Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem #2 (45%) Consolidated Financial Statements Subsequent to Acquisition On January 1, 2017. Parent Company acquired all of Subsidiary's Company voting socks for $16,000,000 in

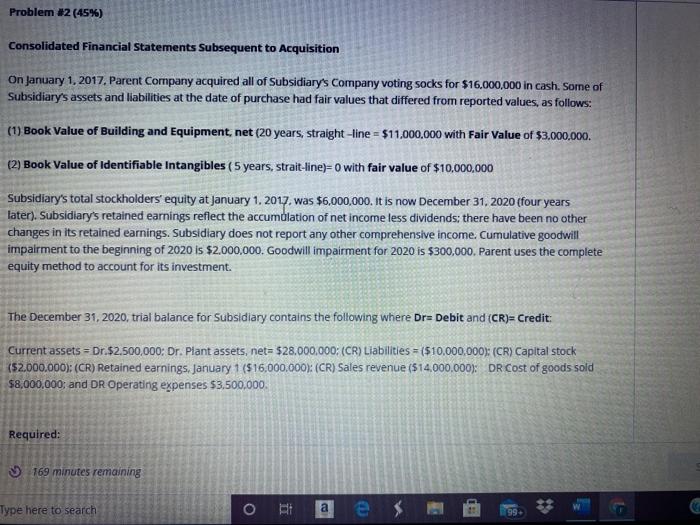

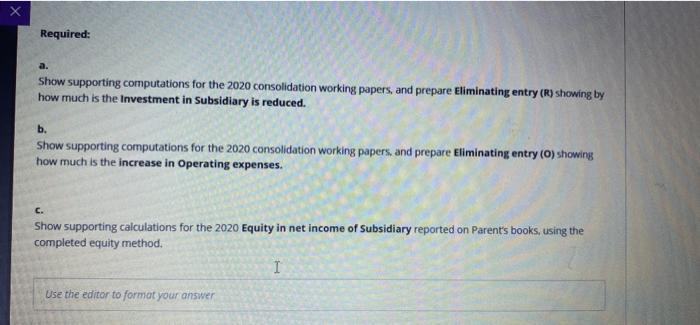

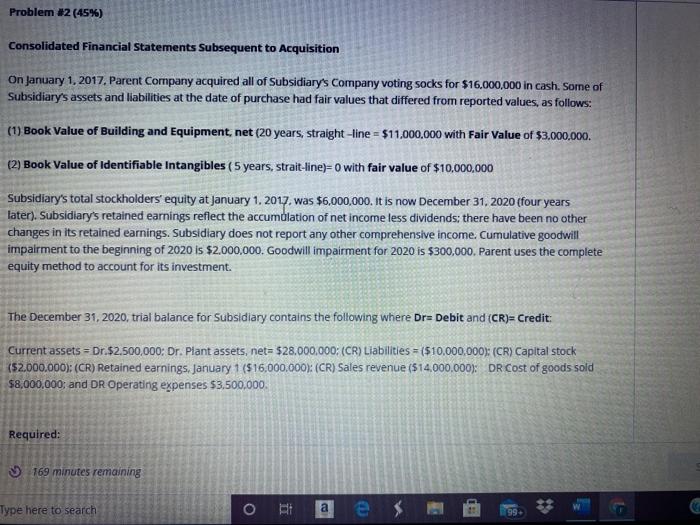

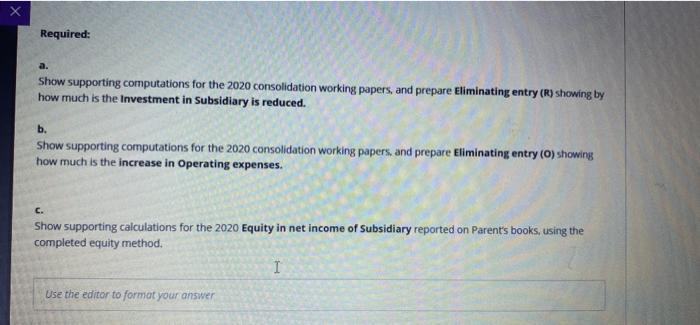

Problem #2 (45%) Consolidated Financial Statements Subsequent to Acquisition On January 1, 2017. Parent Company acquired all of Subsidiary's Company voting socks for $16,000,000 in cash. Some of Subsidiary's assets and liabilities at the date of purchase had fair values that differed from reported values, as follows: (1) Book Value of Building and Equipment net (20 years, straight-line = $11,000,000 with Fair Value of $3.000.000 (2) Book Value of Identifiable Intangibles ( 5 years, strait-lines=0 with fair value of $10,000,000 Subsidiary's total stockholders' equity at January 1, 2017. was $6,000,000. It is now December 31, 2020 (four years later). Subsidiary's retained earnings reflect the accumulation of net income less dividends: there have been no other changes in its retained earnings. Subsidiary does not report any other comprehensive income. Cumulative goodwill impairment to the beginning of 2020 is $2,000,000. Goodwill impairment for 2020 is $300,000. Parent uses the complete equity method to account for its investment. The December 31, 2020, trial balance for Subsidiary contains the following where Dr= Debit and (CR)= Credit: Current assets = Dr.$2.500,000: Dr. Plant assets, net= $28.000,000: (CR) Liabilities = ($10,000,000): (CR) Capital stock (52.000.000): (CR) Retained earnings, January 1 (516,000.000): (CR) Sales revenue (514.000.000): DR Cost of goods sold $8,000,000: and DR Operating expenses $3,500,000 Required: $ 169 minutes remaining Type here to search a e s 99 Required: a. Show supporting computations for the 2020 consolidation working papers, and prepare Eliminating entry (R) showing by how much is the Investment in Subsidiary is reduced. b. Show supporting computations for the 2020 consolidation working papers, and prepare Eliminating entry (0) showing how much is the increase in Operating expenses. c. Show supporting calculations for the 2020 Equity in net income of Subsidiary reported on Parent's books, using the completed equity method. 