Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 2 (25 marks) Mr. B borrows an amount L from the bank today and agrees to repay the loan by m monthly payments (of

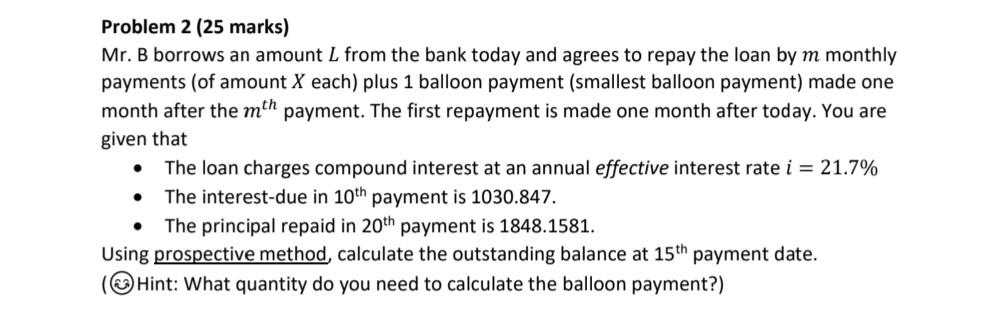

Problem 2 (25 marks) Mr. B borrows an amount L from the bank today and agrees to repay the loan by m monthly payments (of amount X each) plus 1 balloon payment (smallest balloon payment) made one month after the mth payment. The first repayment is made one month after today. You are given that The loan charges compound interest at an annual effective interest rate i = 21.7% The interest-due in 10th payment is 1030.847. The principal repaid in 20th payment is 1848.1581. Using prospective method, calculate the outstanding balance at 15th payment date. (Hint: What quantity do you need to calculate the balloon payment?) . Problem 2 (25 marks) Mr. B borrows an amount L from the bank today and agrees to repay the loan by m monthly payments (of amount X each) plus 1 balloon payment (smallest balloon payment) made one month after the mth payment. The first repayment is made one month after today. You are given that The loan charges compound interest at an annual effective interest rate i = 21.7% The interest-due in 10th payment is 1030.847. The principal repaid in 20th payment is 1848.1581. Using prospective method, calculate the outstanding balance at 15th payment date. (Hint: What quantity do you need to calculate the balloon payment?)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve this problem we need to use the prospective method to find the outstanding balance at the 15th payment date Heres how to do it step by step S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started