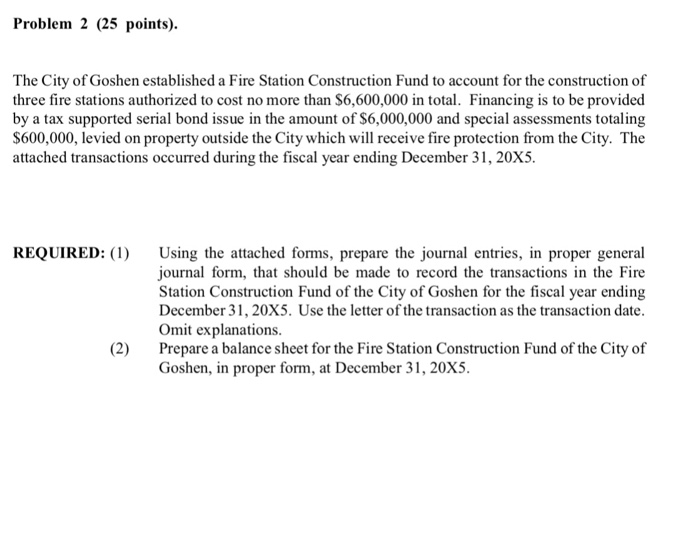

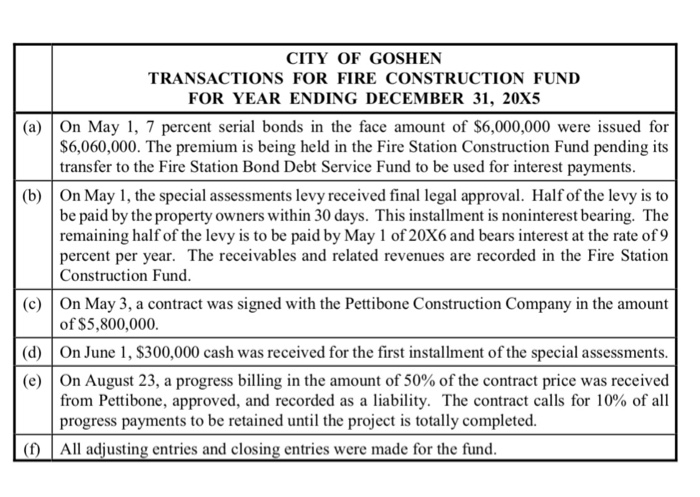

Problem 2 (25 points) The City of Goshen established a Fire Station Construction Fund to account for the construction of three fire stations authorized to cost no more than $6,600,000 in total. Financing is to be provided by a tax supported serial bond issue in the amount of $6,000,000 and special assessments totaling S600,000, levied on property outside the City which will receive fire protection from the City. The attached transactions occurred during the fiscal year ending December 31, 20x5 REQUIRED: ( Using the attached forms, prepare the journal entries, in proper general ournal form, that should be made to record the transactions in the Fire Station Construction Fund of the City of Goshen for the fiscal year ending December 31,20X5. Use the letter of the transaction as the transaction date. Omit explanations. Prepare a balance sheet for the Fire Station Construction Fund of the City of (2) Goshen, in proper form, at December 31, 20x5. CITY OF GOSHEN TRANSACTIONS FOR FIRE CONSTRUCTION FUND FOR YEAR ENDING DECEMBER 31, 20X5 (a)On May, 7 percent serial bonds in the face amount of $6,000,000 were issued for S6,060,000. The premium is being held in the Fire Station Construction Fund pending its transfer to the Fire Station Bond Debt Service Fund to be used for interest payments (b) On May 1, the special assessments levy received final legal approval. Half of the levy is to be paid by the property owners within 30 days. This installment is noninterest bearing. The remaining half of the levy is to be paid by May 1 of 20X6 and bears interest at the rate of9 percent per year. The receivables and related revenues are recorded in the Fire Station Construction Fund (c)On May 3, a contract was signed with the Pettibone Construction Company in the amount of $5,800,000 (d) On June 1, S300,000 cash was received for the first installment of the special assessments. (e) On August 23, a progress billing in the amount of 50% of the contract price was received from Pettibone, approved, and recorded as a liability. The contract calls for 10% of all progress payments to be retained until the project is totally completed. (f)All adjusting entries and closing entries were made for the fund