term bonds | 1,706,300 | 5,984,500 | |||||

| Total liabilities | $ | 2,523,500 | $ | 8,699,800 | |||

| Common stock | $ | 314,300 | $ | 314,300 | |||

| Retained earnings | 1,028,800 | 956,800 | |||||

| Total stockholders' equity | $ | 1,343,100 | $ | 1,271,100 | |||

| Total liabilities and stockholders' equity | $ | 3,866,600 | $ | 9,970,900 | |||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started