Answered step by step

Verified Expert Solution

Question

1 Approved Answer

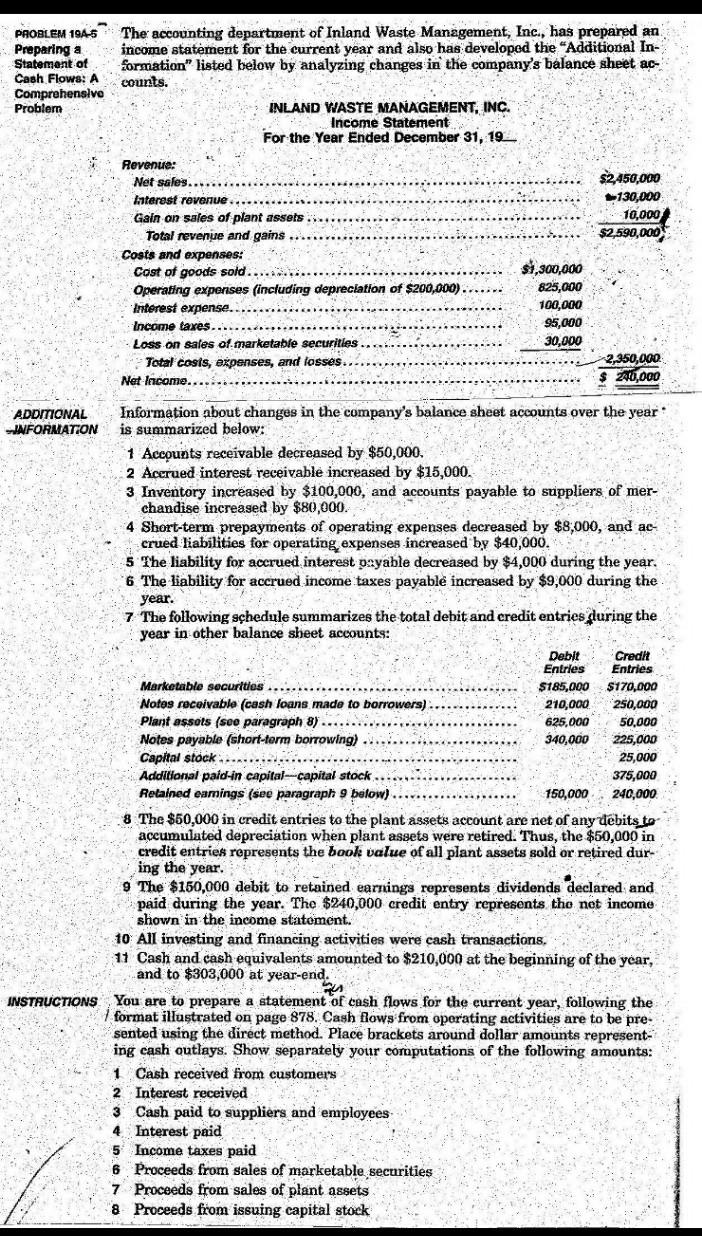

PROBLEM 1945 Preparing a Statement of Cash Flows: A Comprehensive Problem The accounting department of Inland Waste Management, Inc., has prepared an income statement for

PROBLEM 1945 Preparing a Statement of Cash Flows: A Comprehensive Problem The accounting department of Inland Waste Management, Inc., has prepared an income statement for the current year and also has developed the "Additional In- formation" listed below by analyzing changes in the company's balance sheet ac- counts. INLAND WASTE MANAGEMENT, INC. Income Statement For the Year Ended December 31, 19_ $2,450,000 130,000 10,000 $2,590,000 Revenue: Net sales. Interest revenue Gain on sales of plant assets... Total revenue and gains .. Costs and expenses: Cost of goods sold. Operating expenses (including depreciation of $200,000) Interest expense.. Income taxes...... Loss on sales of marketable securities Total costs, expenses, and tosses Net Income..... $1,300,000 825,000 100,000 95,000 30,000 2,350,000 210,000 ADDITIONAL Information about changes in the company's balance sheet accounts over the year INFORMATION is summarized below: 1 Accounts receivable decreased by $50,000. 2 Accrued interest receivable increased by $15,000. 3 Inventory increased by $100,000, and accounts payable to suppliers of mer- chandise increased by $80,000. 4 Short-term prepayments of operating expenses decreased by $8,000, and ac- crued liabilities for operating expenses increased by $40,000. 5 The liability for accrued interest payable decreased by $4,000 during the year. 6. The liability for accrued income taxes payable increased by $9,000 during the year. 7 The following schedule summarizes the total debit and credit entries during the year in other balance sheet accounts: Deblt Credit Entries Entries Marketable securities $185,000 $170,000 Notos receivable (cash loans made to borrowers) 210,000 250,000 Plant assots (see paragraph 8).... 625,000 50,000 Notes payable (short-form borrowing) 340,000 225,000 Capital stock... 25,000 Additional paid-in capital capital stock ... 375,000 Retained eamings (see paragraph 9 below). 150,000 240,000 8 The $50,000 in credit entries to the plant assets account are net of any debits to accumulated depreciation when plant assets were retired. Thus, the $50,000 in credit entries represents the book value of all plant assets sold or retired dur- ing the year. 9 The $150,000 debit to retained earnings represents dividends declared and paid during the year. The $240,000 credit entry represents the net income shown in the income statement. 10 All investing and financing activities were cash transactions. 11 Cash and cash equivalents amounted to $210,000 at the beginning of the year, and to $303,000 at year-end. es INSTRUCTIONS You are to prepare a statement of cash flows for the current year, following the / format illustrated on page 878. Cash flows from operating activities are to be pre- sented using the direct method. Place brackets around dollar amounts represent- ing cash outlays. Show separately your computations of the following amounts: 1 Cash received from customers 2 Interest received 3 Cash paid to suppliers and employees 4. Interest paid 5 Income taxes paid 6 Proceeds from sales of marketable securities 7 Proceeds from sales of plant assets & Proceeds from issuing capital stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started