1 Use the editor to format your answer Problem #2 (45%) Consolidated Financial Statements Subsequent to Acquisition On January 1, 2017. Parent Company acquired all of Subsidiary's Company voting socks for $16,000,000 in cash. Some of Subsidiary's assets and liabilities at the date of purchase had fair values that differed from reported values, as follows: (1) Book Value of Building and Equipment net (20 years, straight-line = $11,000,000 with Fair Value of $3.000.000 (2) Book Value of Identifiable Intangibles ( 5 years, strait-lines=0 with fair value of $10,000,000 Subsidiary's total stockholders' equity at January 1, 2017. was $6,000,000. It is now December 31, 2020 (four years later). Subsidiary's retained earnings reflect the accumulation of net income less dividends: there have been no other changes in its retained earnings. Subsidiary does not report any other comprehensive income. Cumulative goodwill impairment to the beginning of 2020 is $2,000,000. Goodwill impairment for 2020 is $300,000. Parent uses the complete equity method to account for its investment. The December 31, 2020, trial balance for Subsidiary contains the following where Dr= Debit and (CR)= Credit: Current assets = Dr.$2.500,000: Dr. Plant assets, net= $28.000,000: (CR) Liabilities = ($10,000,000): (CR) Capital stock (52.000.000): (CR) Retained earnings, January 1 (516,000.000): (CR) Sales revenue (514.000.000): DR Cost of goods sold $8,000,000: and DR Operating expenses $3,500,000 Required: $ 169 minutes remaining Type here to search a e s 99 Required: a. Show supporting computations for the 2020 consolidation working papers, and prepare Eliminating entry (R) showing by how much is the Investment in Subsidiary is reduced. b. Show supporting computations for the 2020 consolidation working papers, and prepare Eliminating entry (0) showing how much is the increase in Operating expenses. c. Show supporting calculations for the 2020 Equity in net income of Subsidiary reported on Parent's books, using the completed equity method. 1 Use the editor to format your

