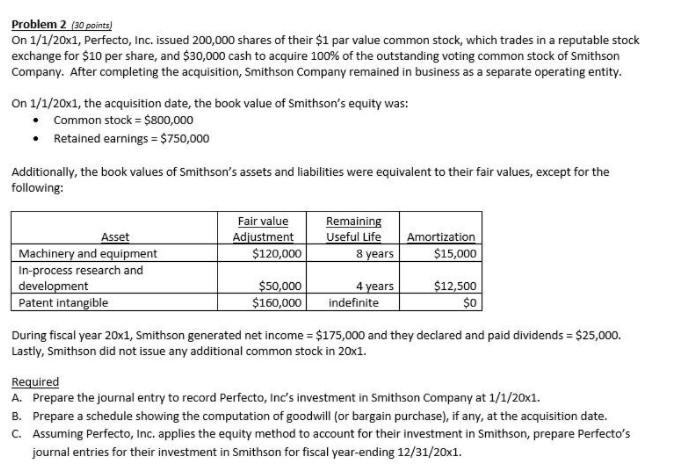

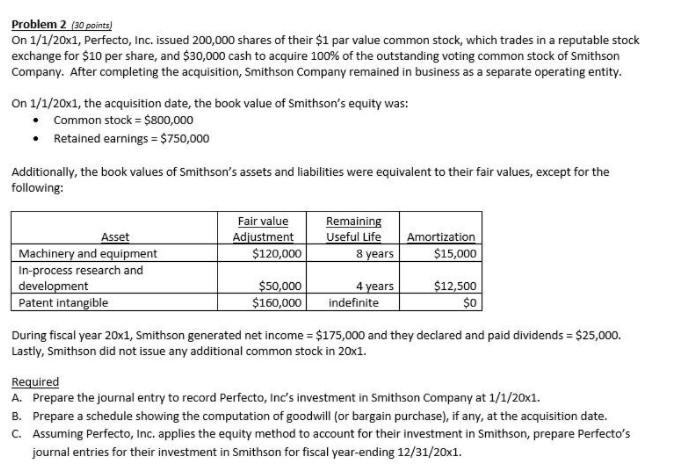

Problem 2 (30 points) On 1/1/20x1, Perfecto, Inc. issued 200,000 shares of their $1 par value common stock, which trades in a reputable stock exchange for $10 per share, and $30,000 cash to acquire 100% of the outstanding voting common stock of Smithson Company. After completing the acquisition, Smithson Company remained in business as a separate operating entity. On 1/1/20x1, the acquisition date, the book value of Smithson's equity was: Common stock = $800,000 Retained earnings = $750,000 Additionally, the book values of Smithson's assets and liabilities were equivalent to their fair values, except for the following: Fair value Adjustment $120,000 Remaining Useful Life Amortization $15,000 8 years Asset Machinery and equipment In-process research and development Patent intangible $50,000 $160,000 4 years indefinite $12,500 $0 During fiscal year 20x1, Smithson generated net income = $175,000 and they declared and paid dividends = $25,000. Lastly, Smithson did not issue any additional common stock in 20x1. Required A. Prepare the journal entry to record Perfecto, Ind's investment in Smithson Company at 1/1/20x1. B. Prepare a schedule showing the computation of goodwill for bargain purchase), if any, at the acquisition date. C. Assuming Perfecto, Inc. applies the equity method to account for their investment in Smithson, prepare Perfecto's journal entries for their investment in Smithson for fiscal year-ending 12/31/20x1. Problem 2 (30 points) On 1/1/20x1, Perfecto, Inc. issued 200,000 shares of their $1 par value common stock, which trades in a reputable stock exchange for $10 per share, and $30,000 cash to acquire 100% of the outstanding voting common stock of Smithson Company. After completing the acquisition, Smithson Company remained in business as a separate operating entity. On 1/1/20x1, the acquisition date, the book value of Smithson's equity was: Common stock = $800,000 Retained earnings = $750,000 Additionally, the book values of Smithson's assets and liabilities were equivalent to their fair values, except for the following: Fair value Adjustment $120,000 Remaining Useful Life Amortization $15,000 8 years Asset Machinery and equipment In-process research and development Patent intangible $50,000 $160,000 4 years indefinite $12,500 $0 During fiscal year 20x1, Smithson generated net income = $175,000 and they declared and paid dividends = $25,000. Lastly, Smithson did not issue any additional common stock in 20x1. Required A. Prepare the journal entry to record Perfecto, Ind's investment in Smithson Company at 1/1/20x1. B. Prepare a schedule showing the computation of goodwill for bargain purchase), if any, at the acquisition date. C. Assuming Perfecto, Inc. applies the equity method to account for their investment in Smithson, prepare Perfecto's journal entries for their investment in Smithson for fiscal year-ending 12/31/20x1