Answered step by step

Verified Expert Solution

Question

1 Approved Answer

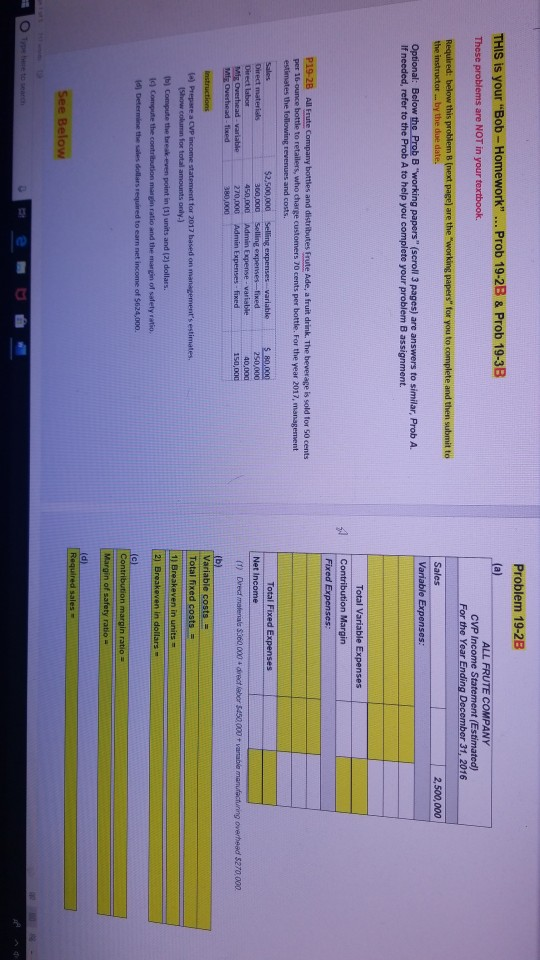

Problem 19-2B THIS is your Bob Homework . Prob 19-2B & Prob 19-3B (a) - ALL FRUTE COMPANY CVP Income Statement (Estimated) For the Year