Problem #2 (45%) Consolidated Financial Statements Subsequent to Acquisition On January 1, 2017. Parent Company acquired all of Subsidiary's Company voting socks for $16,000,000 in cash. Some of Subsidiary's assets and liabilities at the date of purchase had fair values that differed from reported values, as follows: (1) Book Value of Building and Equipment net (20 years, straight-line = $11,000,000 with Fair Value of $3.000.000 (2) Book Value of Identifiable Intangibles ( 5 years, strait-lines=0 with fair value of $10,000,000 Subsidiary's total stockholders' equity at January 1, 2017. was $6,000,000. It is now December 31, 2020 (four years later). Subsidiary's retained earnings reflect the accumulation of net income less dividends: there have been no other changes in its retained earnings. Subsidiary does not report any other comprehensive income. Cumulative goodwill impairment to the beginning of 2020 is $2,000,000. Goodwill impairment for 2020 is $300,000. Parent uses the complete equity method to account for its investment. The December 31, 2020, trial balance for Subsidiary contains the following where Dr= Debit and (CR)= Credit: Current assets = Dr.$2.500,000: Dr. Plant assets, net= $28.000,000: (CR) Liabilities = ($10,000,000): (CR) Capital stock (52.000.000): (CR) Retained earnings, January 1 (516,000.000): (CR) Sales revenue (514.000.000): DR Cost of goods sold $8,000,000: and DR Operating expenses $3,500,000 Required: $ 169 minutes remaining Type here to search a e s 99 Required: a. Show supporting computations for the 2020 consolidation working papers, and prepare Eliminating entry (R) showing by how much is the Investment in Subsidiary is reduced. b. Show supporting computations for the 2020 consolidation working papers, and prepare Eliminating entry (0) showing how much is the increase in Operating expenses. c. Show supporting calculations for the 2020 Equity in net income of Subsidiary reported on Parent's books, using the completed equity method. 1 Use the editor to format your answer Problem #2 (45%) Consolidated Financial Statements Subsequent to Acquisition On January 1, 2017. Parent Company acquired all of Subsidiary's Company voting socks for $16,000,000 in cash. Some of Subsidiary's assets and liabilities at the date of purchase had fair values that differed from reported values, as follows: (1) Book Value of Building and Equipment net (20 years, straight-line = $11,000,000 with Fair Value of $3.000.000 (2) Book Value of Identifiable Intangibles ( 5 years, strait-lines=0 with fair value of $10,000,000 Subsidiary's total stockholders' equity at January 1, 2017. was $6,000,000. It is now December 31, 2020 (four years later). Subsidiary's retained earnings reflect the accumulation of net income less dividends: there have been no other changes in its retained earnings. Subsidiary does not report any other comprehensive income. Cumulative goodwill impairment to the beginning of 2020 is $2,000,000. Goodwill impairment for 2020 is $300,000. Parent uses the complete equity method to account for its investment. The December 31, 2020, trial balance for Subsidiary contains the following where Dr= Debit and (CR)= Credit: Current assets = Dr.$2.500,000: Dr. Plant assets, net= $28.000,000: (CR) Liabilities = ($10,000,000): (CR) Capital stock (52.000.000): (CR) Retained earnings, January 1 (516,000.000): (CR) Sales revenue (514.000.000): DR Cost of goods sold $8,000,000: and DR Operating expenses $3,500,000 Required: $ 169 minutes remaining Type here to search a e s 99 Required: a. Show supporting computations for the 2020 consolidation working papers, and prepare Eliminating entry (R) showing by how much is the Investment in Subsidiary is reduced. b. Show supporting computations for the 2020 consolidation working papers, and prepare Eliminating entry (0) showing how much is the increase in Operating expenses. c. Show supporting calculations for the 2020 Equity in net income of Subsidiary reported on Parent's books, using the completed equity method. 1 Use the editor to format your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started