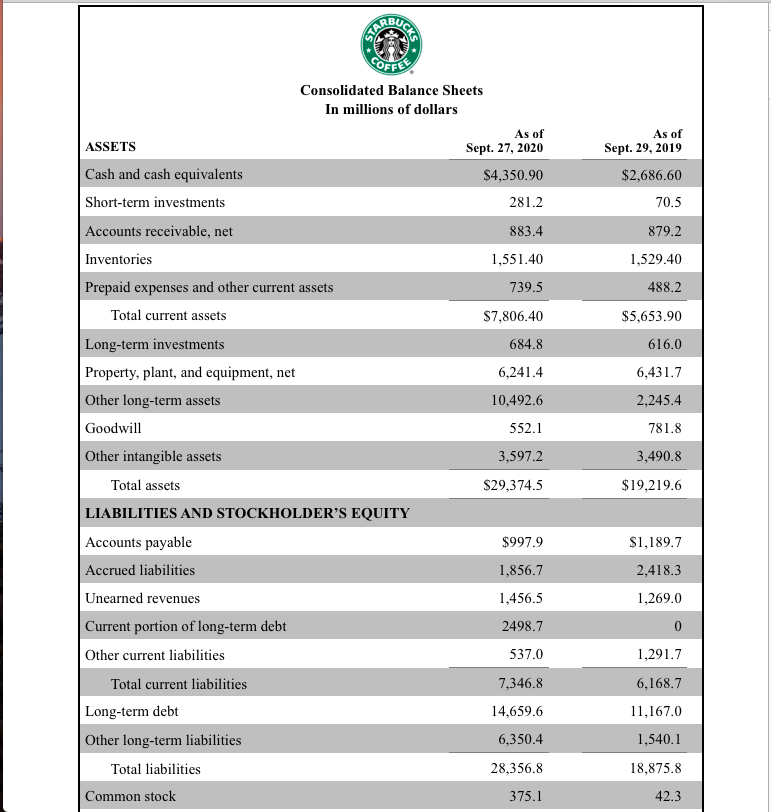

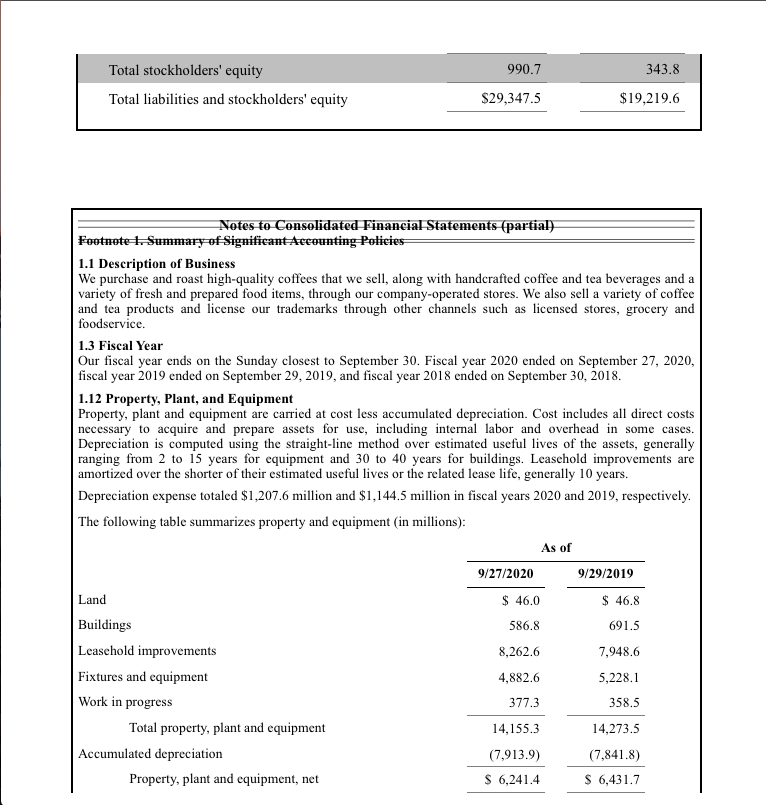

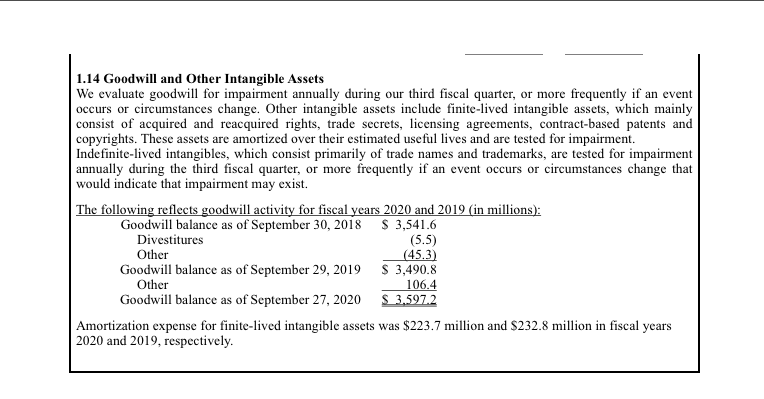

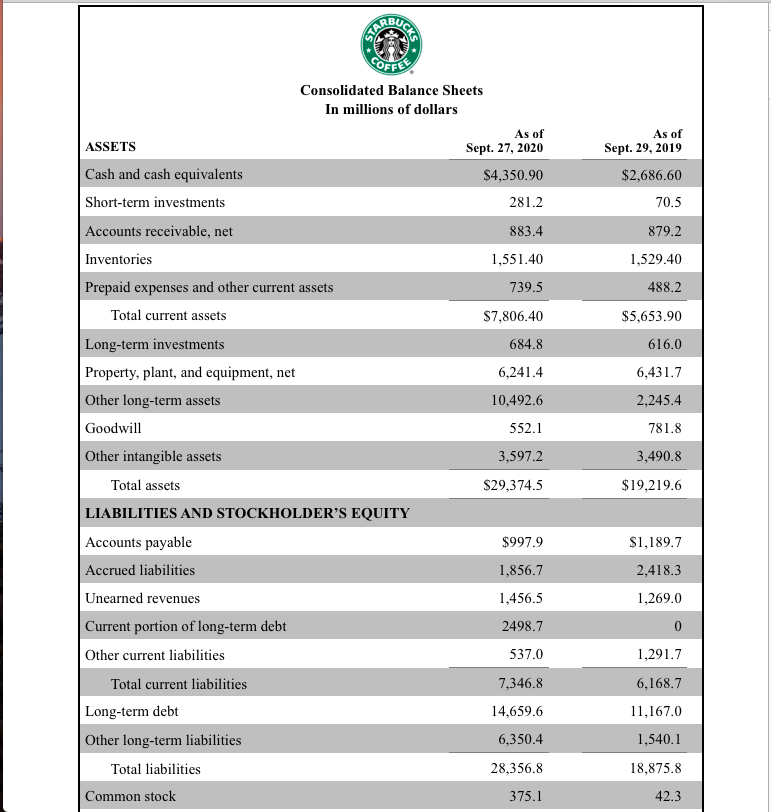

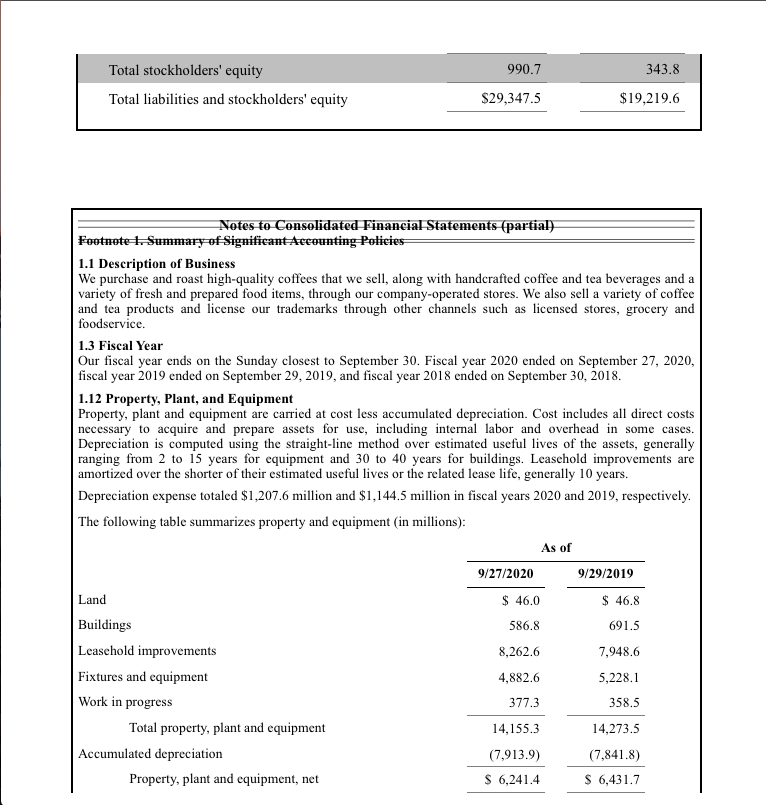

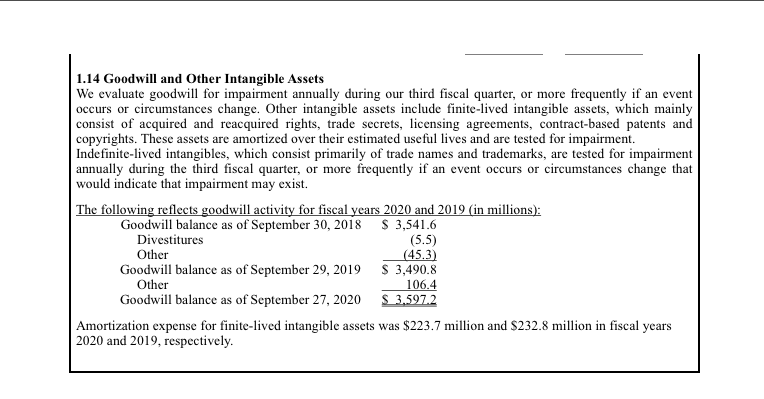

Problem 2 (11 points) Use Starbucks Corporation's financial statements to answer to the following questions. 1. According to the footnotes, what was the total acquisition cost of Land that Starbucks owns as of September 27, 2020? (1 point) $ 2. According to the footnotes, what was the total acquisition cost of the Property, Plant, and Equipment that Starbucks owns as of September 27, 2020? (1 point) $ 3. According to the footnotes, which of the following methods does Starbucks use to depreciate its Property and Equipment? (Circle one) (1 point) Straight-Line Double-Declining Balance Units-of-Activity 4. Provide the fiscal year 2020 adjusting journal entry (both accounts and amounts) that Starbucks made to record depreciation on its Property and Equipment. Assume that Starbucks makes one adjusting journal entry for depreciation expense at the end of each fiscal year as part of its adjusting entries. (3 points) 5. Does Starbucks's Goodwill footnote suggest that the company acquired any other companies during fiscal year 2020? (Circle one) (1 point) YES NO 6. Does Starbucks's Goodwill footnote suggest that the company acquired any other companies during fiscal year 2019? (Circle