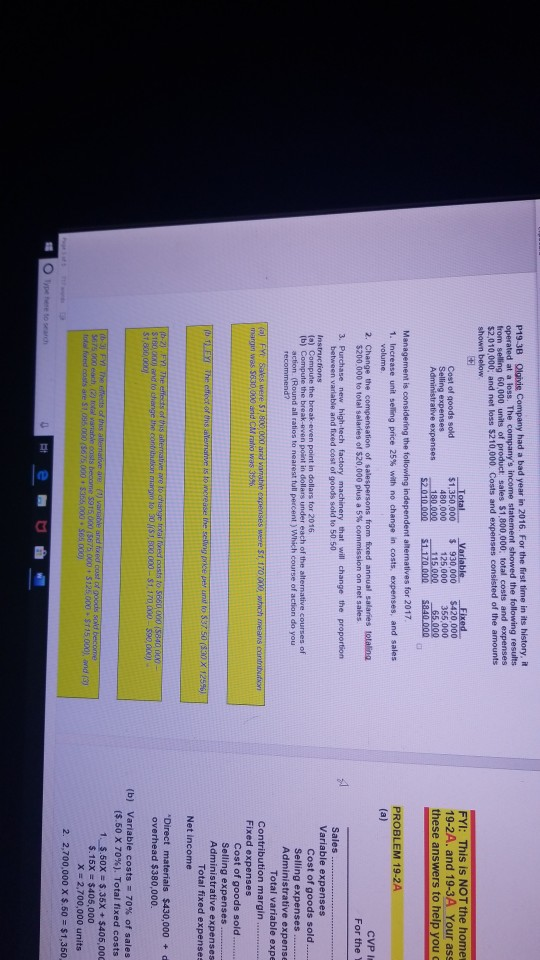

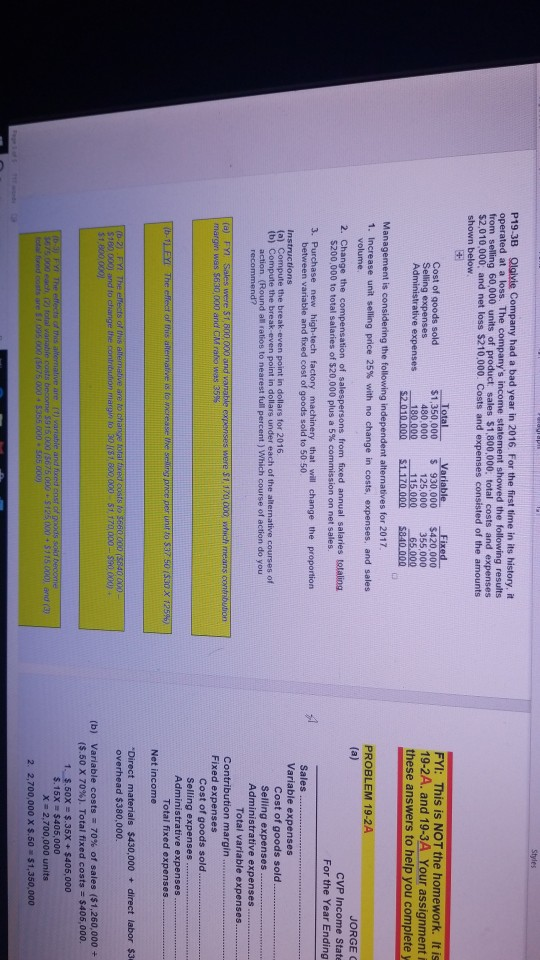

Problem 19-2B THIS is your "Bob Homework" . Prob 19-2B & Prob 19-3B (a) - ALL FRUTE COMPANY CVP Income Statement (Estimated) For the Year Ending December 31, 2016 These problems are NOT in your textbook. Required: below this problem B (next page) are the "working papers" for you to complete and then submit to the instructor... by the due date. Sales 2,500,000 Variable Expenses: Optional: Below the Prob B "working papers" (scroll 3 pages) are answers to similar, Prob A. If needed, refer to the Prob A to help you complete your problem B assignment. Total Variable Expenses Contribution Margin Fixed Expenses: P19-28 per 16-ounce bottle to retailers, who charge customers 70 cents per bottle. For the year 2017, management estimates the following revenues and costs. All Frute Company bottles and distributes Frute Ade, a fruit drink. The beverage is sold for 50 cents Total Fixed Expenses S 80,000 $2,500,000 300,000 Selling expenses variable Selling expenses-fixed Admin Expense-variable Admin Expenses fixed Sales Direct materials 250,000 40,000 Net Income Direct labon Mig Overhead variable Mig Overhead-fixed 450,000 (1) Drecf mafenials $360 000 direct lebor 5450 000+ vanable manufacturing overheed 5270,000 270,000 150,000 380,000 (b) Variable costs= Instructions (a) Prepare a CVP income statement for 2017 based on management's estimates Total fixed costs (Show column for total amounts only.) 1) Breakeven in units (b) Compute the break-even point in (1) units and (2) dollars. 2) Breakeven in dollars 19 Compute the contribution margin ratio and the margin of safety ratio. (d) Determine the sales dollars required to earn net income of $624,000. (c) Contribution margin ratio Margin of safety ratio (d) Required sales See Below O Tpe e to search P19-3B Olgivie Company had a bad year in 2016. For the first time in its history, it operated at a loss. The company's income statement showed the following results from selling 60,000 units of product: sales $1,800,000, total costs and expenses $2,010,000; and net loss $210,000 Costs and expenses consisted of the amounts shown below Cost of goods sold Selling expenses. Administrative expenses Total $1,350,000 480,000 180.000 $2.010.000 Variable 930,000 125,000 115.000 $1.170.000 Fixed $420.000 355,000 65,000 $840.000 FYI: This is NOT the home 19-2A. and 19-3A Your ass these answers to help you c Management is considering the following independent alternatives for 2017 PROBLEM 19-2A 1. Increase unit selling price 25 % with no change in costs, expenses, and sales volume (a) CVP I 2. Change the compensation of salespersons from foxed annual salaries totaling $200.000 to total salaries of $20,000 plus a 5 % commission on net sales For the 3. Purchase new high-tech factory machinery that will change the proportion between variable and fixed cost of goods sold to 50 50 Sales Variable expenses Cost of goods sold Instructions (a) Compute the break even point in dollars for 2016. (b) Compute the break-even point in dollars under each of the alternative courses of action (Round all ratios to nearest full percent ) Which course of action do you recommend? Selling expenses Administrative expense Total variable expe .. Contribution margin ... (al FYC Sales were $1,800000 anid vanable expenses weere $1, 170 000 whch means contnut marqin was S630,000 arid CM ratio was 35% Fixed expenses Cost of