Answered step by step

Verified Expert Solution

Question

1 Approved Answer

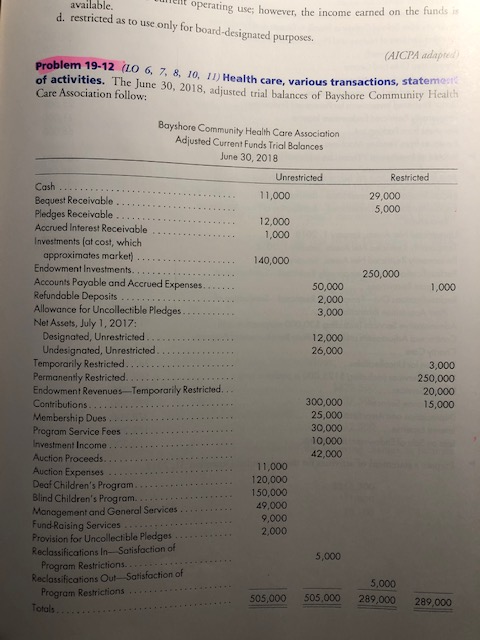

Problem 19-12 with details please available. Tulent operating use; however, the income ca d. restricted as to use only for board-designated purposes. perating use; however,

Problem 19-12 with details please

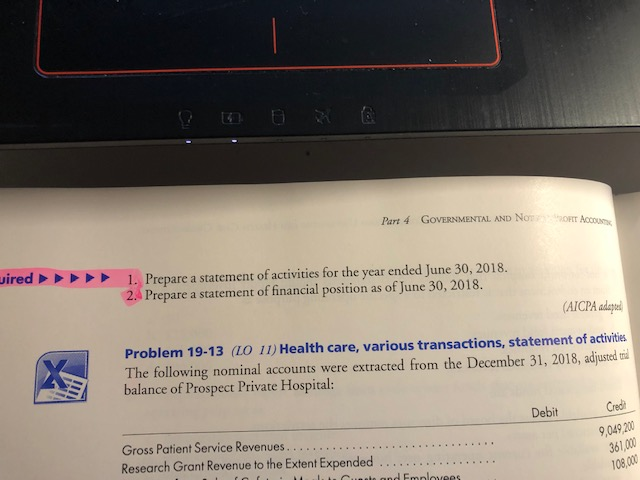

available. Tulent operating use; however, the income ca d. restricted as to use only for board-designated purposes. perating use; however, the income carned on the funds is (AICPA adapted Problem 19-12 (L0 6, 7, 8, 10. Health care various transactions, stat of activities. The June 30, 2018, adjusted trial balances of Bayshore Community Care Association follow: re, various transactions, statement Bayshore Community Health Restricted 29,000 5,000 250,000 1,000 Bayshore Community Health Care Association Adjusted Current Funds Trial Balances June 30, 2018 Unrestricted Cash .................... ........... 11,000 Bequest Receivable ..... Pledges Receivable ......... 12,000 Accrued Interest Receivable 1,000 Investments (at cost, which approximates market) ................... 140,000 Endowment Investments.. Accounts Payable and Accrued Expenses...... 50,000 Refundable Deposits 2,000 Allowance for Uncollectible Pledges. 3,000 Net Assets, July 1, 2017: Designated Unrestricted...... 12,000 Undesignated, Unrestricted 26,000 Temporarily Restricted.......... Permanently Restricted.......... Endowment Revenues-Temporarily Restricted. Contributions..... .. 300,000 Membership Dues ......... 25,000 Program Service Fees ......... 30,000 Investment Income ......... 10,000 42,000 Auction Proceeds.......... 11,000 Auction Expenses ... ... 120,000 Deaf Children's Program... 150,000 Blind Children's Program.......... 49,000 Management and General Services... ... 9,000 Fund Raising Services ........... 2,000 Provision for Uncollectible Pledges ..... .. Reclassifications In-Satisfaction of 5,000 Program Restrictions... Reclassifications Out Satisfaction of Program Restrictions .. 505,000 505.000 3,000 250,000 20,000 15,000 5,000 289,000 289,000 Totals - Part 4 GOVERNMENTAL AND NO O RT NO uired 1. Prepare a statement of activities for the year ended June 30, 2018. 2. Prepare a statement of financial position as of June 30, 2018. (AICPA adapted Problem 19-13 (LO 11) Health care, various transactions, statement of activities The following nominal accounts were extracted from the December 31, 2018, adjusted tid balance of Prospect Private Hospital: Debit Credit 9,049,200 361,000 108,00 Gross Patient Service Revenues. Research Grant Revenue to the Extent Expended .......... . C ole and Employees available. Tulent operating use; however, the income ca d. restricted as to use only for board-designated purposes. perating use; however, the income carned on the funds is (AICPA adapted Problem 19-12 (L0 6, 7, 8, 10. Health care various transactions, stat of activities. The June 30, 2018, adjusted trial balances of Bayshore Community Care Association follow: re, various transactions, statement Bayshore Community Health Restricted 29,000 5,000 250,000 1,000 Bayshore Community Health Care Association Adjusted Current Funds Trial Balances June 30, 2018 Unrestricted Cash .................... ........... 11,000 Bequest Receivable ..... Pledges Receivable ......... 12,000 Accrued Interest Receivable 1,000 Investments (at cost, which approximates market) ................... 140,000 Endowment Investments.. Accounts Payable and Accrued Expenses...... 50,000 Refundable Deposits 2,000 Allowance for Uncollectible Pledges. 3,000 Net Assets, July 1, 2017: Designated Unrestricted...... 12,000 Undesignated, Unrestricted 26,000 Temporarily Restricted.......... Permanently Restricted.......... Endowment Revenues-Temporarily Restricted. Contributions..... .. 300,000 Membership Dues ......... 25,000 Program Service Fees ......... 30,000 Investment Income ......... 10,000 42,000 Auction Proceeds.......... 11,000 Auction Expenses ... ... 120,000 Deaf Children's Program... 150,000 Blind Children's Program.......... 49,000 Management and General Services... ... 9,000 Fund Raising Services ........... 2,000 Provision for Uncollectible Pledges ..... .. Reclassifications In-Satisfaction of 5,000 Program Restrictions... Reclassifications Out Satisfaction of Program Restrictions .. 505,000 505.000 3,000 250,000 20,000 15,000 5,000 289,000 289,000 Totals - Part 4 GOVERNMENTAL AND NO O RT NO uired 1. Prepare a statement of activities for the year ended June 30, 2018. 2. Prepare a statement of financial position as of June 30, 2018. (AICPA adapted Problem 19-13 (LO 11) Health care, various transactions, statement of activities The following nominal accounts were extracted from the December 31, 2018, adjusted tid balance of Prospect Private Hospital: Debit Credit 9,049,200 361,000 108,00 Gross Patient Service Revenues. Research Grant Revenue to the Extent Expended .......... . C ole and EmployeesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started