PROBLEM 2 (50 points)

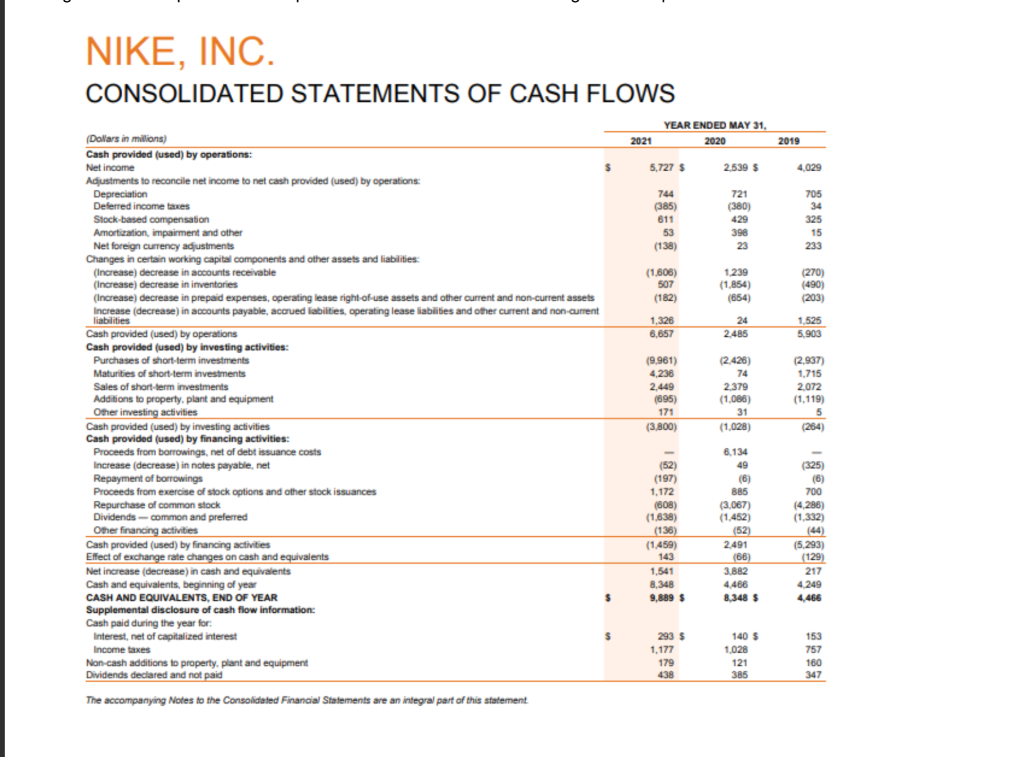

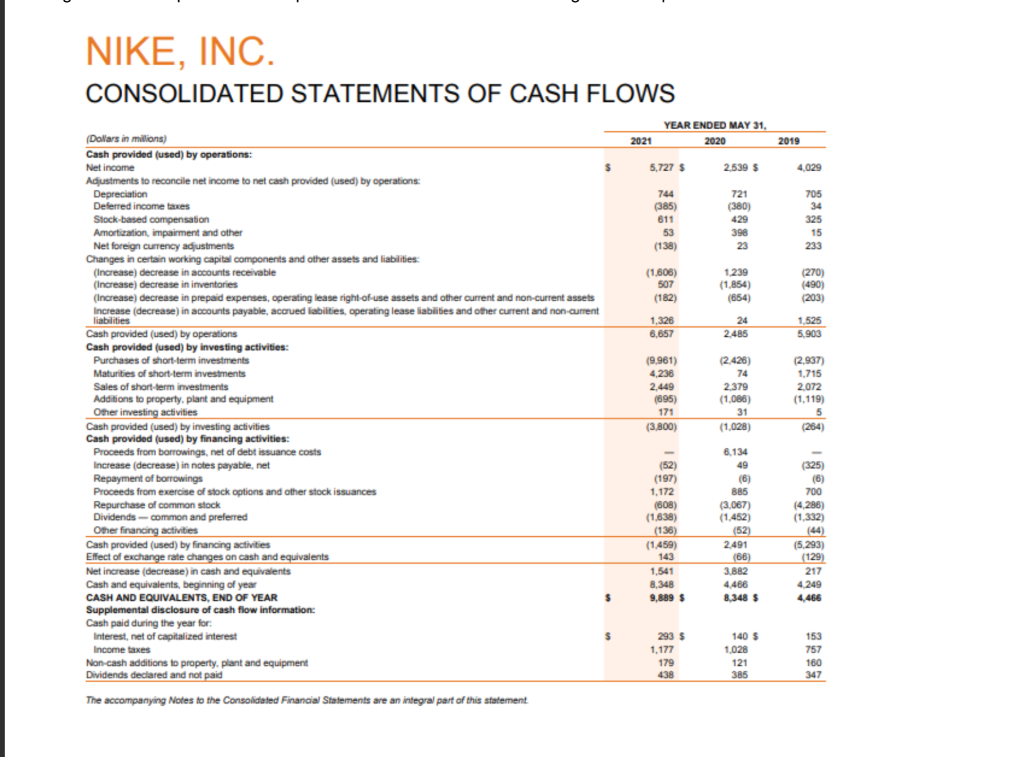

Given the following Statement of Cash Flows from Nike, Inc., indicate at least five items in all three sections that indicate that the company has a good financial position and explain each one of them.

NIKE, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS YEAR ENDED MAY 31, , 2021 2020 2019 5,727 $ 2.539 $ $ 4,029 744 721 705 (385) (380) 611 429 325 53 398 15 (138) 23 233 (1.608) 507 (182) 1.239 (1.854) (654) (270) (490) ) (203) 1.525 1,326 6.657 24 2485 5.903 (2.937 ( (Dollars in millions) Cash provided (used) by operations: Net income $ Adjustments to reconcile net income to net cash provided (used) by operations: Depreciation Deferred income taxes Stock-based compensation Amortization, impairment and other Net foreign currency adjustments Changes in certain working capital components and other assets and liabilities (Increase) decrease in accounts receivable (Increase) decrease in inventories (Increase) decrease in prepaid expenses, operating lease right of use assets and other current and non-current assets Increase (decrease) in accounts payable, accrued liabilities, operating lease liabilities and other current and non-current liabilities Cash provided (used) by operations Cash provided (used) by investing activities: Purchases of short-term