one) (1 point) YES NO 7. Provide the fiscal year 2020 adjusting journal entry (both accounts and amounts) that Starbucks made to record amortization on its finite-lived Intangible Assets. Assume that Starbucks makes one adjusting journal entry for amortization expense at the end of each fiscal year as part of its adjusting entries. (3 points) As of Sept. 29, 2019 $2,686.60 70.5 879.2 1,529.40 488.2 $5,653.90 616.0 6,431.7 2,245.4 781.8 Consolidated Balance Sheets In millions of dollars As of ASSETS Sept. 27, 2020 Cash and cash equivalents $4,350.90 Short-term investments 281.2 Accounts receivable, net 883.4 Inventories 1,551.40 Prepaid expenses and other current assets 739.5 Total current assets $7,806.40 Long-term investments 684.8 Property, plant, and equipment, net 6,241.4 Other long-term assets 10,492.6 Goodwill 552.1 Other intangible assets 3,597.2 Total assets $29,374.5 LIABILITIES AND STOCKHOLDER'S EQUITY Accounts payable $997.9 Accrued liabilities 1,856.7 Unearned revenues 1,456.5 Current portion of long-term debt 2498.7 Other current liabilities 537.0 Total current liabilities 7,346.8 Long-term debt 14,659.6 Other long-term liabilities 6,350.4 Total liabilities 28,356.8 Common stock 375.1 3,490.8 $19,219.6 $1,189.7 2,418.3 1,269.0 0 1,291.7 6,168.7 11,167.0 1,540.1 18,875.8 42.3 990.7 343.8 Total stockholders' equity Total liabilities and stockholders' equity $29,347.5 $19,219.6 Notes to Consolidated Financial