goods sold.. Selling expenses Administrative expenses Total fixed expenses (b 1) EY The effect of this atevranve is to nerease the selng price pey unt to 537 50 ($30 X 125% ). Net income Direct materials $430,000 + d (b-2) Y The effeds of this alerative ore to change total fired costs to 5660,000 (S840 000- $180,000) and to change the contribaation margin to 30 (S1,500 000-$1,170,000-590,000) $1,800000 overhead $380,000. Variable costs= 70% of sales (b) ($.50 X 70 % ) . Total fixed costs rb3 FY The effects of this alternative are (1) variable ard fxed cost of goods sod become 5675 000 each, (2) total variable costs become $915,000 (5675 000 5125,000 $115 000), and (3) total foced costs are 51,095 000 (S675.000$356 000 $65 000 1. $.50X $.35X+ $406.00C $.15X $405,000 X 2,700,000 units 2. 2,700,000 X $.60 $1,350 Poraf O Iype here to search Styles P19-3B Ologivie Company had a bad year in 2016. For the first time in its history, it operated at a loss. The company's income statement showed the following results from selling 60,000 units of product sales $1,800,000: total costs and expenses $2,010,000; and net loss $210,000. Costs and expenses consisted of the amounts shown below Total $1,350,000 480,000 180.000 $2.010.000 Variable $ 930,000 125,000 115.000 $1.170.000 Fixed $420,000 355,000 65,000 $840.000 FYI: This is NOT the homewor Cost of goods sold Selling expenses Administrative expenses It is 19-2A. and 19-3A Your assignment i these answers to help you complete y Management is considering the following independent alternatives for 2017 1. Increase unit selling price 25% with no change in costs, expenses, and sales volume. PROBLEM 19-2A (a) JORGE C 2. Change the compensation of salespersons from fixed annual salaries totaling S200,000 to total salaries of $20.000 plus a 5 % commission on net sales. CVP Income State For the Year Ending 3. Purchase new high-tech factory machinery that will change the proportion between variable and fixed cost of goods sold to 50 50. Sales Variable expenses Instructions (a) Compute the break-even point in dollars for 2016. (b) Compute the break-even point in dollars under each of the alternative courses of action (Round all ratios to nearest full percent) Which course of action do you recommend? Cost of goods sold. Selling expenses Administrative expenses Total variable expenses. Contribution margin Fixed expenses Cost of goods sold Selling expenses Administrative expenses Total fixed expenses (a) FYI Sales were $1,800,000 and vanable expennses were 51,1/0,000 which means contabution margin was $630,000 arid CM rabo was 35% (b-1) EYL The effect of this alternalive is fo wcrease We seiirg prce per unit to $37 50 (530 X 125 %6) Net income direct labor $3 "Direct materials $430,000 overhead $380,000. (b-2).FY The effects of this altemative are to change total tixed costs to 3660 000 (S840 000- $180 000) and to change the contribution margin to 30 (81,800 000 1 170,000-S90 000) $1,800,000) (b) Variable costs 70% of sales ($1,260,000+ ($.50 X 70 %) . Total fixed costs $405,000. 1. $.60X $.35X+ $408,000 S.15X $405,000 (b-3) FYI The effects of this altermative are () variable and fixed cost of noods sold become $675 000 each, (2) total anable costs become 5915,000 (5675 O00 5125 0000+5115 000), and (3) total fored costs are 1 095 000 (5675 000+ $355 000 565 000) X 2,700,000 units 2. 2,700,000 X $.50 $1,350,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started