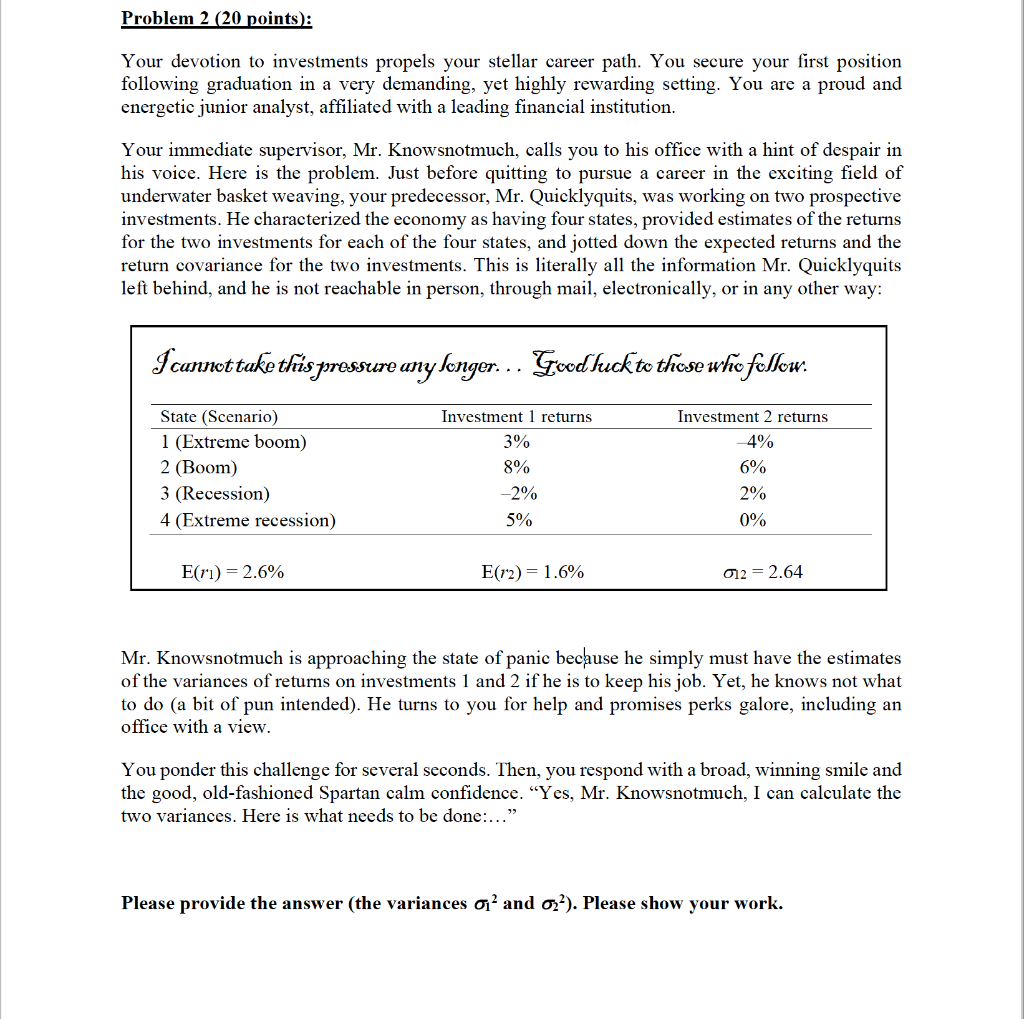

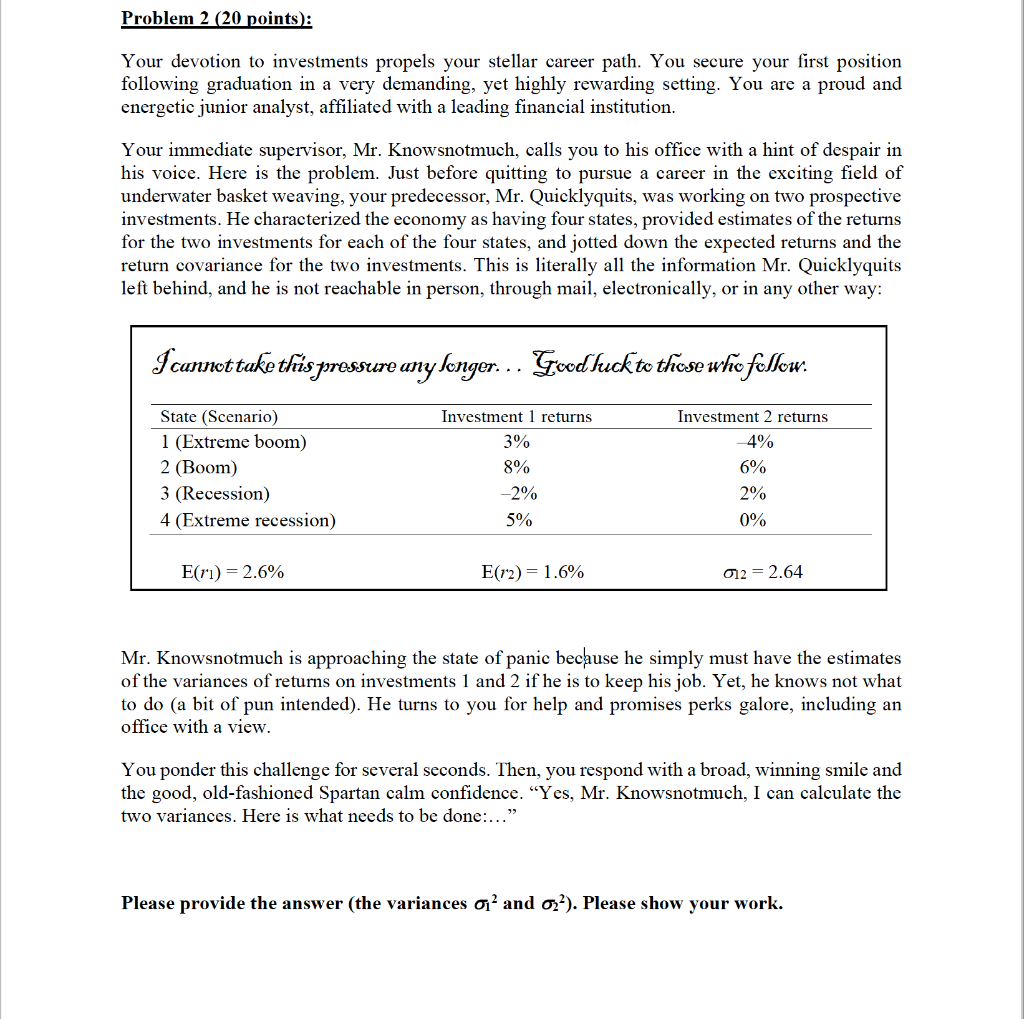

Problem 2 (20 points): Your devotion to investments propels your stellar career path. You secure your first position following graduation in a very demanding, yet highly rewarding setting. You are a proud and energetic junior analyst, affiliated with a leading financial institution. Your immediate supervisor, Mr. Knowsnotmuch, calls you to his office with a hint of despair in his voice. Here is the problem. Just before quitting to pursue a career in the exciting field of underwater basket weaving, your predecessor, Mr. Quicklyquits, was working on two prospective investments. He characterized the economy as having four states, provided estimates of the returns for the two investments for each of the four states, and jotted down the expected returns and the return covariance for the two investments. This is literally all the information Mr. Quicklyquits left behind, and he is not reachable in person, through mail, electronically, or in any other way: I cannot take this pressure any longer... Good luck to those who fellow. State (Scenario) 1 (Extreme boom) 2 (Boom) 3 (Recession) 4 (Extreme recession) Investment 1 returns 3% 8% -2% 5% Investment 2 returns 4% 6% 2% 0% Eri) = 2.6% E(12) = 1.6% 02 = 2.64 Mr. Knowsnotmuch is approaching the state of panic because he simply must have the estimates of the variances of returns on investments 1 and 2 if he is to keep his job. Yet, he knows not what to do a bit of pun intended). He turns to you for help and promises perks galore, including an office with a view. You ponder this challenge for several seconds. Then, you respond with a broad, winning smile and the good, old-fashioned Spartan calm confidence. "Yes, Mr. Knowsnotmuch, I can calculate the two variances. Here is what needs to be done:..." Please provide the answer (the