Statements (partial) Footnote 1. Summary of Significant Accounting Policies 1.1 Description of Business We purchase and roast high-quality coffees that we sell, along with handcrafted coffee and tea beverages and a variety of fresh and prepared food items, through our company-operated stores. We also sell a variety of coffee and tea products and license our trademarks through other channels such as licensed stores, grocery and foodservice. 1.3 Fiscal Year Our fiscal year ends on the Sunday closest to September 30. Fiscal year 2020 ended on September 27, 2020, fiscal year 2019 ended on September 29, 2019, and fiscal year 2018 ended on September 30, 2018. 1.12 Property, Plant, and Equipment Property, plant and equipment are carried at cost less accumulated depreciation. Cost includes all direct costs necessary to acquire and prepare assets for use, including internal labor and overhead in some cases. Depreciation is computed using the straight-line method over estimated useful lives of the assets, generally ranging from 2 to 15 years for equipment and 30 to 40 years for buildings. Leasehold improvements are amortized over the shorter of their estimated useful lives or the related lease life, generally 10 years. Depreciation expense totaled $1,207.6 million and $1,144.5 million in fiscal years 2020 and 2019, respectively. The following table summarizes property and equipment (in millions): As of 9/27/2020 9/29/2019 $ 46,0 $ 46.8 