Question

Problem 2. (3 points) You have the following data about coupon bonds: Maturity (years) Period i Coupon Price (USD) 0.5 1 0.000 96.15 1 2

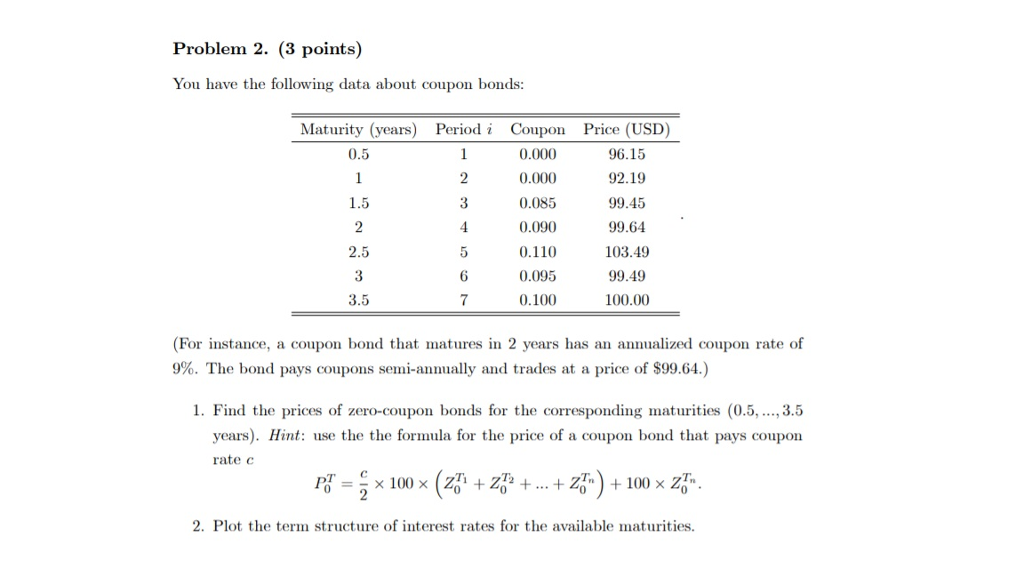

Problem 2. (3 points) You have the following data about coupon bonds:

Maturity (years) Period i Coupon Price (USD)

0.5 1 0.000 96.15

1 2 0.000 92.19

1.5 3 0.085 99.45

2 4 0.090 99.64

2.5 5 0.110 103.49

3 6 0.095 99.49

3.5 7 0.100 100.00

(For instance, a coupon bond that matures in 2 years has an annualized coupon rate of 9%. The bond pays coupons semi-annually and trades at a price of $99.64.)

1. Find the prices of zero-coupon bonds for the corresponding maturities (0.5, ... ,3.5 years). Hint: use the the formula for the price of a coupon bond that pays coupon rate

P (T 0)= (c/2)*100*(Z (T1 0) + Z (T2 0) + ... + Z (Tn 0 ))+ 100*Z (Tn 0)

2. Plot the term structure of interest rates for the available maturities.

Problem 2. (3 points) You have the following data about coupon bonds Maturity (years) Periodi Coupo Price (USD) 0.5 0.000 0.000 0.085 0.090 0.110 0.095 0.100 96.15 92.19 99.45 99.64 103.49 99.49 100.00 1.5 2.5 6 7 3.5 (For instance, a coupon bond that matures in 2 years has an annualized coupon rate of 9%. The bond pays coupons semi-annually and trades at a price of $99.64.) 1. Find the prices of zero-coupon bonds for the corresponding maturities (0.5,,3.5 years). Hint: use the the formula for the price of a coupon bond that pays coupon rate c ?? 2. Plot the term structure of interest rates for the available maturitiesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started