investments Maturities of short-term investments Sales of short-term investments Additions to property, plant and equipment Other investing activities Cash provided (used) by investing activities Cash provided (used) by financing activities: Proceeds from borrowings, net of debt issuance costs Increase (decrease) in notes payable, net Repayment of borrowings Proceeds from exercise of stock options and other stock issuances Repurchase of common stock Dividends - common and preferred Other financing activities Cash provided (used) by financing activities Effect of exchange rate changes on cash and equivalents Net increase (decrease) in cash and equivalents Cash and equivalents, beginning of year CASH AND EQUIVALENTS, END OF YEAR $ Supplemental disclosure of cash flow information: Cash paid during the year for: Interest, net of capitalized interest Income taxes Non-cash additions to property, plant and equipment Dividends declared and not paid (9.961) 4,236 2.449 (695) 171 (3.800) (2.428) 74 2.379 (1.088) 31 (1.028) 1,715 2.072 (1.119) 5 (264) (325) (6) 700 (4,286) (1.332) ( (52) (197) 1.172 (608) (1.638) (136) (1459) 143 1,541 8.348 9,889 $ $ 6.134 49 (6) 885 (3.067) (1.452) ( (52) 2491 (66) 3.882 4.466 8.348 $ (5.293) ( (129) 217 4.249 4.466 293 $ 1,177 179 438 140 $ 1,028 121 385 153 757 160 347 The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement