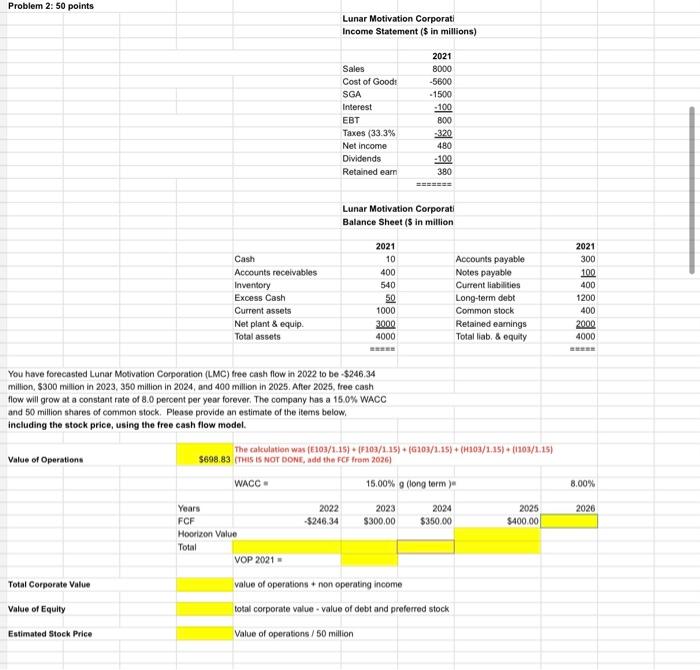

Problem 2: 50 points Lunar Motivation Corporati Income Statement ($ in millions) Sales Cost of Goodt SGA Interest EBT Taxes (33.3% Net income Dividends Retained earn 2021 8000 -5600 -1500 -100 800 -320 480 -100 380 Lunar Motivation Corporati Balance Sheet (s in million Cash Accounts receivables Inventory Excess Cash Current assets Net plant & equip Total assets 2021 10 400 540 50 1000 3000 4000 Accounts payable Notes payable Current liabilities Long-term debt Common stock Retained earings Total liab. & equity 2021 300 100 400 1200 400 2000 4000 You have forecasted Lunar Motivation Corporation (LMC) free cash flow in 2022 to be $246,34 million, $300 milion in 2023, 350 million in 2024, and 400 million in 2025. After 2025, free cash flow will grow at a constant rate of 8.0 percent per year forever. The company has a 15.0% WACC and 50 million shares of common stock. Please provide an estimate of the items below including the stock price, using the free cash flow model. Value of Operations The calculation was (E103/1.15). F103/1.15) (6103/1.15) + (H103/1.15) 1103/1.15) $698.83 (THIS IS NOT DONE, add the FCF from 2026) WACC 15.00% g (long term ) 8.00% 2026 2025 $400.00 Years 2022 2023 2024 FCF -$246.34 $300.00 $350.00 Hoorizon Value Total VOP 2021 value of operations + non operating income total corporate value value of debt and preferred stock Value of operations / 50 million Total Corporate Valve Value of Equity Estimated Stock Price Problem 2: 50 points Lunar Motivation Corporati Income Statement ($ in millions) Sales Cost of Goodt SGA Interest EBT Taxes (33.3% Net income Dividends Retained earn 2021 8000 -5600 -1500 -100 800 -320 480 -100 380 Lunar Motivation Corporati Balance Sheet (s in million Cash Accounts receivables Inventory Excess Cash Current assets Net plant & equip Total assets 2021 10 400 540 50 1000 3000 4000 Accounts payable Notes payable Current liabilities Long-term debt Common stock Retained earings Total liab. & equity 2021 300 100 400 1200 400 2000 4000 You have forecasted Lunar Motivation Corporation (LMC) free cash flow in 2022 to be $246,34 million, $300 milion in 2023, 350 million in 2024, and 400 million in 2025. After 2025, free cash flow will grow at a constant rate of 8.0 percent per year forever. The company has a 15.0% WACC and 50 million shares of common stock. Please provide an estimate of the items below including the stock price, using the free cash flow model. Value of Operations The calculation was (E103/1.15). F103/1.15) (6103/1.15) + (H103/1.15) 1103/1.15) $698.83 (THIS IS NOT DONE, add the FCF from 2026) WACC 15.00% g (long term ) 8.00% 2026 2025 $400.00 Years 2022 2023 2024 FCF -$246.34 $300.00 $350.00 Hoorizon Value Total VOP 2021 value of operations + non operating income total corporate value value of debt and preferred stock Value of operations / 50 million Total Corporate Valve Value of Equity Estimated Stock Price