variances o and oz). Please show your work. Problem 2 (20 points): Your devotion to investments propels your stellar career path. You secure your first position following graduation in a very demanding, yet highly rewarding setting. You are a proud and energetic junior analyst, affiliated with a leading financial institution. Your immediate supervisor, Mr. Knowsnotmuch, calls you to his office with a hint of despair in his voice. Here is the problem. Just before quitting to pursue a career in the exciting field of underwater basket weaving, your predecessor, Mr. Quicklyquits, was working on two prospective investments. He characterized the economy as having four states, provided estimates of the returns for the two investments for each of the four states, and jotted down the expected returns and the return covariance for the two investments. This is literally all the information Mr. Quicklyquits left behind, and he is not reachable in person, through mail, electronically, or in any other way: I cannot take this pressure any longer... Good luck to those who fellow. State (Scenario) 1 (Extreme boom) 2 (Boom) 3 (Recession) 4 (Extreme recession) Investment 1 returns 3% 8% -2% 5% Investment 2 returns 4% 6% 2% 0% Eri) = 2.6% E(12) = 1.6% 02 = 2.64 Mr. Knowsnotmuch is approaching the state of panic because he simply must have the estimates of the variances of returns on investments 1 and 2 if he is to keep his job. Yet, he knows not what to do a bit of pun intended). He turns to you for help and promises perks galore, including an office with a view. You ponder this challenge for several seconds. Then, you respond with a broad, winning smile and the good, old-fashioned Spartan calm confidence. "Yes, Mr. Knowsnotmuch, I can calculate the two variances. Here is what needs to be done:..." Please provide the answer (the variances o and oz). Please show your work