Answered step by step

Verified Expert Solution

Question

1 Approved Answer

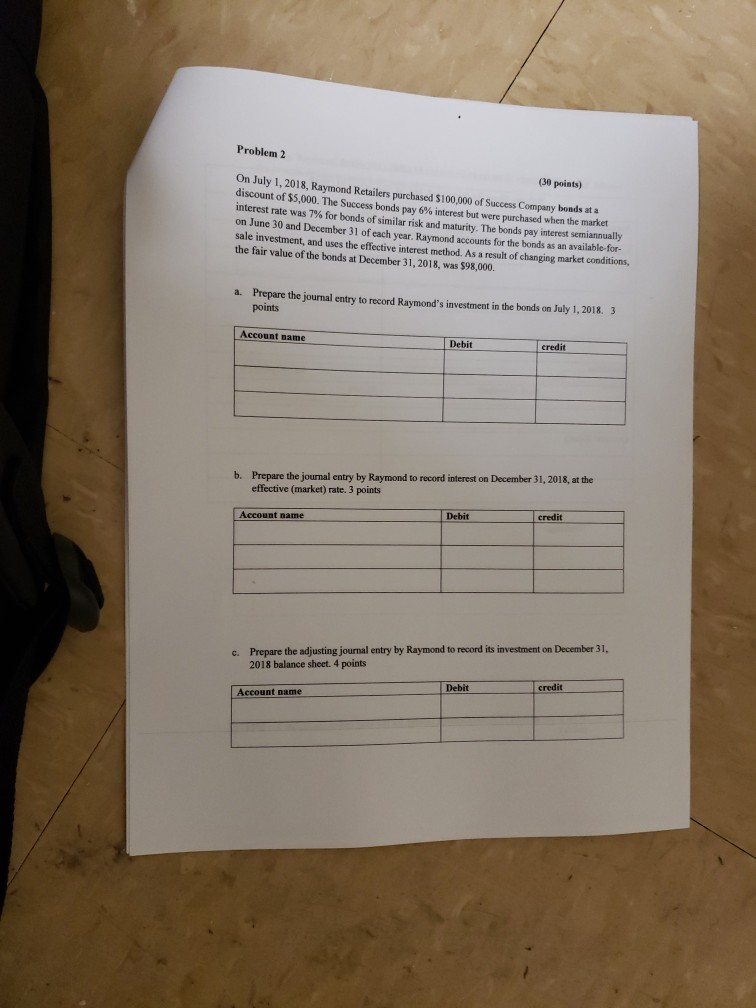

Problem 2 (30 points) On July 1, 2018, Raymond Retailers purchased $100,000 of Success Company bonds at a discount of $5,000. The Success bonds pay

