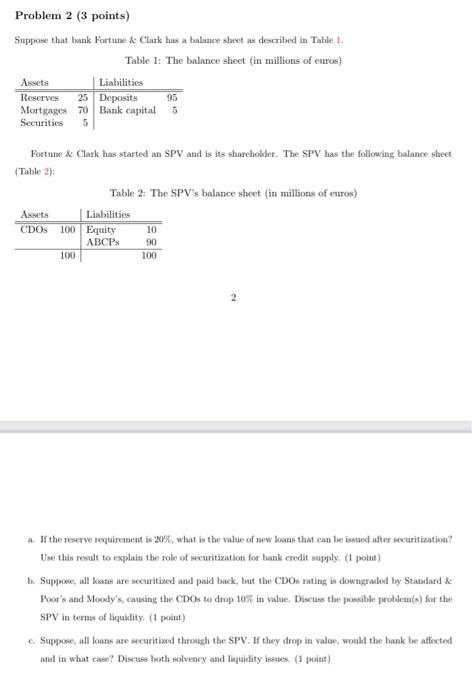

Problem 2 (3 points) Suppose that bank Fortune Clark has a balance sheet as described in the Table 1: The balance sheet fin millions of euros) Assets Liabilities Reserves 25 Deposits 95 Mortgages 70 Bank capital 5 Securities Fortune & Clark has started an SPV and is its shareholder. The SPV has the following balance sheet (Table 2): Table 2: The SPV balance sheet (in millions of euros) Assets Liabilities CDOS 100 Equity ABCP: 10 90 100 100 2 . If the reserwe requirement is 20%, what is the value of new loans that can be issued after securitization! Use this result to explain the role of securitization for bank credit supply. (1 point) Suppose, all kvans are securitized and paid back, but the CDOs rating is downgraded by Standard & Poor's and Moody's, causing the CDOs to drop 10% in value. Discuss the possible problem(s) for the SPV in terms of liquidity. (1 point) c. Suppose, all lootes are securitized through the SPV. If they drop in valtar, would the bank be affected and in what case? Discus both solvency and liquidity issues (1 point) Problem 2 (3 points) Suppose that bank Fortune Clark has a balance sheet as described in the Table 1: The balance sheet fin millions of euros) Assets Liabilities Reserves 25 Deposits 95 Mortgages 70 Bank capital 5 Securities Fortune & Clark has started an SPV and is its shareholder. The SPV has the following balance sheet (Table 2): Table 2: The SPV balance sheet (in millions of euros) Assets Liabilities CDOS 100 Equity ABCP: 10 90 100 100 2 . If the reserwe requirement is 20%, what is the value of new loans that can be issued after securitization! Use this result to explain the role of securitization for bank credit supply. (1 point) Suppose, all kvans are securitized and paid back, but the CDOs rating is downgraded by Standard & Poor's and Moody's, causing the CDOs to drop 10% in value. Discuss the possible problem(s) for the SPV in terms of liquidity. (1 point) c. Suppose, all lootes are securitized through the SPV. If they drop in valtar, would the bank be affected and in what case? Discus both solvency and liquidity issues (1 point)