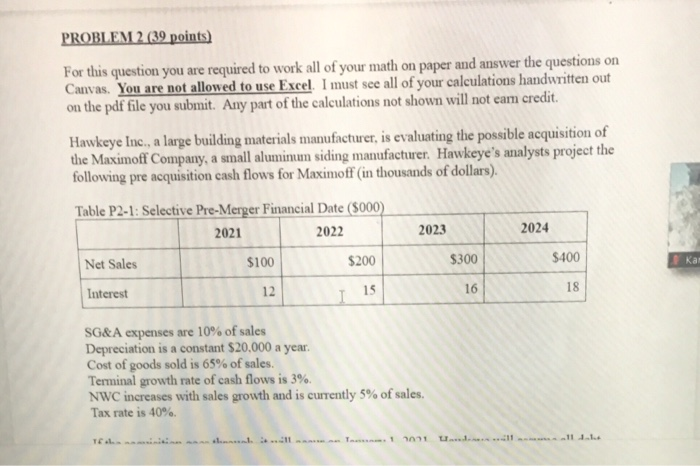

PROBLEM 2 (39 points) For this question you are required to work all of your math on paper and answer the questions on Canvas. You are not allowed to use Excel. I must see all of your calculations handwritten out on the pdf file you submit. Any part of the calculations not shown will not cam credit. Hawkeye Inc., a large building materials manufacturer, is evaluating the possible acquisition of the Maximoff Company, a small aluminum siding manufacturer. Hawkeye's analysts project the following pre acquisition cash flows for Maximoff (in thousands of dollars). Table P2-1: Selective Pre-Merger Financial Date (5000) 2021 2022 2023 2024 $100 Net Sales $200 $300 $400 i Kar 12 Interest 15 16 18 SG&A expenses are 10% of sales Depreciation is a constant $20,000 a year. Cost of goods sold is 65% of sales. Terminal growth rate of cash flows is 3%. NWC increases with sales growth and is currently 5% of sales. Tax rate is 40% TEL 10 COST Or youus on 18 037 OL Sales Terminal growth rate of cash flows is 3%. NWC increases with sales growth and is currently 5% of sales. Tax rate is 40%. If the acquisition goes through, it will occur on January 1, 2021. Hawkeye will assume all debt of Maximoff after the acquisition. Maximoff's current market-determined beta is 1.2 but its investment bankers think that its beta would decrease to 1.0 if the acquisition takes place. The risk-free rate is 3 percent, and the market risk premium is 6 percent. The cost of debt is 4% and the debt to equity ratio is 20% with the firm estimating $200.000 in long term debt in 2021. Synergy from the merger could reduce the cost of goods sold ratio to sales to 55% and the sales could also increase by $50,000 in each year after the acquisition. Capital Expenditures are estimated to increase by $50,000 only in 2021. Questions Questions P2Q1 through P2Q7 are to be answered in Canvas. You must show all of your calculations in your submitted PDF file to receive credit for these answers. The main goal is to calculate the value pre-merger and post merger and tell me what the difference is but I give you a few points for the components of WACC for some of the questions. . T-Mobile 7:16 PM 1 100% > PROBLEM 2 (39 points) For this question you are required to work all of your math on paper and answer the questions on Canvas. You are not allowed to use Excel. I must see all of your calculations handwritten out on the pdf file you submit. Any part of the calculations not shown will not cam credit. Hawkeye Inc., a large building materials manufacturer, is evaluating the possible acquisition of the Maximoff Company, a small aluminum siding manufacturer. Hawkeye's analysts project the following pre acquisition cash flows for Maximoff (in thousands of dollars). Table P2-1: Selective Pre-Merger Financial Date (5000) 2021 2022 2023 2024 $100 Net Sales $200 $300 $400 i Kar 12 Interest 15 16 18 SG&A expenses are 10% of sales Depreciation is a constant $20,000 a year. Cost of goods sold is 65% of sales. Terminal growth rate of cash flows is 3%. NWC increases with sales growth and is currently 5% of sales. Tax rate is 40% TEL 10 COST Or youus on 18 037 OL Sales Terminal growth rate of cash flows is 3%. NWC increases with sales growth and is currently 5% of sales. Tax rate is 40%. If the acquisition goes through, it will occur on January 1, 2021. Hawkeye will assume all debt of Maximoff after the acquisition. Maximoff's current market-determined beta is 1.2 but its investment bankers think that its beta would decrease to 1.0 if the acquisition takes place. The risk-free rate is 3 percent, and the market risk premium is 6 percent. The cost of debt is 4% and the debt to equity ratio is 20% with the firm estimating $200.000 in long term debt in 2021. Synergy from the merger could reduce the cost of goods sold ratio to sales to 55% and the sales could also increase by $50,000 in each year after the acquisition. Capital Expenditures are estimated to increase by $50,000 only in 2021. Questions Questions P2Q1 through P2Q7 are to be answered in Canvas. You must show all of your calculations in your submitted PDF file to receive credit for these answers. The main goal is to calculate the value pre-merger and post merger and tell me what the difference is but I give you a few points for the components of WACC for some of the questions. . T-Mobile 7:16 PM 1 100% >