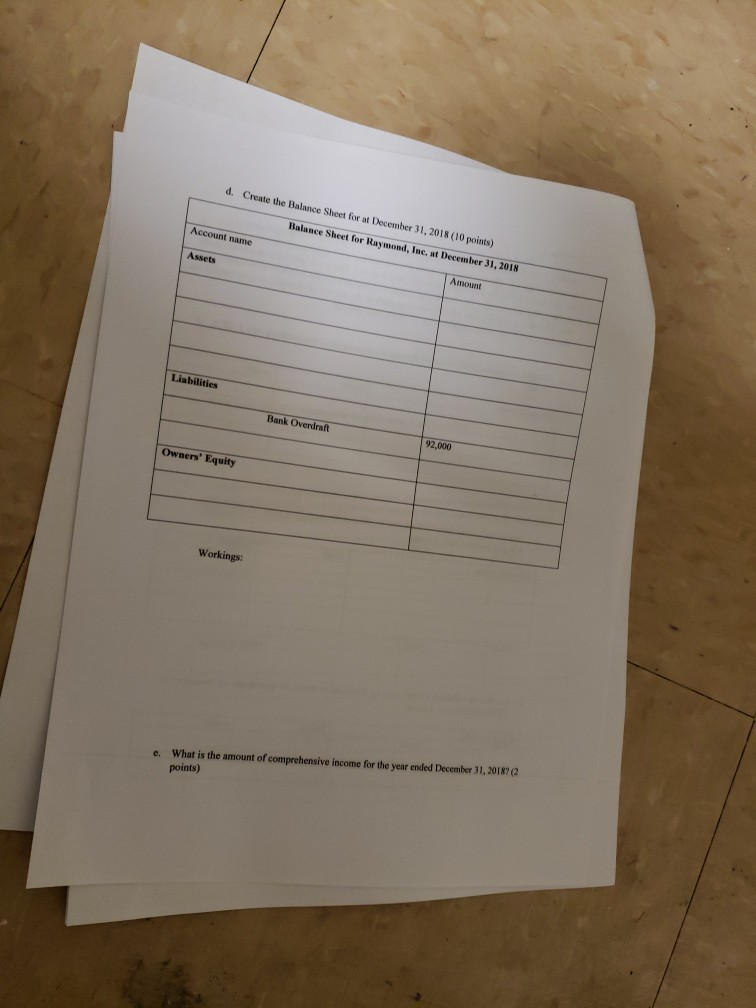

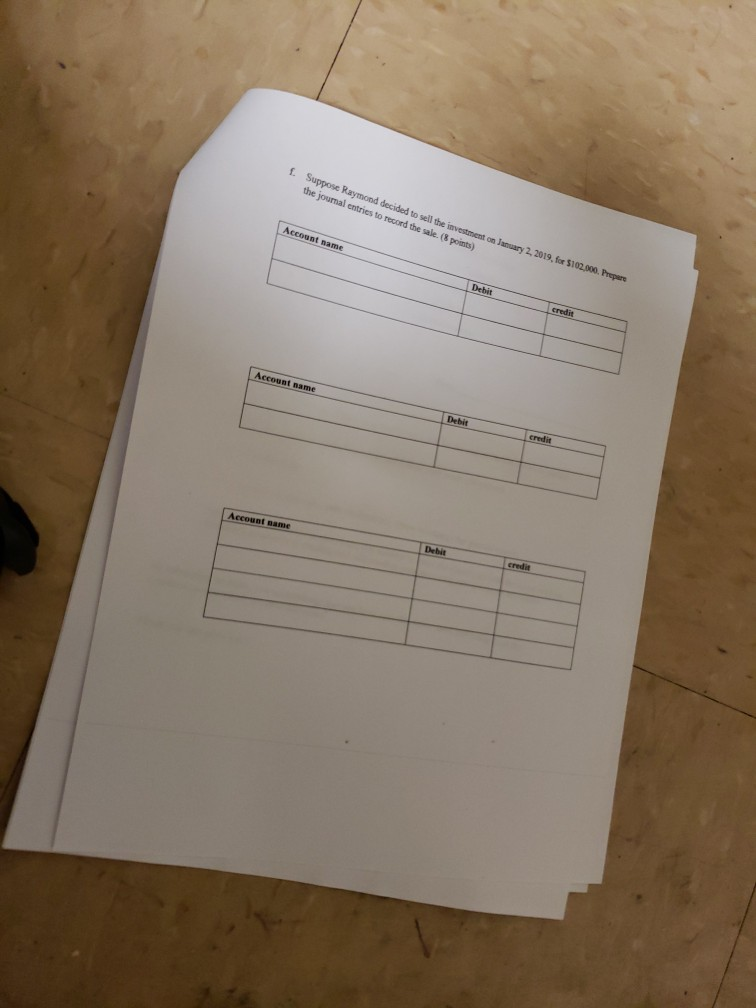

Problem 2 (30 points) On July 1, 2018, Raymond Retailers purchased $100,000 of Success Company bonds at a discount of $5,000. The Success bonds pay 6% interest but were purchased when the market interest rate was 7% for bonds of similar risk and maturity. The bonds pay interest seman ually on June 30 and December 31 of each year. Raymond accounts for the bonds as an available-for- sale investment, and uses the effective interest method. As a result of changing market cond the fair value of the bonds at December 31,2018, was $98,000. a. Prepare the journal entry to record Raymond's investment in the bonds on July 1,2018. 3 points Account Bame Debit credit Prepare the journal entry by Raymond to record interest on December 31, 2018, at the effective (market) rate. 3 points b. credit Debit Account name e. Prepare the adjusting jourmalentry by Raymond to recorDecember31, 2018 balance sheet. 4 points credit Debit Account name d. Create the Balance Sheet for at December 31, 2018 (10 points) Balance Sheet for Raymond, Inc, at December 31, 2018 Account name Amount Assets Liabilities Bank Overdraft 92,000 Owners' Equity Workings: What is the amount of comprehensive income for the year ended December 31, 20182 (2 points) c. the journal entries to record the sale. (8 points) on January 2, 2019, for $102,000. Prepare credit Account name Debit credit Debit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started