Buildings 691.5 Leasehold improvements 8,262.6 7,948.6 Fixtures and equipment 4,882.6 5,228.1 Work in progress 377.3 358.5 Total property, plant and equipment 14,155.3 14,273.5 Accumulated depreciation (7,913.9) (7,841.8) Property, plant and equipment, net $ 6,241.4 $ 6,431.7 Land 586.8 1.14 Goodwill and Other Intangible Assets We evaluate goodwill for impairment annually during our third fiscal quarter, or more frequently if an event occurs or circumstances change. Other intangible assets include finite-lived intangible assets, which mainly consist of acquired and reacquired rights, trade secrets, licensing agreements, contract-based patents and copyrights. These assets are amortized over their estimated useful lives and are tested for impairment. Indefinite-lived intangibles, which consist primarily of trade names and trademarks, are tested for impairment annually during the third fiscal quarter, or more frequently if an event occurs or circumstances change that would indicate that impairment may exist. The following reflects goodwill activity for fiscal years 2020 and 2019 (in millions): Goodwill balance as of September 30, 2018 $3,541.6 Divestitures (5.5) Other (45.3) Goodwill balance as of September 29, 2019 $ 3,490.8 Other 106.4 Goodwill balance as of September 27, 2020 S 3.597.2 Amortization expense for finite-lived intangible assets was $223.7 million and $232.8 million in fiscal years 2020 and 2019, respectively